Several reactions have continued to trail the Central Bank of Nigeria’s recent directive ordering all commercial banks within the Nigerian banking industry to maintain a minimum loan to deposit ratio (LDR) of 60% starting from September 2019.

The apex bank had argued that the directive is aimed at encouraging “SME, Retail, Mortgage, and Consumer Lending“. Lenders who fail to follow through with the directives would result in a levy of additional Cash Reserve (CR) Requirement, which is equal to 50% of the lending shortfall of the target LDR.

The latest criticism trailing the directive from the CBN came from EFG Hermes Research. A report which was authoured by EFG Hermes Research’ Director in charge of Sub-Saharan African banks, Ronak Ghadi, opined that the apex bank’s regulation could be damaging for the Nigerian Banking Industry.

The report which was seen by Nairametrics, posited the directive could negatively affect the asset allocation decisions of Nigerian banks.

The report also noted that the sector’s regulators normally introduce maximum LDR thresholds aimed at limiting risk-taking by commercial banks. Below are some of the points highlighted in the report:

- The introduction of the new net LDR encourages commercial banks to undertake more risk at a time when the macro-economic environment remains fragile at best.

- Conversely, it could lead to the underwriting of high risks loans which could further lead to the weakening of assets and by extension, the destabilisation of the industry.

What this regulation means for banks: They will have to reduce their investments in debt securities while underwriting high-risks loan assets. This could create a pull-push effect on the banks’ profits, depending on the quality of the new assets created.

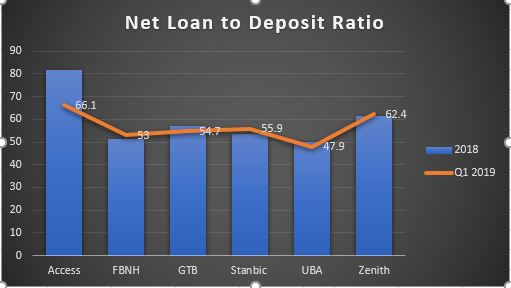

As the EFG Hermes Research noted, the CBN directive may disrupt the asset allocation choices of some banks going forward. It should be noted, however, that most tier-1 banks have LDR close to the regulatory 60% minimum.

For example, Access Bank Plc and Zenith Bank Plc met the minimum net LDRs of 81.7% and 61.5% as at 2018 and 66.1% and 62.4% respectively, at Q1 2019 ending. United Bank for Africa (UBA), recorded the largest shortfall with an estimated net of 50.1% and 47.9% as at ending of 2018 and Q1 2019. FBN, GTBank, and Stanbic’s net LDRs also fell below the regulatory threshold.

Meanwhile, the report shows that the regulation could be stringent because the CBN is exploring ways to limit banks’ investments in government’s securities. This move is aimed at accelerating lending to the private sector.

[READ THIS: Meet Julian Osula, the billionaire who disrupted traffic with a helicopter]

Will this move by the CBN fuel a possible Mergers and Acquisitions?

The introduction of minimum LDR threshold is unlikely to have any significant impact on most tier-1 banks. This is because the financial institutions will be able to meet the threshold either by either:

- Moderately increasing their loan book, or

- Seeking for deposit substitutes in other funding sources (such as local corporate bonds, Eurobonds, etc,) which could reduce the rate of financial inclusion.

Note, however, that should the new regulations fail to achieve their objective (which is, to accelerate private sector lending, especially to the “Real sectors”), the CBN may announce further guidelines to try and achieve the same.

[READ FURTHER: Nigeria’s GDP records slow growth of 2.01% in Q1, as Oil contracts]