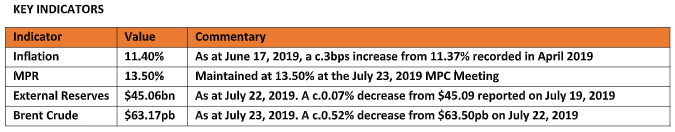

This is the summary of the daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills and FGN Bonds.

This report is dated July 23rd.

***CBN Retains MPR at 13.50%***

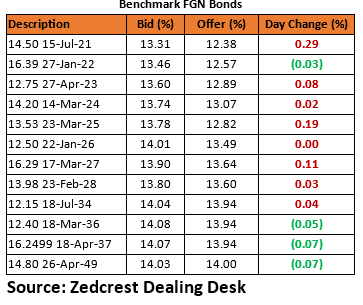

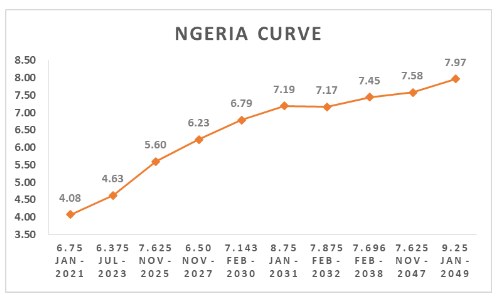

Bonds: The FGN Bond market was relatively muted during today’s session, as market players awaited the outcome of the CBN’s MPC meeting. Yields tracked higher on the short and mid-end of the curve, whilst they ticked lower on the longer end as some market players re-invested coupon payments on the FGN 2030 bond. Yields were consequently higher by c.5bps on average.

We expect yields to trend higher in tomorrow’s session, with bullish sentiments expected to soften, given the hold in MPR by the CBN, whilst market players reposition ahead of the FGN Bond auction tomorrow.

[READ ALSO: Three quick ways to find out if a stock is overvalued]

Given the recent decline in sovereign yields, we expect the auction stop rates to clear below their previous auction levels at the FGN Bond auction scheduled for tomorrow, where the DMO intends to offer a total of N145bn bonds across the 5, 10 and 30yr tenors.

[READ MORE: 9 TIPS to KNOW when NOT to INVEST]

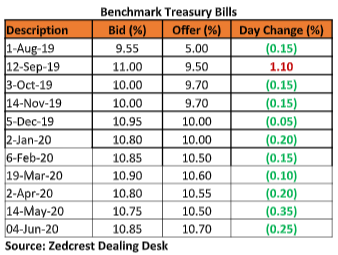

Treasury Bills: The T-bills market remained slightly bullish, as demand interest persisted on the mid to long end of the curve. We, however, witnessed a slight sell interest on the shorter end of the curve due to system liquidity squeeze from the wholesale FX auction in the previous session. Yields were consequently lower by c.5bps on average.

We expect rates to remain relatively stable in the near term, with system liquidity expected to remain slightly constrained in the near term.

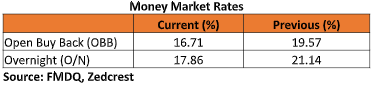

Money Market: Rates in the money market moderated slightly by c.2pct, due to inflows (c.N30bn) from coupon payments on the FGN 2030 bond. The OBB and OVN rates consequently ended the session at 16.71% and 17.86%, with system liquidity currently estimated at c.N70bn positive.

We expect rates to moderate further tomorrow, as there are no significant outflows anticipated.

[READ MORE: Daily Update: Nigeria debuts 30year FGN bonds priced at a coupon of 14.80%]

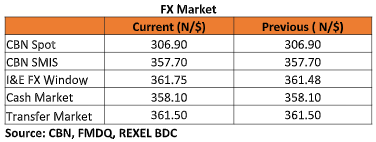

FX Market: At the interbank, the Naira/USD rate remained stable at N306.90/$ (Spot) and N357.70/$ (SMIS). The NAFEX closing rate at the I&E window rose higher by 27k to N361.75/$, whilst the market turnover rose by c.40% to $128m. At the parallel market, the cash and transfer rates remained stable at N357.50/$ and N361.50/$ respectively.

Eurobonds: Demand interests remained firm in the NIGERIA sovereigns, with yields lower by c.5bps and the most gains witnessed on the long end of the curve.

We witnessed a continued rally across all the traded NIGERIA Corp Tickers, with most bonds higher by c.1pct on the day. The boost in prices was largely fueled by the repayment of $450m to the FBNNL 21 bondholders, following a call earlier announced on the 16th of June and effective today. The highest gainers during the session were the UBANL 22s (107/108) and ETINL 24s (113.75/114.75).

Contact us: Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment advice or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.

[READ MORE: Stockbrokers won’t agree whether CBN’s SDF policy will make banks great again]