One of the largest industries currently undergoing a seismic shift is financial services. The stark contrast from traditional financial institutions to new age (digital) financial services is tremendous, ranging from business efficiency, cost savings, increased accuracy, improved competitiveness, greater agility and most importantly enhanced security. The slick experience and transparency offered by challengers’ bring a great shift in customer loyalty.

Nowhere is that belief more embedded than in retail banking, a sector that has been the focus of consumer dissatisfaction and mistrust. Nevertheless, over 80% of Nigeria current account holders still use one of the ‘big six high street banks. If FINTECH really is going to make an outsized impact in this market, it needs to attract a more radical movement of customers and capital. And that means it needs a digital bank which can break out of the niche market of early adopters and into the mainstream.

We believe that bank is going to be Rubies, and we’re excited to have invested a $2M investment round to power the Technology driving it.

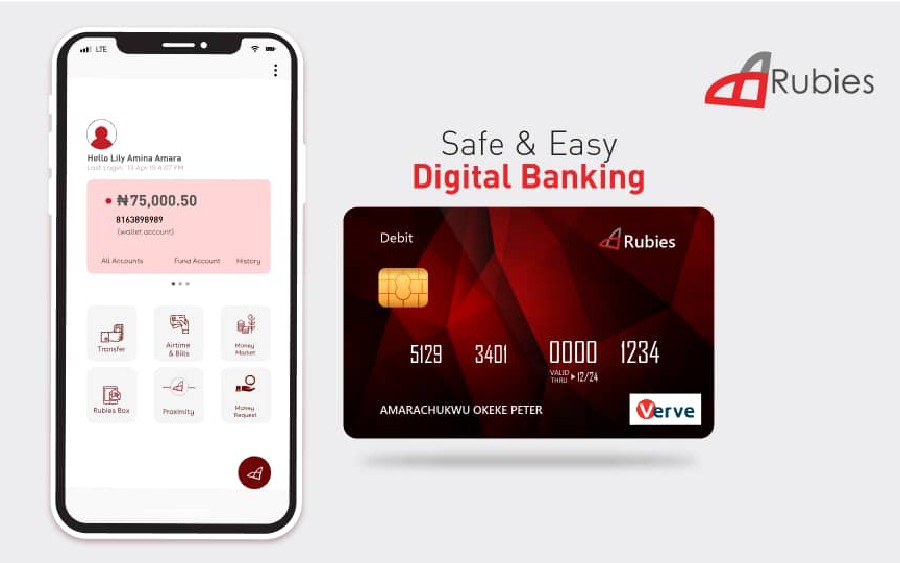

Rubies is a fully digital banking platform, offering zero fee banking targeted at millennials, young professionals, SMEs, quasi-financial institutions and FINTECH companies. Rubies brings new concepts to Banking Technology, Marketing and Engagements powered by Cloud Technology, AI and analytics.

Rubies Unique features and offerings:

Rubies ensures that every feature has something to offer to make the experience highly personalized. The following are some of its features:

- Account number can be personalised (some use their phone numbers)

- Free debit cards having your preferred name e.g. a nickname. It is also delivered to you at no cost

- Money Request – for those who keep on giving excuses of not having your account number or even those that owe you money. This feature allows a customer to request money and instantly get credited from someone’s account number or even phone number. You request money from people, they only approve and you get credited. That simple!

- Proximity Transfer – Sending money using location (The new Bluetooth for money transfer)

How Rubies allows customers earn money

With the aim of empowering people, Rubies brings to the market a unique feature, which allows anyone, become an Independent banker. What does it mean to be an independent banker you might ask?

If you are willing to run your own mini bank, Rubies serves as the platform for you to do that freely. You simply on-board your own “banking customers” using your unique link and every time your customer does a transaction, you earn money. Rubies wants everyone to take a piece of the pie.

The possibilities are endless.

What makes Rubies different from other banks?

Starting with the most sensitive topic these past couple of months, which is bank charges. Typically, traditional banks incur a lot of avoidable expenses – such as monstrous Technology cost, huge marketing cost, branch operations cost, big bankers’ salaries and so on. Rubies is entirely powered by Technology, home-grown software, Artificial Intelligence and analytics.

