Cryptocurrency is no longer a part of our distant future but what is already part of our present – a tool to help us escape the oppression of banks and governments, a report from Fortunly revealed.

It means a lot of things to different people. To idealists, crypto is a brave new idea; to politicians, an illegal enabler of deep-web sites like the Silk Road. Also, it is a way for the average consumer to regain some financial power.

[READ MORE: French Government addresses the danger of Facebook’s Cryptocurrency]

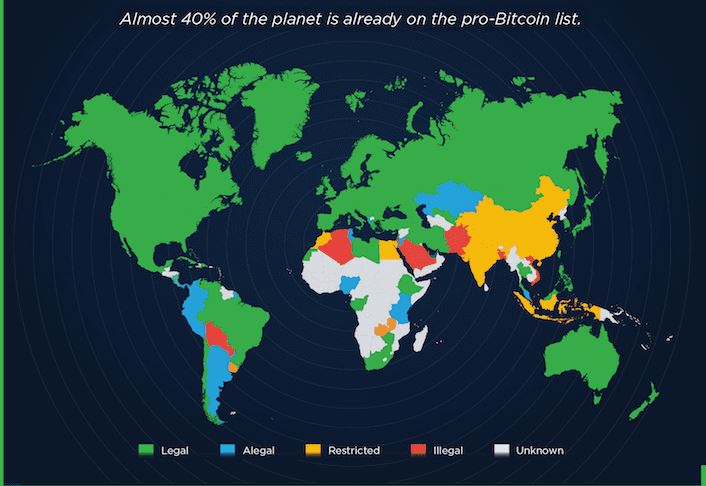

How it works: Fortunly said the cryptocurrency market is a bit like the Wild West. It’s unregulated and offers a dose of anonymity that can easily be abused, and it seems impossible to control. Since it’s not regulated by the government, the current Bitcoin price varies wildly from day to day. Even though transactions are not taxed, they’re legally subject to taxation, something that’s not always easy for the government to enforce.

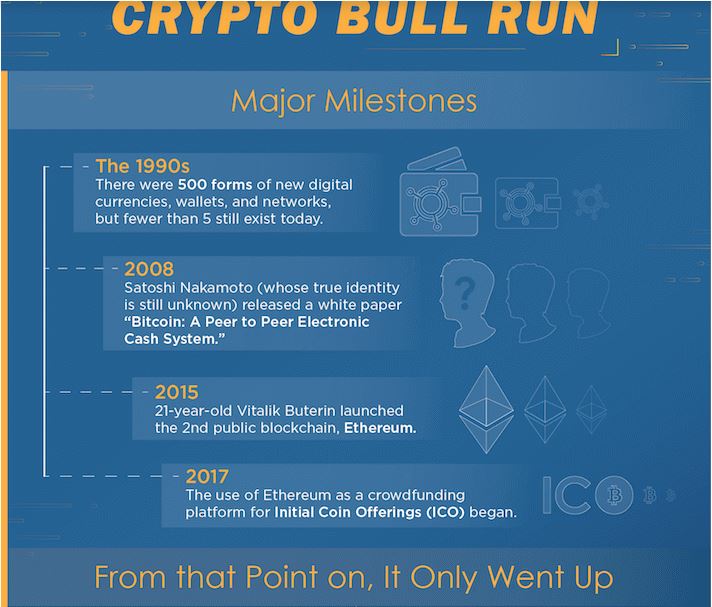

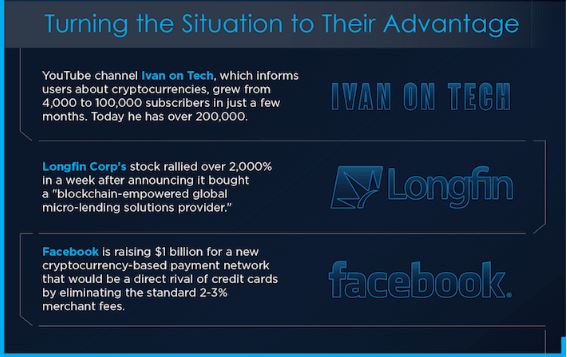

From the emergence of Bitcoin and Ethereum, all the way to Facebook’s Libra, Fortunly explained that the blockchain technologies and crypto had been raising dust and changing the concept of finance as we know it. We know the whole thing is exciting and innovative.

