After exactly one month that President Muhammadu Buhari appointed Mr. Mele Kolo Kyari as the new Group Managing Director of the Nigerian National Petroleum Corporation (NNPC), alongside 7 new Chief Operating Officers, the new NNPC boss has formally taken over the helm of affairs from the former GMD, Makanti Baru.

The Valedictory Service of the outgone NNPC GMD held today at the Amphitheatre of the NNPC Tower in Abuja.

Recall that Kyari’s appointment came as a result of the mandatory retirement of the Makanti Baru, who clocked the retirement age of 60 years on 7th July 2019.

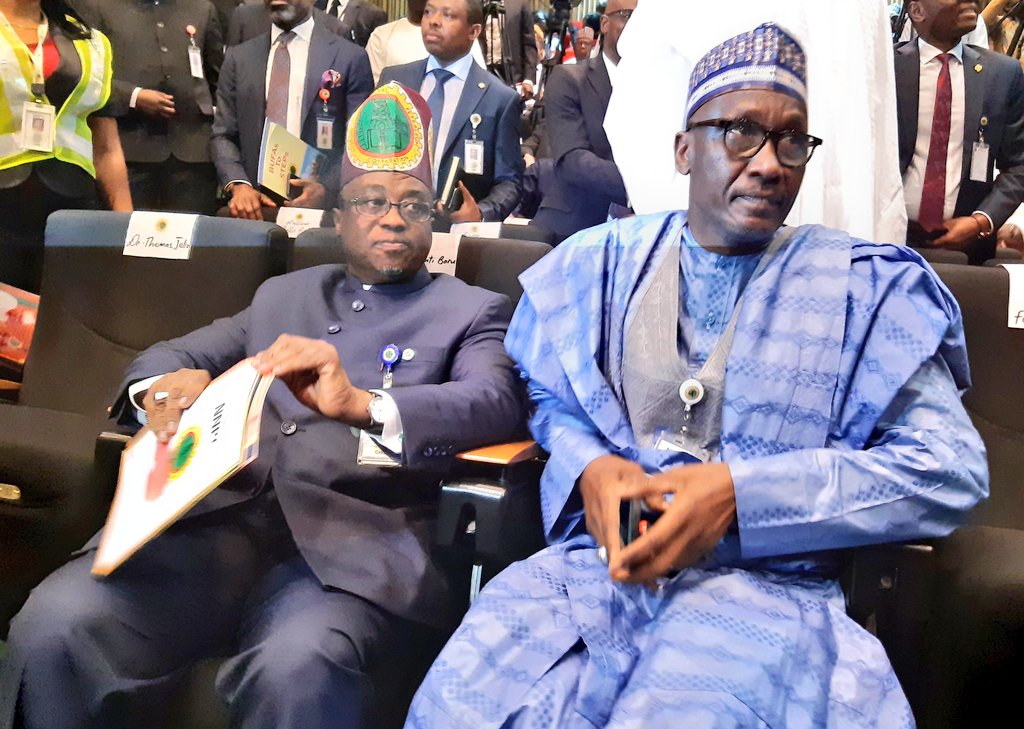

In attendance: Former GMDs L-R: Dr. M.T. John, Chief Odoliyi Lolomari, Chief Festus Marinho (1st @NNPCgroup GMD), Engr. Abubakar Yar'adua, Chief Chambaerlain Oyibo, Engr. Funsho Kupolokun & Dr. Joseph Dawha. 4th & 5th from left is outgoing GMD @DrMKBaru and incoming GMD @MKKyari pic.twitter.com/umzlZs3WKR

— NNPC Group (@NNPCgroup) July 8, 2019

Some of the dignitaries who attended the Valedictory session are the current Governor of Ekiti State, Doctor Kayode Fayemi, the Chairman of Economic and Financial Crimes Commission (EFCC), Ibrahim Magu; the Executive Secretary of Nigerian Extractive Industries Transparency Initiative (NEITI), Dr. Waziri Adio, and others.

Baru speaks on NNPC: While delivering his valedictory speech, Baru stated that NNPC had been restored on the growth path in the three years of his administration.

He said, “My dear colleagues, it is three years since I took over as the 18th GMD of NNPC. Over these eventful 1,099 days, I’ve done my very best to put the Corporation on the path of recovery, then to sustainable growth.

As always, there is a time when it is proper to leave the scene for fresh blood to continue the journey of leading the Corporation. For me, this time is NOW!

When you are young, speed and adrenaline seem to be great. But as you get older and wiser, comfort and peace of mind are not to be despised either. This is called S.O.S.: Slower, Older and Smarter!

I look back with so much pride of what we have achieved together as a family towards moving this great Corporation forward with the Twelve Business Focus Areas (12 BUFA).”

Highlighting some of his achievements, the former NNPC boss emphasized some of the feats he achieved. He said that some of the achievements recorded with his team of officers, include securing the $5 billion areas the Joint Venture through incremental production.

He also stated that NNPC had fully exited the payment of cash-call to ExxonMobil and that the corporation had paid about N198billion as pension arrears.

[ALSO READ: NNPC considering JV funding through the capital market]

The other achievements noted by Baru include:

- three folds increase and stabilized gas supply to the domestic market for power generation and other use;

- the rise of domestic gas supply to 1.7 bscf per day;

- increased and sustained crude oil/gas production to above 2million bopd and gas production of 8,000 MMcfd; and

- securing third-Party financing for the rehabilitation of the four refineries.

Focus on a global standard: While delivering his address after being introduced, the new NNPC boss restates his commitment to putting the corporation among global peers. Meanwhile, Kyari admitted his administration will give zero tolerance to corruption.

“There will be no corruption without discretion. We will work with all stakeholders within the NNPC group to ensure there is no discretion in the system.”

“We will build this company to enable it to compete with its global peers. We are not saying we will not make mistakes along the way, but we will not make deliberate mistakes.”

“We will deliver all our four refineries within the life of President Buhari’s administration. We shall seek strategic partnerships to ensure Nigeria becomes a net exporter of petroleum products.”

Brief Profile of NNPC’s new boss: Mele Kolo Kyari was born in Maiduguri, Borno State on the 8th of January, 1965. He obtained his Secondary School Certificate from Government Community Secondary School, Biu in Borno State between 1977 and 1982. In 1987, he graduated with a Bachelor’s degree in Geology from the University of Maiduguri.

Achievements: In 2007, Kyari won the GMD Prize for the Overall Best Performance for NNPC Management Development Programme, having transverse the entire value chain of the petroleum industry, with resounding records and performance in all his assignments. He was also awarded the Group Executive Director (GED) award for the best performance in Leadership.

Positions held: Prior to his appointment as the GMD of NNPC, Kyari was Nigeria’s National Representative at the Organisation of the Petroleum Exporting Countries (OPEC). He also doubled as the Group General Manager, Crude Oil Marketing Division of the NNPC. A position he held since 13th May, 2018.

[ALSO READ: 132 companies jostle for NNPC’s Direct Sale and Purchase Term Contract]