Nigeria’s largest companies have spent a whopping N85.7 billion on Advertising, Branding, Marketing and Promotion “ABMP” expenses in 2019. This is according to the information contained in the annual report of these companies as compiled by Nairametrics research.

According to the data, ABMP spend annualized for 2019 is about N114 billion compared to N116.394 billion spent in 2018 and N101.8 billion in 2017. We believe the ad spend could top N114 billion as ABMP expenses typically increase in the last quarter of the year. Most of the companies featured in our survey do not report advertising spend separately bundling it with marketing, branding and promotional expenses.

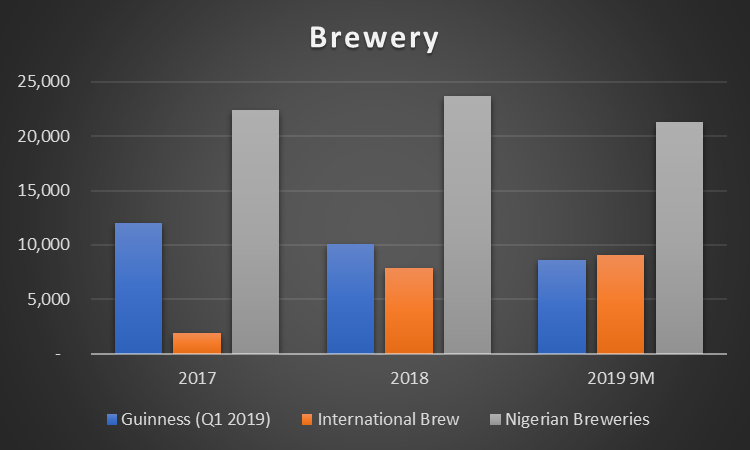

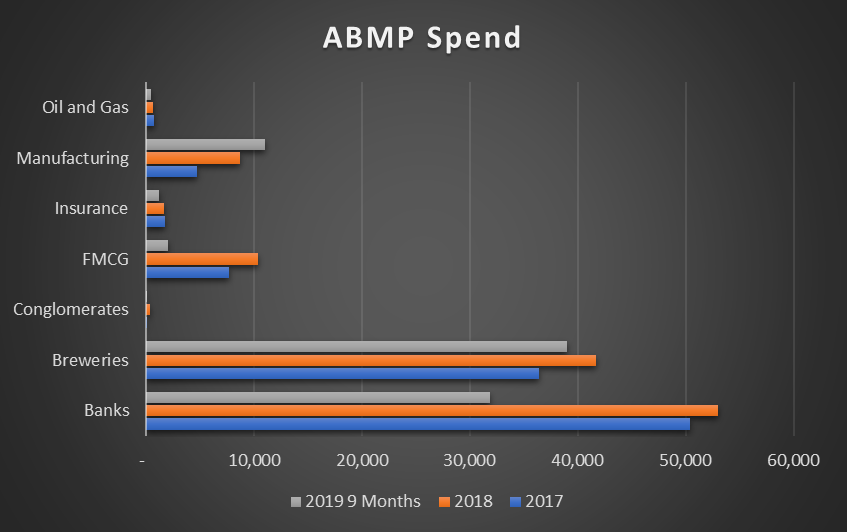

Big spenders: The research also indicates big ad spend occurs mainly in industries with stiff competition as they jostle to draw customer attention and pockets. For example, the brewery industry made of Nigeria Breweries, Guinness and International Breweries spent about N41.6 billion in 2018 compared to N36.4 billion in 2017. ABMP data in the first 9 months of 2019 suggests they have spent about N39 billion. Guinness’s financial year-end is June 30th as such its ABMP spend for 2018 was between July 2018 and June 2019.

International Brewery’s acquisition by ABInbev has resulted in a big leap in ad spend between 2017 and 2019 helping them scrape into the market share of its closest rival Guinness Nigeria Plc. In 2018, Intl. Breweries spent N7.86 billion compared to N1.9 billion in 2017. It has so far spent about N9 billion in the first 9 months of 2019. Nigerian Breweries continues to lead the pack with over N20 billion (N22.4b, N23.7 billion and N21.3 billion in 2017, 2018 and 2019 respectively.

Big spenders: Apart from the Brewery sector, the banking sector also recorded significant ABMP spend with about N31.9 billion so far in 2019. Spending in this sector topped N52.9 billion in 2018 and about N50.4 billion in 2017.

Access Bank’s merger with Diamond Bank helped recorded the biggest increase in ABMP spend topping N5.9 billion in the first 9 months of 2019. This compares to N4.8 billion recorded in 2018 and N6billion recorded in 2017 all 12 full calendar months compared to 9 months so far in September. The bank is set to top its total ABMP spend for 2017.

We also observe, Zenith Bank remains the highest spenders with aver N9 billion spent in 2018. The bank has so far spent about N5.1 billion in 2019. Combined, the banking sector has spent about N135.3 billion in 33 months. We also observed a rise in the commercial bank’s preference for spending on big media events such as fashion shows, SME fairs, and hackathons. It is unclear how they classify this spend in their books considering that it cuts across advertising, branding, promotions, and marketing.

How are they spend: Nairametrics research concludes big brands spend a huge chunk of their money on billboards, TV spend, Newspapers and digital ads. We also observe ABMP spending on branded events has increased over the years as brands pivot more into fashion shows and fairs.

[READ ALSO: Nigerians who earn less than minimum wage spend 95% on food – Report(Opens in a new browser tab)]

The pivot towards organic media sponsored events is thought to have started with Guaranty Trust Bank following the success of its fashion and food fair. Banks like Zenith, UBA, and Fidelity Bank have also veered into this space splashing millions of naira on billboard and digital ad spend. Some banks also spend heavily running online TV stations that promote their brand and products as well as cover their events. The banks also not report how to measure return on investments.

A recent PWC research report on outlook of Entertainment and Media in Nigeria projects total advertising spend of about $450 million (N162 billion) in 2019. This amount likely excludes branding, marketing, and promotions. According to the report, Nigerian brands spent about $387 million and $419 million in 2017 and 2018 respectively. Most of the money went towards TV & Video spend as well as Out of home (billboard) advertising. Internet ad spend is only expected to hit $86 million in 2019.

Source: Statista/PWC

Foreign ads: Sources from some of Nigeria’s largest ad agencies inform Nairametrics that foreign ad sellers like Google, Facebook, and Twitter attract most of the $86 million projected to be spent on internet ads in 2019. Online businesses such as news and blogs are often paid pittance compared to their foreign counterparts mostly due to their larger user base and significantly better ad programs.

Nigerian media agencies and ad sellers also complain of being shortchanged by internationally affiliated PR agencies. According to a CEO of a PR agency who preferred to remain anonymous, multinationals doing business in Nigeria often prefer to key into global PR contracts with their European or US headquarters cutting off the services of PR agencies locally. Even when they do decide to work with local PR agencies, the fees are relatively smaller compared to when they directly invoice brands.

Recession and increased competition: Ad and PR agencies also complained that stiffer competition in the sector has reduced their earnings. This is even made worse by budget cuts from major brands who are now more frugal with how they channel their ad spend. According to the agencies, most brands also demand data on ROI as they increasingly want to tie ad spend increase in topline revenues.

Note: The report focusses on about 24 of the largest quoted companies on the Nigerian Stock Exchange with published annual reports for the last three years.

Nice one. Thanks for the analysis

Well done guys. Good job. We want more analysis like this!