According to a report by Vanguard Newspaper, the Senate has raised alarm over the rising rate of unemployment in the country and called on the federal, state, and local governments to urgently declare a state of emergency on the problem.

The Senate, according to the report, is asking the Federal Government to direct the Ministry of National Planning to set up a machinery for job creation for youths and urging the three tiers of government to revitalise existing industries, build new ones, and provide conducive and enabling environment for the private sector to build more industries.

The legislative body also asked the government to initiate a sustainable Unemployment Fund for the payment of living stipends to unemployed Nigerians until such persons secure employment.

The Senate noted that dealing decisively with the problem of unemployment is the only way to save the country from the problems of banditry, kidnapping, armed robbery and other social vices that are fast becoming a daily occurrence.

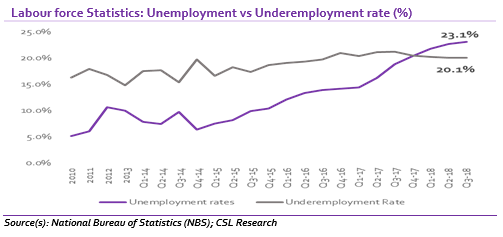

The National Bureau of Statistics (NBS) disclosed that Nigeria’s official unemployment rate accelerated to 23.1% in the third quarter of 2018 (the most recent employment data). This is the highest rate of unemployment recorded in the last eight years as the number of unemployed people surged by about 31% to 21 million people when compared to Q3 2017.

[READ MORE: NBS clears air on independence of unemployment data)

Unemployment rate in Nigeria averaged 10.63% from 2006 until 2017, reaching an all-time high of 19.70% in the fourth quarter of 2009 (the peak of the global financial crisis) and a record low of 5.10% in the fourth quarter of 2010 (the period of high oil prices).

Although it was expected that the return to economic growth in Q2 2017 following five consecutive quarters of negative growth should provide an impetus to employment, the pace of recovery has not been strong enough to encourage businesses to raise their demand for labour.

Whilst we agree with the Senate that the high unemployment rate is a major contributor to the increasing crime rate in the country, we are uncertain that the suggestion on the creation of an unemployment fund is feasible considering that the government is in dire need of funds.

________________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.