In our recently published equity commentary on Diamond Bank (See report: Overblown fright or Justified concerns), we had stated three options the bank’s management will adopt to keep the bank operational and meet its obligation to lenders. While we had considered the possible acquisition by a bigger bank, the management of both banks in separate press releases refuted the claim. Consequently, as with one of our options, Diamond Bank got approval from the CBN to operate as a national bank following the sale of its UK business, a development that was perceived to have saved the bank from capitalisation needs and continue operations on a better footing.

…and then a Scheme of Merger

To our surprise, news broke over the weekend of a possible merger between both banks, with the management of Access Bank Plc and Diamond Bank Plc yesterday separately issued releases on the Nigerian Stock Exchange (NSE) stating the planned acquisition of Diamond by Access with a consideration price of N3.13/share. This is on the consideration of N1.00 in cash for one share of Diamond bank held and 2 new shares of Access for every 7 shares of Diamond. Accordingly, we estimate total cash consideration of N23 billion and new allotted shares of 6.6 billion units in Access Bank. We note that the consideration price is 213% above the closing market price of N1.0 per share of Diamond yesterday.

Estimating the transaction multiples

As at 9M 2018, Diamond bank’s book value stood at N217.1 billion with a book value per share (BVPS) of N9.37, we estimate a transaction price to book multiple (P/B) of 0.3x compared with the market valuation of 0.1x P/B. Given our thought that the transaction is strictly equity based, we assume a situation wherein the unprovisioned part of the non-performing loan is adjusted for through equity to leave the books with performing assets. As such, based on current NPL of N99 billion and total credit charge loss of N54 billion, we estimate an equity charge of N45 billion by Diamond bank over Q4’18 to leave the book value at N172.1 billion and BVPS of N7.4 with implied transaction price to book multiple of 0.4x.

How they Stack up Post Consolidation

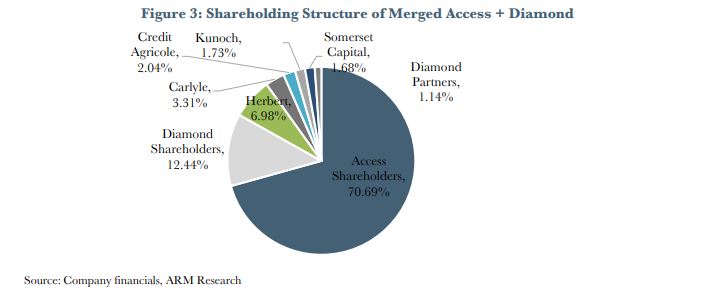

The notice by Access indicated that the bank will issue additional shares of 6.6 billion shares to accommodate the shareholders of Diamond bank. Assessing the impact on current outstanding shares of Access bank of 28.9 billion, we estimate increase in total shares post consolidation to 35.5 billion. Accordingly, we estimate that the potential dilution from the merger of 19%. Furthermore, post-merger, Carlyle Group, Kunoch Holdings and Diamond Partners will own 3.3%, 1.7% and 1.1% of the enlarge Access bank respectively.

Expected Moderation in Cost of Funds. During our engagement with management of Access Bank in November, they guided to the bank’s plan to gradually close out on expensive borrowings. Specifically, the CFO stated that the bank could refinance its expensive Eurobonds if presented with the opportunity and any other available opportunity that could result in a significant moderation in its funding costs.

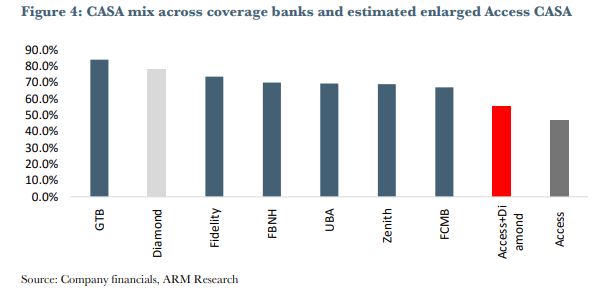

Notably, as at 9M 18, Access cost of funds stood at 5.6% compared to Tier 1 average of 4.0%, following contraction in cheaper deposit (current and savings account) mix by 195bps to 45% which resulted in 18.5% YoY jumps in interest on customers deposits, 1.0x YoY growth in interbank placements, and 73.8% YoY increase in borrowing cost. However, Diamond cost of funds remains the lowest among peers at 4% (coverage Tier 2 average of 5.4%) despite a 260bps YoY contraction in CASA composition to 78.3% over 9M 18. Accordingly, we see some benefit to Access in terms of moderation in funding cost from the acquisition of Diamond and estimate that Access’s cost of funds could moderate to ~5.1% with a CASA mix of ~55.3% post-consolidation.

