The Federal Government of Nigeria has made an unexpected U-turn over the $9 billion (N3.5 trillion) judgment involving Nigeria and a British Firm – Process and Industrial Developments Ltd (P&ID).

The sudden move by the federal government to negotiate with the firm was disclosed by the Minister of Information and Culture, Lai Mohammed while speaking on NTA breakfast programme on Thursday.

The details: According to Muhammed, the government knows the consequences of such payment on the economy, and is ready to negotiate with P&ID to find a way out.

The statement credited to the minister came against the backdrop of the recent press release by the Federal Government, where the same minister for information threatened that the reports of Nigerian assets take over held no water.

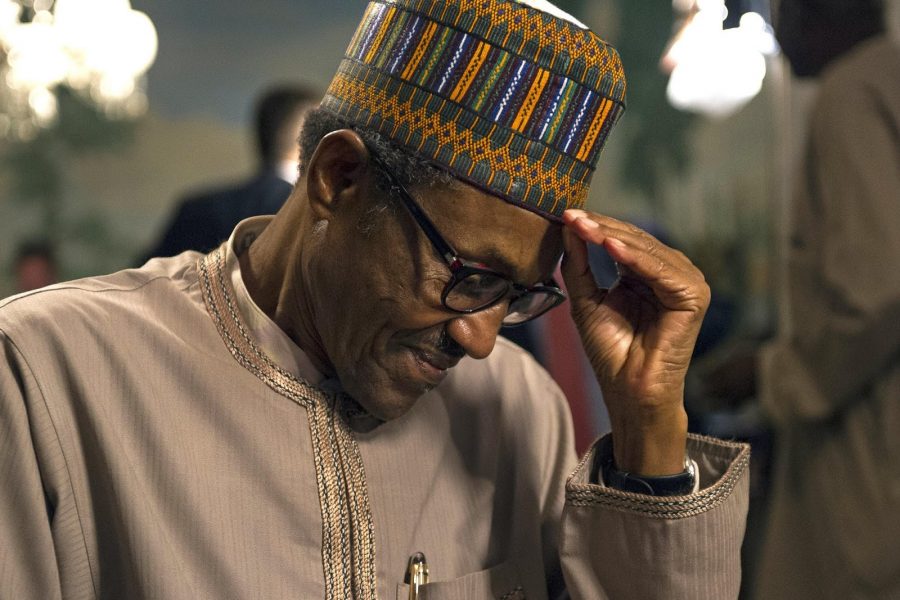

[READ MORE: Buhari orders probe of past administrations over $9 billion U.K judgment]

However, the government appears to have bowed to pressure, resolving to negotiate with the firm as there were concerns over the judgment.

“We are leaving no stone unturned to resolve this matter. We are ready to sit down with them and negotiate what is reasonable to all parties. You don’t inflict this kind of injury on a country and its people.

“First eleven would be engaged to take over the case. We are making wide consultations on the matter. Nigerians can rest assured that everything is being done to make sure that the country is not short-changed in this case,” the minister said.

Reasons for negotiation: The minister disclosed the reason behind the decision of the government to negotiate. According to him, the firm in question has the resources to hire the best PR agencies in the world to turn the case on Nigeria.

“The contract itself was not justifiable and I know that the EFCC, Ministry of Justice and other bodies investigating the contract will come up with facts on how the whole thing was done. The government will not sleep until this matter is resolved in a manner that will not injure the interest of Nigeria.

“The P&ID has the resources to hire the best PR agencies in the world to spread this falsehood. And without internal collaborators, external conspirators will not succeed. We will find those involved in this scam, either inside or outside government. The Ministry of Justice has enough experts to know that this would not be in the interest of our country. On the surface, it was a scam ab initio and the actors knew where they were going,” Muhammed disclosed.

The minister further reiterated that the government would do everything within its power to ensure that those involved are exposed and prosecuted.

Recent Development: As earlier published by Nairametrics in recent articles, P&ID, an Irish Firm, was awarded $6.6 billion in an arbitration decision over a failed project to build a gas processing plant in the Southern Nigerian city of Calabar. With the accumulated interest payments, the sum now tops $9 billion, which amounts to 20% of Nigeria’s foreign reserves.

- The firm had initiated moves to identify the Nigerian assets that could be seized and it might include the country’s oil cargoes.

- Meanwhile, the latest move by Nigeria includes the order given by President Muhammadu Buhari for the immediate probe of past administrations over the $9 billion judgment. The investigation may cover both the former President Good luck Jonathan’s administration and his predecessor – Umaru Musa Yar’Adua.

- Commenting on the development at a press briefing, the Minister of Finance, stated that the judgment cannot stand as it constitutes about N3.5 trillion.

The bottom line: Experts have disclosed that P&ID can target Nigeria’s real estate, bank accounts or any kind of moveable wealth, but it has to prove that the property is unrelated to Nigeria’s operations as a sovereign state.

The move to negotiate suggests the presidency may be under some sort of pressure and concerns have been raised that the possibility of seizing Nigerian assets might cost fortunes if negotiations are not initiated.

In the meantime, the firm may now likely enter into a negotiation with the Nigerian government, as it had earlier warned that instead of Nigeria to enter into negotiation, the government resolved into sham media campaign over the case.

[READ ALSO: Buhari’s CBN policies may drag the Nigerian economy into crisis – Fitch]

Good handiwork