Despite the reduction in crude oil production by both members and non-members of the Organization of the Petroleum Exporting Countries (OPEC), the past few days have marked constant fluctuations in the movement of crude oil prices in the global oil market.

The most noticeable fluctuation in recent time was the sudden decline in oil price by $2.34 in just one day. On February 22nd, oil price closed at $67.25, while it crashed on 25th to $64.91. Again, just last week, oil price crashed to $66.91 a barrel on Friday 15th of March 2019, from $67.29 the previous day, according to OPEC Secretariat calculations.

Some key Stats in the oil markets

- Oil price gained improvements in 2018 due to OPEC and OPEC+ decision to cut crude oil production by 1.2 million barrels per day (bpd),

- The U.S still maintains sanctions on Iran and Venezuela.

- Saudi Arabia cut its crude oil production output to 10.15 million (bpd) in February 2019 to keep OPEC quota

- Crude oil price was $64.84 per barrel (pb), as at September 2018, oil price rose to an average of $82.

- The month of October recorded all-high in 2018 to date as oil price hit $84.09.

- However, there was a twist in crude oil prices as prices plummeted. As at the 1st of January 2019, oil price had fallen to $52.14.

- There is a high level of uncertainty surrounding the global oil market as the U.S shale ready to storm the oil market

OPEC recorded 90% compliance level to quota as Nigeria joins JMMC

The Joint OPEC-non-OPEC Ministerial Monitoring Committee (JMMC) conference held today 18th of March 2019, in the Azeri capital, Baku. Basically, the members of JMMC comprises ministers of six countries: Russia, Saudi Arabia, Kuwait, Venezuela, Algeria, and Oman, whose task is to review market development scenarios and make recommendations for OPEC+ countries regarding the necessary actions.

The JMMC declared that overall conformity by its members to crude oil production cuts reached almost 90% for the month of February 2019, which is up from 83% in the month of January.

The committee further reiterated the critical role that the “Declaration of Cooperation” has played in supporting oil market stability since December 2016 and took note of the expressed commitment of all participating countries to ensure that such stability continues on a sustainable basis.

The JMMC also welcomed Iraq, Kazakhstan, Nigeria, and the UAE as new members of the Committee.

Recall that in December 2018, the block and allies led by Russia agreed to cut oil production by 1.2 million barrels per day (bpd) starting January 2019, to help rebalance the global oil market and prop up prices, despite pressure from the U.S. to not decrease global oil supply.

The total crude oil supply by OPEC members have reduced in recent weeks, with the exception of few countries including Nigeria that defied the quota given by OPEC. The total OPEC-14 preliminary crude oil production averaged 30.55 million (bpd) in February, a decrease of 221,000 (bpd) over the previous month. Crude oil output decreased mostly in Venezuela, Saudi Arabia, and Iraq, while production inched up in Libya, Angola.

However, a steep increase of the U.S’s oil exports in recent month, and sustained sanctions on Venezuela and Iran are mirroring negative trends to the oil market.

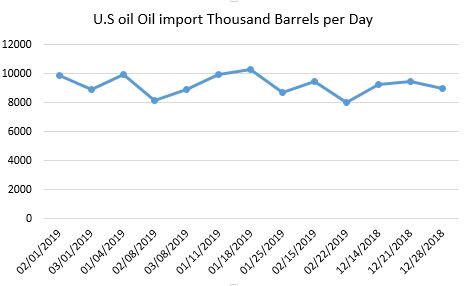

Meanwhile, U.S oil import continues to decline

The U.S which ranks as one of the highest importers of dollar value worth of crude oil in the world has continued to reduce the volume of its import. According to Energy Information Administration (EIA), as of January 18th, 2019, U.S imported 10,312 thousands bpd of crude oil. However, by mid-March 2019, crude oil import dropped to 8,898 thousand (bpd).

According to the EIA data, Nigeria is among the top 10 countries of U.S Crude export market. Specifically, while Nigeria ranks 7th, 2019 data revealed that Nigeria crude oil was not demanded by the U.S in some of the weeks between February to date.

On the other hand, the production of crude oil in the U.S has taken a new stride, thanks largely to an onshore boom in shale formation drilling. For instance, in the U.S, crude production has soared by around 2million bpd. This implies that Nigeria may soon forget ever exporting crude oil to the U.S.

Nigeria’s oil revenue to suffer dip yet again

With the fluctuation in oil prices, the Nigerian economy may suffer a dip again in its revenue. Besides the falling in oil prices, there have been recent reports of Nigeria’s crude being stranded on the high seas in search of buyers.

In stating the obvious, increase in demands for crude oil over the years has not translated into improving the country’s fortunes. Hence, a decline in global demand and price, coupled with the U.S potentially joining the league of U.S exporters, Nigeria needs to prepare ahead for what looms – declining revenue that plunged it into recession in 2016.

As oil price fluctuates, revitalizing local refineries becomes a necessity

As the global oil market continues to become increasingly uncertain, refining crude in Nigeria must be one of the top priorities on the list of the Nigerian government. Nairametrics opines that the 2019 target of NNPC to stop refined crude importation and float three refineries cannot be overemphasized. Essentially, as revenue falls due to declining volume of crude oil export sold and oil prices, importing refine crude with the same foreign exchange will plunge the country into unavoidable economic woes.

As was the case in time past, this should not be allowed, if Nigeria must abate the disturbances likely to hit the economy through external disturbances from the global oil markets.