The Central Bank of Nigeria (CBN), in collaboration with other stakeholders in the banking industry, have established N1 billion Bankers’ Charitable Endowment Fund in order to improve the standard of living across the nation.

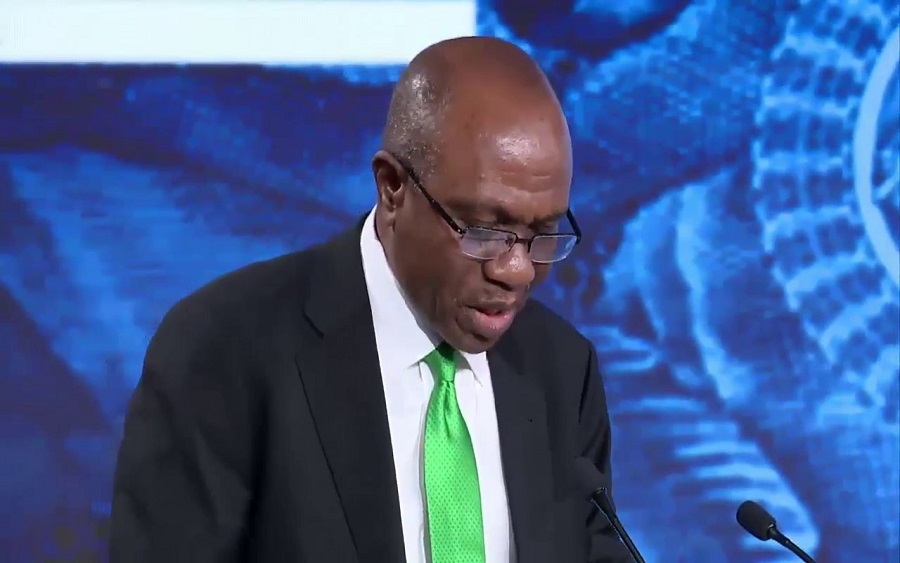

According to Leadership, the CBN Governor, Mr Godwin Emefiele at the 2019 Bankers’ Dinner, disclosed that the Fund would cater to social programmes across the different communities in Nigeria. The governor encouraged other sectors of the economy to follow suit and put in efforts to better the standard of living in the country.

The Fund was created after a critical discussion with industry stakeholders, who desired to increase their support for social causes that are beneficial to society. Emefiele said that the banking industry has a critical part to play in the growth of the economy, as access to credit can boost household consumption and domestic production of goods and services.

According to him, the Bankers’ Charitable Endowment Fund, would fund a major charitable initiative every year starting from next year.

“As we push forward on our priorities to drive economic growth, it is also critical that the banking industry remains focused on having a positive social impact on society. I am glad that the banking sector is making significant contributions in this direction, as 5% of its annual profits are dedicated to the Agric-Business/Small and Medium Enterprises Investment Scheme.

“The scheme has supported farmers, entrepreneurs and small businesses in engaging in productive activities. This contribution does not mean that we should relent in supporting social causes that are beneficial to society. If we all work together, we will be able to generate double-digit growth numbers in the near future,” Emefiele said.

[READ MORE: 2020: CBN eyes $4 billion non-oil revenue)

However, on the issue of border closure, the governor said there’s a need for Nigeria to eliminate the culture of importation so as to reduce unemployment and support growth of local industries.

“This is because if we do not reduce imports, the same imports will kill us knowing full well that such activities do not aid our efforts in creating jobs and supporting the growth of our local industries.

“If we choose to support excessive imports of goods that can be produced in Nigeria, we will lose jobs, our industries will die and insecurity and other social vices in our land will continue to increase. We must choose this alternative path of improving domestic production, which will support the growth of our local economy.

“While errors have been made in the past, we must forge ahead knowing that it is indeed still possible to attain a great Nigeria. But this can only be achieved if we work together and engage in activities that support improved production and consumption of goods and services that can be produced here.

“As the monetary and fiscal authorities continue to work tirelessly to support the recovery of our economy, I would like to reiterate that Nigeria is indeed open for foreign investors who are keen to support our efforts at unlocking the immense opportunities in our economy, knowing that it offers mutual gains to both the investors and the nation.

“Investors can be assured that their investments in Nigeria would be duly protected by the authorities, as we are fully aware of the various advantages they can provide to our economy in terms of capital and technological know-how. We hereby reaffirm our commitment to investors that Nigeria is indeed open for business,” said Emefiele.