There is a possibility that the Nigerian government may again be fined for the alleged breach of contract on Mambilla Hydroelectric project. This development emerged following a $9 billion (N3.5 trillion) judgment against Nigeria, involving British Firm – Process and Industrial Developments Ltd (P&ID).

The dispute: Messrs Sunrise Power and Transmission Company Limited (SPTCL) has instituted a legal action against the Nigerian government over the Mambilla project.

The plaintiffs claimed that it was awarded a $5.8 billion contract for the construction of the Mambilla Hydroelectric Power Project on the basis of Build, Operate and Transfer.

According to the firm, after they were awarded the contract in 2003, some ‘vested interests’ in government in 2017 signed another contract with three Chinese companies, Sinohhydro Corporation of China, China Ghezouba Group Corporation of China and China Geo-Engineering Group Corporation, to form a joint venture for the execution of the same project.

[READ MORE: Despite FG’s reduction, US refuses to drop hiked visa fees for Nigerians]

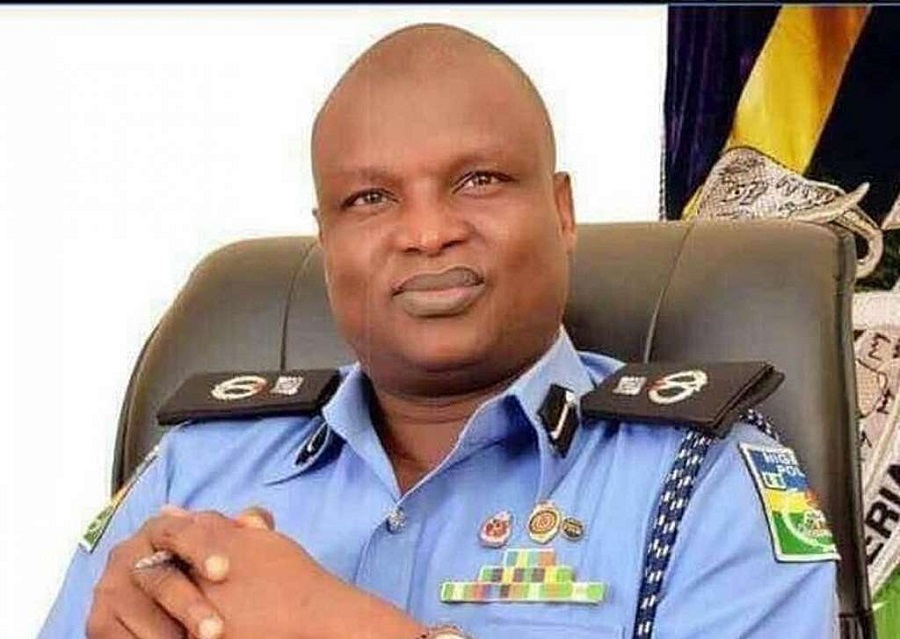

The Chief of Staff to the President, Abba Kyari, was also mentioned in the controversy, as the company reportedly accused him of the unilateral decision to remove the company from the contract. Similarly, the former Minister of Power, Babatunde Fashola, was accused of not supporting the project, contrary to his promise.

As a result of the breach of contract, the SPTCL dragged the government and its Chinese partners before the International Chamber of Commerce in Paris, France.

What you should know: Mambilla hydropower project is a 3.05GW hydroelectric facility being developed on the Dongo River near Baruf, in Kakara Village of Taraba State, Nigeria.

Expected to commence operation in 2030, Mambilla will be Nigeria’s biggest power plant, producing approximately 4.7 billion kWh of electricity a year.

[READ MORE: FG bows to pressure, ready to negotiate with P&ID firm over $9 billion U.K judgement]

The project is estimated to cost $5.8 billion and will generate up to 50,000 local jobs during the construction phase.