Money Market: The money market rate increased last week as the Overnight rate (OVN) and Open Buy Back (OBB) rose to 12.00% and 11.14% from 5.29% and 4.57% respectively from the previous week. Consequently, the average money market rate increased by 6.64% to settle at 11.57% due to reduced system liquidity.

Major Inflow for the week included: OMO Maturity of cN106.9bn, Coupon Payment of cN16bn, CBN retail FX refund of cN155bn, FAAC payment of cN311bn, Paris club refund of cN650bn while major outflow for the week included: Weekly Wholesale, Invisible and SME FX auction of $210mn, OMO Sales of cN360.7bn, Bond Auction of cN100bn, CBN Retail Debit of cN340bn

We expect the rate to trend higher on Monday as banks prepare for another round of FX auction.

Forex: USD/NGN: The CBN Official rate fell marginally by 0.02% last week to close at N306.90/$ while the rate in the Investors and Exporters’ FX Window fell by 0.03% to close at N360.39/$ due to reduction of 41% in market turnover to close at $855 million during the week from $1.44 billion in previous week. However, Naira at the parallel market remained unchanged at N361.00/$ (using the Everdon BDC Rate).

We expect rates in the parallel market to remain constant as the apex bank continues to supply FX into the market, coupled with its frequent Wholesale and Retail SMIS programme.

Commodities: The Crude Oil Price recorded one of the biggest weekly drop in 2019 last week with Brent Crude Oil and WTI Crude Oil down by 4.87% and 6.58% to close at $68.69 and $58.63 per barrel from $72.21 and $62.76 per barrel respectively. This was in part due to:

• A hefty weekly increase in US domestic crude inventories, and

• Trade tension between US and china as it weighed on energy-demand prospects.

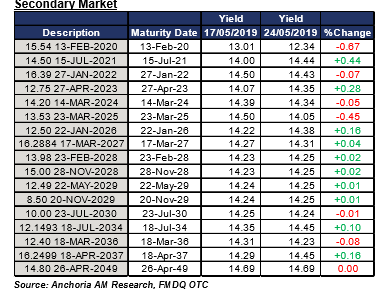

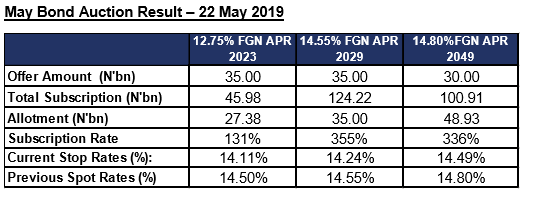

Fixed Income Bond: FGN The Bond Market closed on a bullish note last week as average yields fell by 7bps to close the week at 13.88%. At the beginning of the week, activities in the bond market were scanty ahead of MPC outcome on Tuesday and Bond Auction on Wednesday while renewed activities was witnessed after the Bond Auction.

The Bond Auction witnessed a subscription rate of 271% with demand more pronounced on the 10- and 30-years Bonds while rate trend lower by an average of 34bps to 14.28% from 14.62% in the previous auction.

We expect market participants to remain cautious ahead of the short term securities (T-bills) auction during the week.

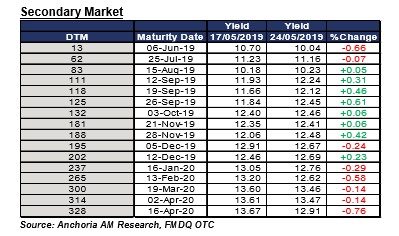

Treasury Bills: The secondary treasury bills market closed on a flat note due to the issuance of OMO during the week. The average yield closed at 12.15% from 12.14% in the previous week.

The OMO auction conducted during the week witnessed an oversubscription on the 91 days, 175 days and 357 days OMO bills closing at 11.40%, 11.68% and 12.50% respectively.

________________________________________________________________________

CONTACTS

Anchoria Asset Management Limited 5th Floor, Elephant House 214, Broad Street Marina Lagos

Investment Research research@anchoriaam.com +234 908 720 6076

Wealth Advisory investor-relations@anchoriaam.com +234 818 889 9455