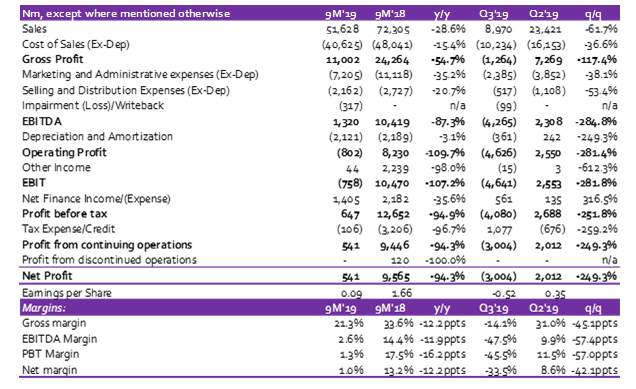

Unilever Nigeria Plc in its just-published H1 2019 result announced a 28.6% y/y decline in Revenue to N51.6 billion in 9M 2019 from N72.3 billion in 9M 2018 following an underwhelming Q3 2019. In Q3, Revenue plunged 61.7% q/q and 62.9% y/y to N9.0 billion. The steep decline in Revenue for Q3 came in as a surprise causing 9M Revenue to miss our 9M estimate of N69.2 billion. As our estimates show, we anticipated a moderate decline in Revenue for Unilever.

Our findings show that the steep Revenue decline in Q3 may be partly due to the company’s decision to stop extending credit to suppliers leading to reduced demand. A 33.7% q/q decline in Trade Receivables supports this assumption. The company last recorded this magnitude of decline in Receivables in Q4 2018 where it was down 31.8% q/q and Revenue declined in tandem by 14.8%.

[READ MORE: Quick Take: Poor performance extends into Q3]

The company’s two product segments were pressured within the quarter which compounded an already weak H1 2019. The Home and Personal Care (HPC) business suffered the biggest weakness declining 34.6% y/y to N25.0 billion in 9M 2019 and 69.8% q/q to N3.7 billion in Q3 2019. In addition, the Food Products business segment fell 21.9% y/y to N26.7 billion in 9M 2019 and 56.1% q/q to N5.3 billion in Q3 2019.

Cost of Sales (adjusted for Depreciation) declined by 15.4% y/y to N40.6 billion in 9M 2019 from N48.0 billion in 9M 2018 largely on the back of lower volumes. On a q/q basis, Cost of Sales fell by 36.6% q/q to N10.2 billion in Q3. The faster decline in Revenue and per unit cost pressures saw Gross Profit decline by 54.7% y/y to N11.0 billion while the company recorded a Gross loss of N1.3 billion in Q3 2019. Input cost continue to pressure operating performance as high cost of industrial heavy Linear Alkyl Benzene continues to pressure margins in the HPC business. Overall business Gross margin dipped 12.2ppts y/y to 21.3% for 9M 2019.

In the face of pressured Revenues and input costs, management has maintained its strategy of keeping the lid on Operating Costs. Thus, Marketing & Administrative Expenses, as well as Selling & Distribution Expenses adjusted for depreciation, dipped 35.2% y/y and 20.7% y/y to N7.2 billion and N2.2 billion respectively for 9M 2019. Despite the decline in Operating Expenses, EBITDA declined 87.3% y/y to N1.3 billion in 9M 2019 from N10.4 billion in 9M 2018 while EBITDA margin fell 11.9ppts y/y to 2.6%. Despite lower Depreciation Charge (down 3.1% y/y to N2.1 billion), the company recorded Operating loss of N0.8 billion in 9M 2019 compared to Operating Profit of N8.2 billion in 9M 2018.

The company recorded Profit before Tax of N0.6 billion in 9M 2019 despite the Operating Loss recorded as the company booked Net Finance Income which was down 35.6% y/y to N1.4 billion.The decline in Net Finance Income was driven by decline in Cash & Cash Equivalents (down 47.5% y/y to N30.0 billion) for the period. Overall, Net Income was down 94.3% y/y to N0.5 billion from N9.6 billion in 9M 2019 while the company recorded a loss of N3.0 billion in Q3 2019 which compares with a Net Profit of N2.0 billion in Q2 2019 and N3.8 billion in Q3 2018.

[READ ALSO: Quick take: Earnings beat estimates on strong Non Interest Income and write backs]

We recall expressing concerns on the operations of Unilever from end 2018 into Q1 2019. Though Q2 performance gave room for some optimism, Q3 performance has deepened our concerns. We believe Unilever’s core business in the HPC segment is under severe pressure due to the availability of steeply discounted alternatives to the company’s product.

______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.