According to data from the Nigerian Inter-bank Settle System (NIBSS), the total number of Automated Teller Machines (ATMs) in Nigeria as at September, 2018 is 18,321. While the total number of transactions performed is 650.06 million, the transaction value is N4.76 trillion.

As of September 2017, the total number of ATMs across the country was 17,051, while the total number of transactions performed was 560.86 million and the transaction value was N4.61 trillion.

This interprets that compared to the total number of ATMs in 2018 there was an addition of 1,270 ATMs, thereby increasing the number of transactions performed by 89.20 million, and transaction value by N15 billion.

Numbers from previous years

Figures from the CBN, show as at September 2016 was 29.24 million,ATM transactions stood at N400 billion monthly and N4.2 trillion annually, and since then the use of ATMs has increased tremendously. Nigerians now rely on their ATM cards rather than carry cash around.

ATM history in Nigeria

For several decades, Nigeria as a predominant consuming society was not disposed to buying goods on credit or with credit cards. The norm has been to operate exclusively with cash. This approach seemed to be more conservative and members tend to think more carefully before spending their money.

Today, the tide has changed as many banks now extend credit cards to individuals, qualified customers, courtesy of automobile functional Automated Teller Machine systems.

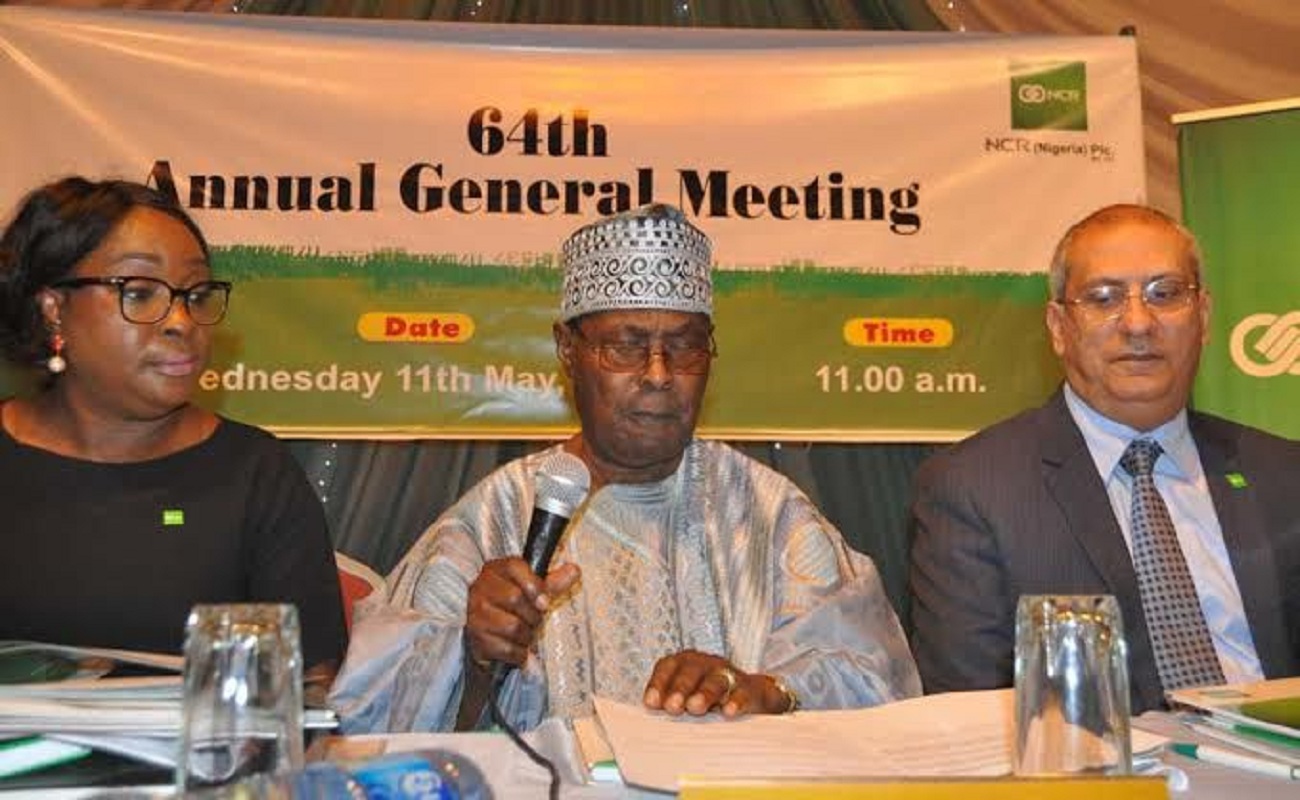

The first ATM machine in Nigeria was installed by National Cash Registers (NCR) for the defunct Societe Generale Bank of Nigeria in 1987, and introduced into the Nigerian market in 1989.