Last week, Continental Reinsurance Plc issued an update to the Nigerian Stock Exchange (NSE) and the investing public on the proposed scheme that would allow the company’s core investor to buy out minority shareholdings.

SEC is considering the matter- A statement signed by the company’s Legal Counsel, Ms Patricia N. Ifewulu, said the matter is being considered by the Securities and Exchange Commission (SEC).

SEC’s approval is important- The Securities and Exchange Commission must approve the move before it can take effect. This is part of SEC’s oversight functions as an apex regulator in the Nigerian market.

The NSE is continually being engaged – The statement also went further to state that the company will keep updating the Nigerian bourse with the latest development on the matter.

“The SEC is still reviewing the transaction file and is engaging with the company in that process. The company expects to receive the final approval in the coming weeks and will thereafter apply to the Federal High Court for the approval of the scheme.

“We will continue to update The Nigerian Stock Exchange and the investing public with further developments on the transaction.”

What happened before now

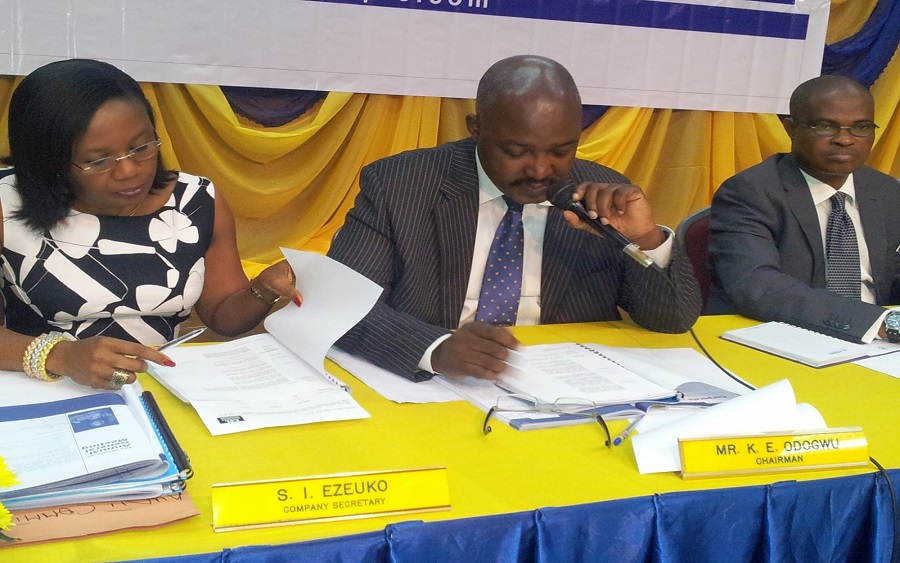

Prior to this time, the company’s shareholders met on December 20th, 2018 to deliberate on the takeover bid by the company’s core investors. The court-ordered meeting ended with shareholders approving the proposed takeover. And subsequently, “an application was submitted to the Securities and Exchange Commission for final approval for the scheme.”

A possible NSE-delisting in the horizon?

A closer examination of this development suggests that Continental Reinsurance Plc might be planning to voluntary delist from the Nigerian Stock Exchange. After all, a complete buy-out of minority shareholdings (by core investors) leaves little or no securities for trading.

In other words, there will not be need for the company’s continued stay on the NSE if its shares are majority-owned by only a few investors.

Continental Reinsurance might be considering other means of capital raise – Voluntary delisting are not new on the Nigerian Stock Exchange. Every now and then, companies decide to explore other avenues of raising capital other than issuing equities.

Newrest ASL Nigeria Plc is already on course to delist – As we reported earlier, the Management and Board of Newrest ASL Nigeria Plc also recently informed the NSE of its willingness to voluntarily delist from the Exchange. Our analysis suggested this could make the company the first to delist this year.

About Continental Reinsurance Plc

Continental Reinsurance Plc is a Nigerian insurance company which was incorporated in 1985. It is listed on the Nigerian Stock Exchange where its share price is currently trading at N1.90. It is a subsidiary of Continental Reinsurance Africa Limited, which also happens to comprise the core investors.