However, given the reaction to the bank in recent months, we are cautious on the level of cheaper deposits composition being inherited by Access bank. For context, over the last five quarters, Diamond bank has lost CASA deposits of N247.6 billion, reflecting a 22.8% decline YoY to N836.7 billion in Q3 18 from N1.1 trillion in Q3 17. Also, given the lower credit rating of Diamond bank, in terms of corporate deposits, we do not rule out the possibility of erosion in Access bank’s credit rating.

What’s the immediate Impact?

In summary, while this acquisition appears positive for shareholders of Diamond Bank, we are of the view that the transaction will be undesirable for Access Bank in the near term, giving bottlenecks in terms of collapsing of structures as well as dilution impact on profitability metrics. That said, we await meeting with Management of Access Bank tomorrow (Click here for conference detail) for further details and discussion on this acquisition and would communicate our views in due course.

Any benefit for the core investors in Diamond?

Following the exit of Actis in August 2014 and the need for recapitalization of the bank in November 2014 via a rights issue, Carlyle Group, became the largest single shareholder in Diamond with transaction valued at $147 million (N7.38 per share). Accordingly, we estimate that on current price of N1.07, the Group is taking a bad hit on the investment to the tune of N20 billion. Accordingly, we believe that the consideration price of N3.13 could reduce Carlyle loss in the venture to ~ N11.4 billion in the short term. However, post consolidation and integration of the shareholders into the enlarged Access bank, we believe the change in the fortune of Carlyle in the venture will be determined by the gains from the integration.

ARM ratings and recommendations

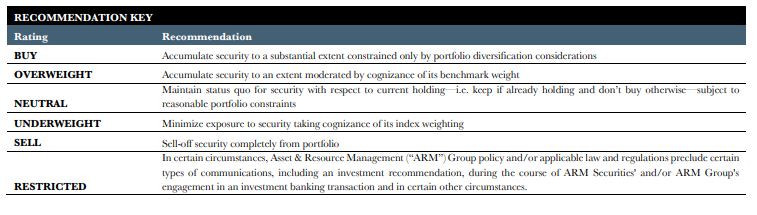

ARM now employs a two-tier rating system which is based on systemic importance of the security under review and the deviation of our target price for the stock from current market price. We characterize systemic importance as a function of a stock’s ranking among the group of top 20 stocks by NSE market capitalization over a trailing 6-month period (minimum) to the review date.

We adopt a 5-point rating system for this category of stocks and a 3- point rating system for stocks outside this group. The choice of top 20 stocks arises from the consideration that this group of stocks constitutes >75% of overall market capitalization and stocks outside this group are generally less liquid and individually account for <<1% of market capitalization. For stocks in both categories, the basis for ratings subject to target price deviation is outlined below:

Does this mean, for instance, if I own 10 Diamond bank shares;

1) I’d receive ₦10 plus 2 unit of shares of Access Bank at the prevailing Access Bank share price? Based on the consideration of ₦1.00 in cash for one share of Diamond bank held and 2 new shares of Access for every 7 shares of Diamond.

And

2) What would happen to my remaining 3 units of Diamond bank shares? Would they be acquired for ₦3.13 per share?

Thank you!

If you own 10 Diamond Bank shares, you would get N10 for them. In addition, you would get roughly two Access Bank shares and some fraction. The bank could decide to either round up the shares to 3, or round it down to 2. Diamond Bank shares would cease to exist if the transaction is approved.

Nicely written piece.

I don’t really get this though, “Also, given the lower credit rating of Diamond bank, in terms of corporate deposits, we do not rule out the possibility of erosion in Access bank’s credit rating.” Are you saying the credit rating of Diamond bank could lead to an erosion of Access bank’s credit rating? Not entirely correct. I also don’t get the bit on corporate deposits; as far as I know, they are usually a function of credit rating for the multinationals, and all the others are largely rate sensitive. So, I struggle with the plot here.