Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

- Bond Yields Pare Losses amid Renewed Local Demand

- Nigeria budget minister expects economy to grow by 3 pct. in 2019

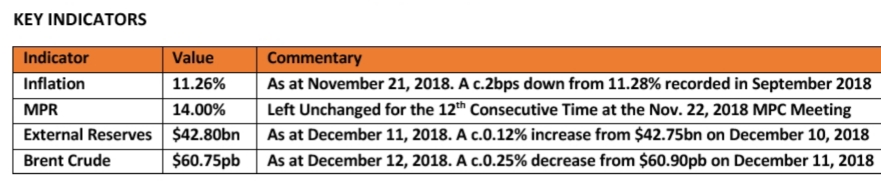

KEY INDICATORS

Bonds

The FGN Bond market pared some of its previous session’s losses, with yields compressing slightly by c.4bps on average, following slight demand from local client orders.

Yields are expected to maintain their current flattish trend, as dearth of FPI flows continue to weigh on sentiments in the market.

Treasury Bills

Yields in the T-bills market compressed marginally by c.2bps avg., despite the continued OMO auction by the CBN. This was as market players cherry-picked on yields on some short tenured maturities, in anticipation of inflows from c.N551bn OMO maturities tomorrow, which is expected to elevate system liquidity from its current negative position.

We however expect the CBN to intervene in the market with a longer tenured OMO offering (>300days), in a bid to mop up all maturities, in tune with its aggressive stance on system liquidity.

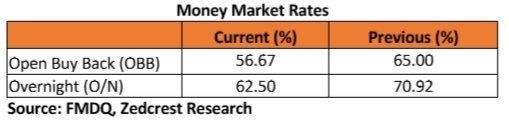

Money Market

Rates in the money market remained relatively stable from their previous day levels, with the OBB and OVN rates closing slightly lower at 56.67% and 62.50% respectively. This was inspite of the c.N26bn OMO sale today, which is expected to have tightened system liquidity further to c.N90bn Negative.

We expect rates to further moderate in view of the c.N551bn in OMO maturities tomorrow.

FX Market

At the Interbank, the Naira/USD spot rate remained stable at N306.90/$, while the SMIS rate weakened slightly by c.0.01% to N359.24/$. At the I&E FX window, the NAFEX closing rate appreciated firmly by c.0.12% to close at N364.77/$ from N365.21/$ previously.

At the parallel market, the cash and transfer rate appreciated by 0.39% and 0.54% to N362.00/$ and N366.00/$ respectively.

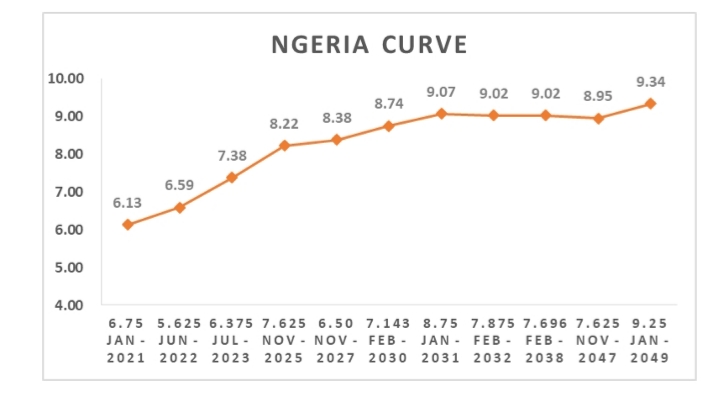

Eurobonds

The NGERIA Sovereigns were stronger in today’s session, following renewed buying interests mostly on the mid to long end of the curve. Yields consequently compressed by c.7bps on average.

In the NGERIA Corps, investors were bearish on the DIAMBK 19s and Access 21s Sub, whilst we continued to see interest on the ACCESS 21s Snr and the UBANL 22s.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.