No fewer than 36,350 cases of delayed flights were recorded in 2018 from domestic airlines operating in Nigeria, according to the figures released by the Consumer Protection Department of Nigerian Civil Aviation Authority (NCAA).

The News Agency of Nigeria reported that the number of delayed flights represents about 60.1% of all flights, even as 544 flights were cancelled.

There are about nine airlines operating in Nigeria, all of whom operated a total of 59,818 flights last year. These airlines are – Aero Contractors, Arik Air, Air Peace, Azman Air, Dana Air, First Nation, Med-View, Overland and Max Air.

Air Peace was most affected

Out of the nine airlines in operation, Air Peace topped the list in regards to the number of delayed flights in 2018. The airline scheduled 22,055 flights, with 14,067 delayed flights and 67 outright cancellations.

Similarly, it was reported that Arik air ranked second with the 8,073 delayed flights out of 15,205 and 152 outrightly cancelled schedules. It suggests 53% of scheduled flights were delayed.

Dana Air scheduled 5,944 with 3,915 cases of delayed flights and 67 cancelled. Also, Aero Contractors operated 4,361 flights with 2,459 delayed and 70 cancellations; Overland, 601 flights with 1,960 delayed and 29 cancellations.

Medview, 2058 flights with 1,256 delayed and 42 cancellations. It was also reported that Max Air recorded 1,151 delays and five cancellations, out of the 2,205 flights operated by the airline.

Furthermore, First Nation Airways, whose licence operating license was recently suspended by the NCAA, recorded 137 delayed flights and three cancellations, out of 445 flights operated within the period under review.

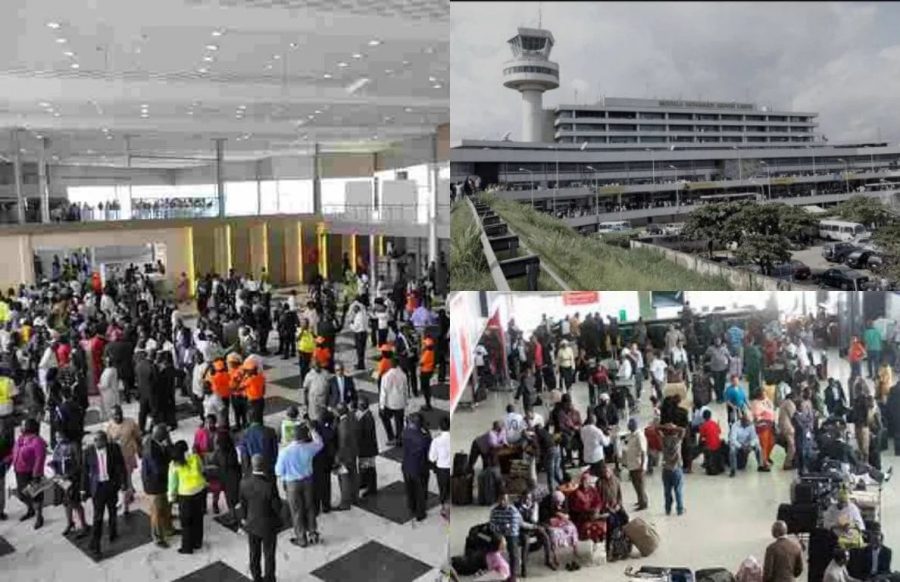

Reacting to this development, the NCAA’s General Manager in charge of Public Relations of NCAA, Mr Sam Adurogboye, stated that the construction of modern terminals and remodelling of old terminals to ease passengers facilitation is one of the major ways to reduce flight delays.

“Some of these problems are infrastructural related. The government is remodelling most of the airports and this will ease passenger facilitation. By the time these modern facilities are deployed, it will curb unnecessary delays.”

“However, issues like adverse weather or a machine (aircraft) developing a problem cannot be ruled out, and you can’t expect them to fly with a machine that had developed problem. Those ones happen occasionally.”

Airline Patronage Increased by 20.8 Percent in 2018

Air travellers who went through Nigeria airports increased by 20.8 in between January and December 2018. The figure released by Consumer Protection Directorate of the Nigerian Civil Aviation Authority revealed that 14,171,722 air travellers went through Nigeria airports in 2018 as against 11,221,608 recorded in 2017.

NAN reported that the 34 airlines on the international routes operate 15,645 flights and flew 4,079,078 passengers during the period under review.

The nine domestic airlines operated a total of 59,818 flights and airlifted 10,092,648 passengers across the country, it added.

NCAA said that airlines on the domestic routes accounted for 72 per cent of the passenger traffic, while the international route recorded 28 per cent. Adurogboye further stated:

“We are hoping and working harder to ensure that there is more movement of passengers. By the time those new terminals in Lagos and Kano come on stream, they will equally enhance more frequencies.”