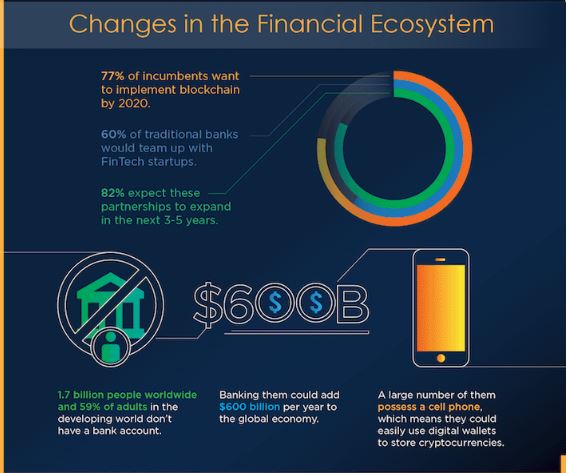

But is it safe? Since cryptocurrency transactions operate on open online ledgers, the need for a trusted intermediary is completely eliminated. Given the fact that banks build their entire business on being trusted intermediaries and handling transactions for other people, the very existence of cryptocurrency exchanges is an affront to them. Banks are worried, governments are terrified, financial experts are torn between glee and gloom, and consumers simply don’t know what to think. How will this affect them?

Blockchain technology is changing the world of finance and giving us a tool that could potentially transform global law, commerce, and politics. And the danger it presents? Well, that lies mostly in the fact that cryptocurrencies aren’t well-regulated, which is bound to change as governments implement new measures to protect their financial systems. Facebook’s Libra

Is it lucrative? As of December 2018, about 35 million users were participating in the cryptocurrency ecosystem, which was a 94% rise from 2017. But that is still less than 1% of the global population, which signals far from mass adoption. The total crypto market value is $64 billion, with Bitcoin claiming a 52% market share.

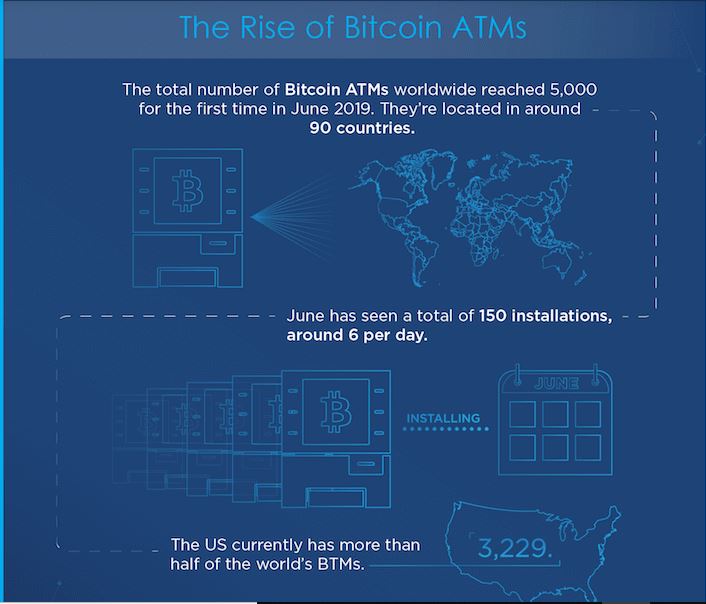

Rise of Bitcoin ATMs: The total number of Bitcoin ATMs (BTMs) worldwide reached 5,000 for the first time in June 2019. They are located in about 90 countries across the globe. As at June, a total of 150 installations and that translate to about 6 installations per day were carried out. The US has more than half of the world’s BTM.

[READ ALSO: 6 features to look out for in a Cryptocurrency]

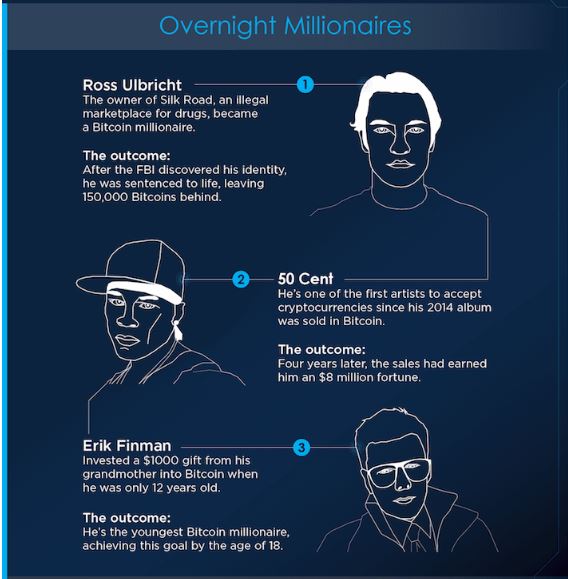

Some Bitcoin Millionaires:

- Ross Ulbricht is the owner of Silk Road, an illegal market place for drugs. He became a Bitcoin millionaire. After FBI discovered his identity, the Silk Road boss was sentenced to life, leaving 150,000 Bitcoins behind.

- Another overnight Bitcoin millionaire is 50 Cent. He is one of the first artists to accept the goldmine since his 2014 album was sold in Bitcoin. Four years later, the sales had earned him an $8 million fortune.

- Erik Finman invested a $1000 gift from his grandmother into Bitcoin when he was only 12 years old. Six years later, he became the youngest Bitcoin millionaire, achieving this goal at age 18.

See Cryptocurrency infographics below: