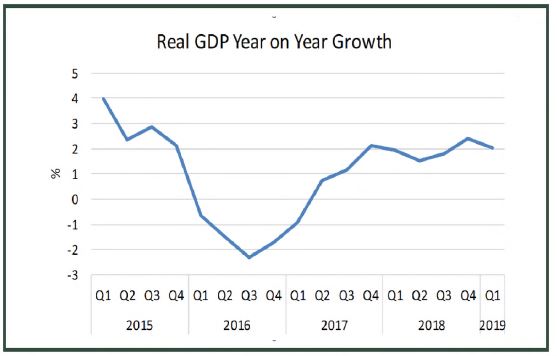

Nigeria’s Gross Domestic Product (GDP) grew by 2.01 percent in real terms, in the first quarter (Q1) of 2019, compared to 2.38 percent in Q4 2018. This is revealed in the latest GDP data released by the National Bureau of Statistics (NBS).

According to the NBS report, year on year, Nigeria’s GDP grew by 2.01 percent, compared to the corresponding growth of 1.89 percent in Q1 2018. Analysis of the GDP data also shows that although Nigeria’s service and industrial sectors grew in the previous quarter (Q4 2018), both contracted in the quarter under review.

Also, aggregate GDP stood at N31.7 million in nominal terms, higher than in the first quarter of 2018 which recorded N28.4 million; representing a year on year nominal growth rate of 11.80%. Basically, the nominal GDP growth rate in Q1 2019 was higher than the rate recorded in Q1 2018 by 2.54% points.

Get the latest insights on Nigeria’s GDP

Growth by Sectors: Nigeria’s GDP by sector shows that the services and industrial sectors contracted in the quarter when compared to the previous quarter of 2018. The agricultural sector, however, peaked. Specifically, the industrial sector grew at an abysmally low growth of 0.04 percent for the quarter, showing that there was a lackluster performance of Nigeria’s industrial sector. Contractions in growth may partly be traceable to the general elections, as noted by the Bureau.

Similarly, the services sector also contracted in the quarter from 2.90 percent in Q4 2018, to 2.41 percent in Q1 2019. However, the agricultural sector continued its growth prospect as it recorded a 3.17 percent growth in the quarter, up from 2.46% recorded in the last quarter of 2018. This suggests that Nigeria’s agricultural sector is on the growth path despite challenges witnessed due to dependence on Oil.

Sectors’ contributions to GDP: Analysis of the data shows that the services sector maintains its bullish path, as it marshaled the percentage of sectors contributions to GDP. In Q1 2019, the contribution of Nigeria’s services sector to the GDP was estimated at 54.60 percent, up from 52.63 percent and higher than 2018 full year contribution of 52.63 percent.

The industry sector also improved in terms of contribution to total GDP. It recorded 23.49 percent of total GDP when compared to 2.24 percent in the last quarter of 2018. It is also higher than the full year 2018 of 22.24 percent.

Get the latest insights on Nigeria’s GDP

However, the contribution of the agricultural sector contracted to 21.91 percent, lower than its contribution in the last quarter. Meanwhile, the agricultural sector’s contribution was higher than the corresponding quarter of 2018 with 21.66 percent.

Oil and Non-oil sectors: The Nigerian economy can be classified broadly into the oil and non-oil sectors. Growth in Nigeria’s oil sector contracted and worsened as it recorded negative growth of -2.40 percent in Q1 2019, down from -1.62 percent earlier recorded. Note that Nigeria’s oil sector has been contracting since the second quarter (Q2) of 2018.

According to the NBS’s data, Oil entered the negative region and contracted in Q2 2018 to -3.95 percent from 14.02 percent in Q1, and later to -1.62 percent in Q4 2018. However, despite recording three months consecutive decline, the oil sector recorded a positive growth of 0.97 percent in the full year 2018.

On the other hand, the Non-oil sector has gained over the oil sector since the Q2 of 2018. Data shows that the oil sector grew by 2.47 percent in Q1 2019. Although, this shows a drop when compared to 2.70 percent recorded in Q4 2018. Comparing the oil and non-oil GDP, in the full year 2018, Non-oil sector grew by 2.00 percent, while the oil sector grew by 0.97 percent.

Similarly, in terms of contribution to the GDP, the non-oil sector also improved, recording 9.14 percent up from 7.06 percent in Q4 2018. Oil contracted in its contribution but still maintained the biggest contribution to GDP of 90.86 percent.

Optics: Nigeria’s GDP contracted in the latest data released by the Bureau. However, the Bureau noted that the contraction is most likely due to the general elections. The Bureau also stated that the 2.01 percent growth may have reflected in the strongest first quarter performance observed since 2015.

This implies that Nigeria’s economy is on a sustainable growth path as it withstood the shock of the general elections in 2019, better than it did in 2015. On the other hand, the growth recorded in the non-oil sector shows that government policies in diversifying the economy may already be showing signs of progress.

Upshots: Nairametrics had earlier reported about analysts’ prediction that the economy will grow by 2.25 percent in 2019, with agriculture expected to post a very gradual recovery to its trend growth rate of 3 percent. Also, the 2.01 percent growth further corroborates the decline in inflation for three consecutive months in the first quarter, with surging oil prices making it possible for the CBN to use reserves buffer to stabilize naira. Nairametrics expects Nigeria’s trade to also improve in the quarter.

Although, the growth recorded is slower than what was recorded in the previous quarter, there are signs of sustainable growth in the economy. However, the decline in the industrial sector may be a source of concern in the next quarter.