The cost is driven down to near zero. This makes it possible to waive charges and avoid all the “hidden” charges that traditional banks levy their customers. For interbank transactions, Rubies charges N21 (instead of N52 that traditional banks charge), this being the cost of the transaction payable to the switches, while Rubies earns nothing.

The technology invested in building Rubies is unparalleled, with the fast pace world of ever-growing technology, the use of artificial intelligence, data analytics and recommender systems aid to personalize each individual’s banking experience. In addition, for scalability, cloud computing allows scale, seamless customer growth as well as ensuring top-notch security.

Rubies has taken the disruptive and unorthodox approach to marketing using advocacy based techniques such as Independent Banker, freelance Brand Ambassadors and direct data-driven marketing.

Rubies is a Banking app on steroids. It provides banking functions much like any other banking solutions but it offers much more than most banking app. Here are some of the things that make it so much better:

- Social Appeal – you interact with other users on Rubies and get alerted when your buddies join Rubies, Proximity feature allows you to see people around you. The look and feel is sleek, neat and appealing.

- Money Market – this is where you make money either by investing or providing money to those who need it on loan. Rubies Credit score is growing in popularity as a standard.

- Open Banking – API-based architecture of Rubies will give it the scale it yearns. Open banking architecture allows smooth integration with FINTECH companies, SMEs and other quasi-financial institutions while Rubies serves a layer-2 Clearing function.

- Bank-as-a-service – Rubies Technology is available for use by any other financial institutions playing in Banking, Finance, Technology and FINTECH industries, thus offering bank as a service.

Rubies is here to disrupt and give every individual control of their banking experience as well as financial freedom.

Wow this is amazing stuff

With reluctance I got on Rubies only to realise how much suffering I had endured on my two banking apps…banking apps are boring and clumsy. Rubies is neat and intuitive. Everything about it is smart. It makes you want to login and remain on it, almost like whatsapp experience. When you put a beneficiary account, is tells you the bank unlike other boring banks that will present you endless list of banks to select from. I thought that’s basic, or Rubies makes it look basic…. I wonder why the monsterous banks didn’t figure this out until now.

Truly sleep experience. Everything is very free and the idea of making money as an independent banker is out of this world. Truly disruptive. Now I understand why the business model makes sense because I had been wondering and concerned about how they make money. Technology disruptions and Marketing disruptions are their secrets.

I see my friends on Rubies and we interact financially right there. Open/APi based banking, I dont understand quite well but it will be nice to know.

The marketing would aid speedy increase in financial inclusiveness drives of government. Awesome stuffs here. This is truly genuine disruptions……

Wow. The future is really here

Wonderful Application!

Wow this is great

i’m going to give it a try. and let you know my review. Cheers

Will give it a try based on rave reviews here and subsequently give my opinion. Cheers

is there a customer care number? i requested for my account number via mail yet no response.

Hi Wuraola, visit their website for more information.

Having read through Rubies profile and the testimony of other customers, i decided to sign up on the Rubies platform but it appears I’m finding it difficult o get registered as the page is not proceeding beyond the page where I’m supposed to fill in my phone number and BVN.

Kindly suggest alternative means of signing on.

Exactly what I want Nigeria to be! Technological advanced country with tech like Rubies!

Oh, I got a VIP style bank account now with very unusual account number hahaha

I tried to be an independent banker but it wasn’t responding positively…

this will great for those of us that leave in uk for we will be able to set up account in nigeria and control it online at any time but my problem is how will one access the money if one want to redraw with going to nigeria

ho no i just seen that after opening it you will send out a card to us so like i was told by my parent that after opening account in nigeria you will be taking out maintainance money from what ever we deposite is this true for i just want a bank just so i can have nigeria account but i dont want to get charge any fee just like our account in uk it free we put money in it and leave it till any time we want and we dont get chage no fee i hope yours is like that tooo

How much can be saved in a rubies bank

I will give it a try