Welcome to Fixed Income Daily Report, where we take you through the daily performance of major economic indicators and highlights from tradings sessions, as well as other key statistics on Treasury Bills, Bonds, FX rates, inflation, oil price.

***Nigeria’s active mobile subscribers hit 172m in Q4 2018***– NBS

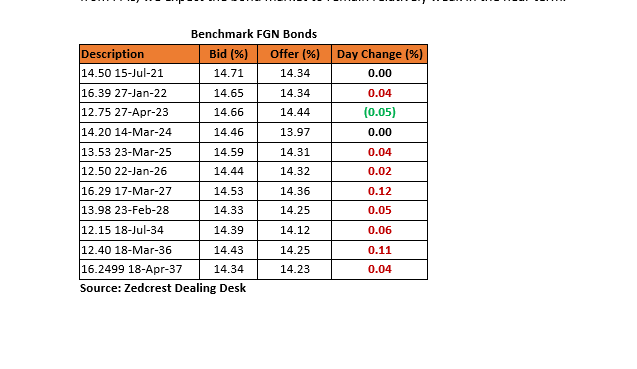

Bonds

The FGN Bond Market remained scantily traded, with yields trending further higher by c.4bps as demand interests remained relatively weak across the curve.

The recent pullback in bond yields have been mostly due to the slowdown in FPI interests, even as local fixed income investors have maintained preference for the Fed Govt T-bills. Barring renewed interests from FPIs, we expect the bond market to remain relatively weak in the near term.

Treasury Bills

The T-bills market traded on a relatively calm note, with better offers on the short and mid end of the curve as against the relatively stronger bids seen on the longer end of the curve.

The CBN on behalf of the FGN would offer c.N90bn T-bills at a Primary Market Auction scheduled to hold tomorrow. Given the recent stop in the one year OMO offering by the CBN, we expect demand to be heavily skewed to the 364-day bill with stop rates on the tenor expected to clear at c.150bps below the level at the previous NTB auction. Stop rates on the 91 and 182 day bills are however expected to be relatively unchanged from previous levels.

Money Market

Rates in the money market remained relatively stable with the OBB and OVN rates closing the session slightly lower at 9.67% and 10.33% respectively. This was as system liquidity improved to c.N180bn positive, in absence of an OMO auction by the CBN.

We expect rates to remain relatively stable tomorrow, as there are no significant outflows anticipated.

FX Market

At the Interbank, the Naira/USD rate remained unchanged at N306.95/$ (Spot) and N356.92/$ (SMIS). The NAFEX closing rate in the I&E window however weakened slightly by 0.06% to N360.44/$, while the cash rate and transfer rates at the parallel market remained unchanged at N358.00/$ and N365.00/$ respectively.

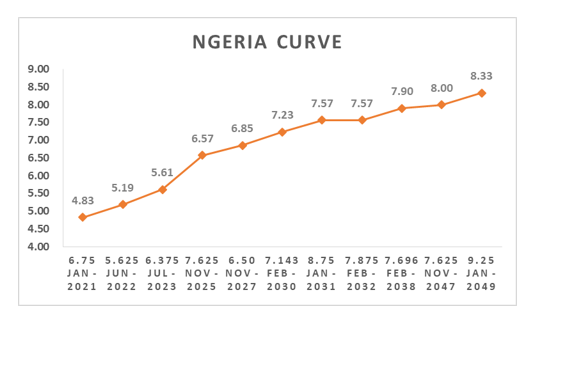

Eurobonds

The NGERIA Sovereigns remained bullish as oil prices sustained gains, now above $67pb. Yields were consequently lower by c.9bps on average, with the most demand still witnessed on the 2032s.

Activities remained relatively muted in the NGERIA Corps, with slight demand witnessed on the DIAMBK 19s, UBANL 22s and SEPLLN 23s.

Contact us: Dealing Desk: 01-6311667 | Dayo: 07032208237 | Seyi: 08023231396 | Nnamdi: +2348133385000 | Tosin: +2347039394376

Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.