Nigeria’s total debt stock rose to N25.7 trillion (US$83.8 billion) as of the end of June 2019. This is contained in the latest report released by the Debt Management Office (DMO). This figure increases net borrowing to about N754 billion.

According to the latest report released by DMO, Nigeria’s total debt portfolio rose to N25.7 trillion as of June 30, 2019, compared to N24.9 trillion recorded in March 2019. That is, within three months, Nigeria increased its debt by N754.56 billion, representing a 3.2% increase.

Debts Breakdown

Nigeria’s total debt stock constitutes both external and domestic debts. According to the latest DMO report, the country’s total external debt rose to N8.32 trillion ($27.1 billion), representing about 32.38% of the total debt stock. While the domestic debt constitutes 67.68%.

- The breakdown of the total external debt showed that the federal government accounted for the biggest external debt stock in the country.

- As at June 2019, out of the N8.32 trillion external debt, the Federal Government accounted for 7.01 trillion, while states and FCT accounted for only N1.30 trillion. This means the Federal Government accounts for 84% of Nigeria’s total external debt.

- Also, the Federal Government (FG) accounts for the biggest domestic debt in the country. Specifically, out of Nigeria’s total N13.4 trillion domestic debt, FG accounted for N13.4 trillion, while states and FCT’s domestic debt stood at N3.9 trillion.

- Overall, out of Nigeria’s N25.7 trillion debt stock, debt accruing to FG stood at N20.4 trillion (79%), while that of states and FCT stood at N5.27 trillion (20.5%).

The Rising Cost

While Nigeria’s debt profile hit a new height in the second quarter of 2019 (thanks to the federal government) the cost of servicing the debt hits just another height. In recent times, there have rising concerns over Nigeria’s debt service.

Experts have stated that while the country’s debt to GDP ratio may be sustainable in the meantime, the cost of servicing the debt eats deep into the country’s already depleting revenue.

- According to the DMO’s report, Nigeria paid a total of $252.2 million or N77 billion to service the country’s external debt between April and June 2019, while N189.8 billion was paid to service domestic debt.

- This means Nigeria paid a total sum of N267.1 billion to service the country’s debt stock in just three months.

- The breakdown shows that for the external debt, the World Bank’s debt servicing gulped almost $100 million within the period.

- On the domestic front, interest paid on FG green bond was estimated at N718.5 billion with the period. Other instruments that gulped debt servicing in the domestic fronts include FG bonds (N128.9 billion), Treasury bonds (N6.25 billion) and FG Sukuk (7.84 billion).

More debt on the horizon

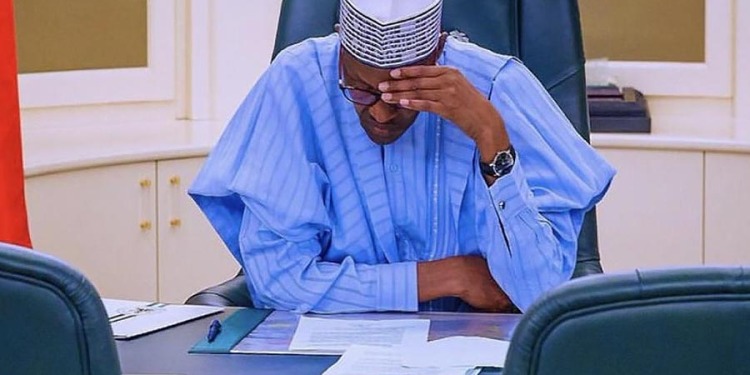

On Tuesday, October 8, 2019, President Muhammadu Buhari presented to a joint session of the National Assembly the details of the budget which is named, ‘Budget of Sustaining Growth and Job Creation.’

Specifically, the aggregate expenditure for the 2020 Budget is now N10.33 trillion. While experts have weighed in to criticize the budget for lacking wits, characterized with recycled elements and unrealistic targets, the budget proposal showed debt services would gulp another N2.45 trillion.

According to the Minister of Finance, Budget and National Planning, Mrs. Zainab Shamsuna Ahmed, the sum of N1.7 trillion will be borrowed to finance the 2020 budget. As earlier published on Nairametrics, Nigeria has already approached the World Bank for another loan to the tune of $2.5 or N767.3 billion in a new tranche of concessionary lending.

Experts have raised concerns over financing the budget by borrowing. Following the budget presentation, the Lagos Chamber of Commerce & Industry (LCCI) recently stated that from the total budget size of N10.3 trillion, having a recurrent component of N4.88tn and debt service of N2.45 trillion means there was not much left for infrastructure development.

[READ ALSO: Expert says Federal Government can make $280 billion from iron ore every year]

According to the Director-General of LCCI, Muda Yusuf, “Debt service commitment and recurrent spending are beginning to crowd out capital expenditure. This scenario is not in alignment with the aspiration to build infrastructure and a competitive economy. Debt service of N2.46 trillion is more than the capital budget of N2.14 trillion.”

Also commenting on the 2020 budget, the head of Tax and Regulatory Services at PricewaterhouseCoopers (PwC), Taiwo Oyedele, stated that revenue would be a challenge to achieve 2020 budget due to the rising debt burden.

It is crystal clear that the government faces a huge fiscal revenue quagmire, and it is in this context that the FG’s proposed 7.5% Value Added Tax (VAT) increase was incorporated in the 2020 budget.