A new majority shareholder may have taken shelter in Wema Bank Plc, going by the recently-recorded spike in the volume of shares traded.

The Strategic Investor Revealed: According to some stockbroker with insights into the transactions that happened on the bank’s stocks between Monday and Tuesday, the large transaction volumes point to the fact that a strong strategic investor is taking a controlling stake in the company. This strong investor was specifically identified as Nigerian billionaire Adebutu Kesington.

“There were large volumes on Wema shares transaction on Monday and Tuesday. A strategic investor suspected to be Adebutu Kesington is taking controlling ownership of Wema Bank.” -Anonymous

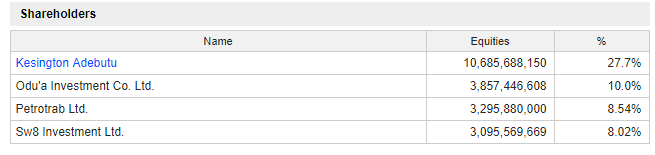

Figures from marketscreener.com show Adebutu holds 10,685,688,150 shares or 27.7% of the bank’s outstanding shares.

Shareholders are okay with this: According to Patrick Ajudua, the President of New Dimension Shareholders Association, any measure that is taken to keep the bank competitive is a welcome development.

“Whatever it will take to reposition the bank in order to compete with its peers is a welcome development for minority shareholders. You will recall that there is a movement in trading of the bank shares in last three days, which is an indication of possible boardroom changes. Also, it is just recently that the bank is able to declare dividend after 14 years. So I welcome the new development.”

Meanwhile, the President of the Progressive Shareholders Association of Nigeria said Boniface Okezie, said-

“If the man has the capacity to run the place as a core investor he is welcome on board, but I must also warn that the management must be allowed to operate with free hands with less interference.”

Note that between Monday and Tuesday, there was an unusual upsurge in the volumes of transaction in the bank’s shares, with 2,695,950,744 and 2,399,041,825 shares traded respectively. The value of Wema Bank’s shares traded on Monday was N1.71 billion, representing 43.6% of the total value of shares which is N3.93 billion. The value of the bank’s shares traded on Tuesday was N1.48 billion.

[READ MORE: Is a key investor selling down a stake in Wema Bank Plc?]

Between Monday and Tuesday, the bank’s share gained 3 kobo to close at 63 kobo

The company topped the activity chart of the Exchange on the two days after a total of 5.095 billion shares changed hands in the period.

Note that Wema Bank has not confirmed this development, even as no written statement has been issued to the Nigerian Stock Exchange on this matter.