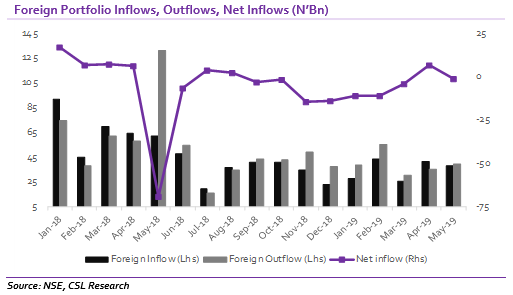

According to data released by the Nigerian Stock Exchange (NSE) on Domestic and FPI Report for the month of May, foreign investor participation in the equities market slumped to 35% of total transactions from 52% recorded in April. Foreign inflows also declined by 9.3% to N37.9 billion (US$105.3m) while outflows grew by 12.0% to N39.4 billion (US$109.4m) when compared to the month of April.

Consequently, the month of May showed a net outflow of N1.5bn (US$4.2m) compared to the net inflow of N6.6bn (US$18.3m) recorded in April.

In our view, the steep decline in foreign investors participation in the month of May was on the back of strong domestic investors (retail and institutional) participation following the listing by introduction of MTN Nigeria (MTNN) shares on the local bourse. Corroborating our view is data from the NSE which revealed that the value of domestic transactions doubled to N143.9bn (US$399.7m) in the month of May, representing a one-year high.

The breakdown revealed that retail transactions grew by 61% to N47.2bn (the highest since August 2018) while that of institutional investors grew by 126% to N96.6bn ((the highest since January 2018) when compared to the month of April.

That said, the decrease in inflow from foreign investors affirms our view that foreign investors’ sentiment towards the Nigerian equities market remains weak despite favourable oil prices and the dovish tone of systemic important monetary authorities.

In the short to medium term, our outlook for the equities market remains subdued as foreign investors remain wary of emerging economies like Nigeria who are vulnerable to external shocks given growing concerns about a weakening global economy.

READ THIS: MAN to ensure manufacturing sector contributes more to GDP

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.