Welcome to daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

The report is dated May 6th, 2019.

***NNPC records N15bn trade surplus for January 2019***

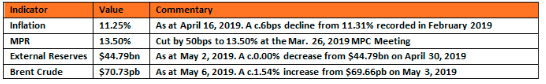

Key Indicators

Bonds: The Bond market opened the week on a relatively quiet note, with yields marginally higher by c.2bps on average, following some profit taking on the 2024s which posted some gains in the previous session. We also witnessed slight sell interest on the longer end of the curve (36s & 37s).

We expect yields to remain relatively well supported at current levels, barring a worsening in global EM positioning given the renewed US-China trade spats.

Treasury Bills: The T-bills market traded on a slightly bullish note, with demand mostly on some short and mid tenored bills due to the robust sytem liquidity levels from FAAC inflows into the system. The Longer end of the curve however remained relatively stable as market players awaited confirmation of stop rate levels from the OMO auction conducted by the CBN.

On the back of the significant over-subscription on the 353-day bill offered, the CBN cut the long tenor OMO rate by 10bps to 12.94%. The rate on the 199-day bill (Mid-tenor) was also managed lower by 7bps to 12.88%, while the 108-day bill (Short-tenor) rate was unchanged at 11.80%. The CBN eventually sold a total of N313bn OMO T-bills from total subscriptions of c.N413bn, with the most sale (N265bn) on the longer tenored bill.

We expect the market to remain slightly bullish on the back of the moderation in OMO stop rates by the CBN.

Money Market: The OBB and OVN rates trended higher by c.6pct, as outflows for an OMO Sale and Wholeale FX funding compressed system liquidity, despite the significant inflows from FAAC payments. The OBB and OVN rates consequently ended the session at 11.36% and 12.07%, with system liquidity estimated at c.N150bn positive.

We expect rates to be relatively stable tomorrow, barring a renewed OMO sale by the CBN.

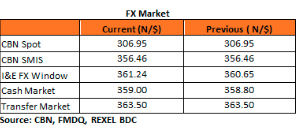

FX Market: At the Interbank, the Naira/USD rate was unchanged at N306.95/$ (spot) and N356.46/$ (SMIS). The NAFEX closing rate in the I&E window however declined by 0.16% to N361.24/$, outside the long sustained (360.00 – 361.00) closing rate band. At the parallel market, the cash rate depreciated by 0.06% to N359.00/$, while the transfer rate remained unchanged at N363.50/$.

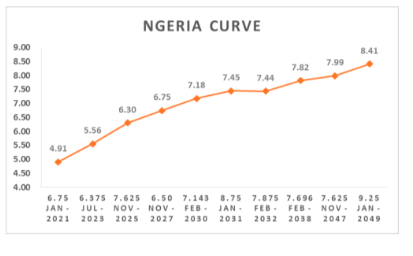

Eurobonds: The NGERIA Sovereigns remained slightly bearish, with the most selloff witnessed on the 2047s which lost c.0.35pct despite the low traded volumes on the day.

In absence of UK flows, the NGERIA Corps were relatively muted, with some profit taking witnessed on some longer dated tickers.

________________________________________________________________________

Contact us:

Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com