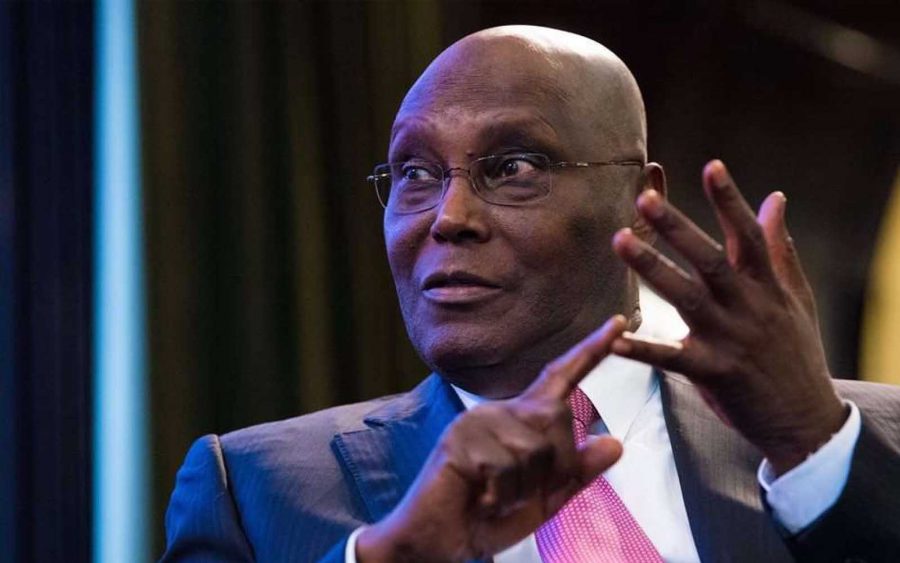

Nigeria’s main opposition candidate for the highly-contested February presidential election, Mr Atiku Abubakar, said he will remove Godwin Emefiele as Governor of the Central Bank of Nigeria if he wins the election.

The former Nigerian Vice President disclosed this during an interview with Bloomberg, during which he also revealed another major economic plan – to float the naira.

According to the PDP presidential flag bearer, Mr Emefiele isn’t doing a good job managing the apex bank, hence the need to remove him once his first term in office comes to an end this coming June.

“I don’t think he’s pursued the right policies. We have to have the right people in there.” -Atiku Abubakar

Bloomberg reports that the Head of Corporate Communications at the Central Bank of Nigeria, Mr Isaac Okorafor, declined to comment on this development.

What could Godwin Emefiele have done wrong to deserve this harsh criticism from Mr Abubakar?

Godwin Emefiele was appointed Governor of the Central Bank of Nigeria in 2014 by Mr Goodluck Jonathan, the country’s immediate past President. Jonathan belongs to the same political party as Atiku Abukar.

This brings into focus the fact that Atiku’s decision to fire Emefiele is probably not motivated by politics. Instead, it is purely because the man has not done the job well so far, as Atiku had argued in the interview.

So, what has the CBN Governor done wrong? Let us look at two of his major policies:

Multiple exchange rates

First of all, the CBN under Godwin Emefiele has introduced multiple exchange rates, a move that has been criticised by some people, including some foreign investors.

But despite the criticisms, the CBN has maintained that that the multiple exchange rates are the only way to ensure that forex liquidity is maintained, while simultaneously allowing investors to trade their own dollars at a more market-determined rate.

Banned imports

The CBN has a list of 41 items that are banned from being imported into the country. These items range from raw materials to consumer goods and especially grains, which the apex bank believes can be produced in Nigeria and by so doing, grow the economy.

While this is a good move, no doubt, some have criticised it; saying that it is ill-thought out and counter productive.

It is also important to note that the country has struggled with rising inflation despite efforts by the CBN to control it. Take for instance, the CBN Monetary Policy Committee (MPC) has consistently retained key rate at 14% percent since 2016.

As the inflation rate rose significantly in December to 11.44%, chances are the the MPC will retain the 14% key rate when it meets next.

This is very unreasonable, asides the other negative parts of this government, the CBN Governor has done a very good job in managing the country’s currency. Look at how bad other countries fared last year due to the rising dollar from the interest rate hike in the US. I completely disagree with Atiku on this

The biafrauds are yet to say anything on this.