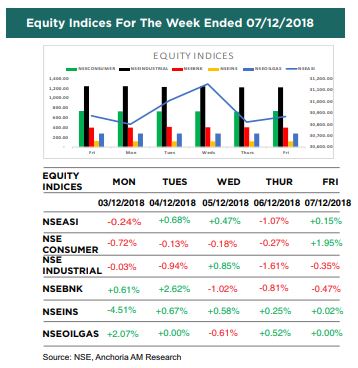

The performance of the Nigerian Equity Market remained bearish last week with the index (NSE ASI) down by 0.02% WTD to close at an index level of 30,866.82 and Market capitalization of N11.269 trillion.

The Market sentiment was positive as bargain hunting was witnessed on Banking, Consumer Goods and Oil and Gas counters although heavily weighed down by sell offs on some high cap stocks in the Industrial Goods such as WAPCO (-3.85%), DANGCEM (-1.55%) and FIRSTALUM (-9.09%).

Market activities were characterised by profit taking on 2 out of 5 trading sessions with market participation relatively lower during the week as both volume and values traded slumped by 11.19% and 22.78% respectively.

In the global space, all selected equities closed negative except the Chinese’s CSI 300 as trade war fears between US and China linger and as investors fled for safety to the bond market. The bond market had its best weekly performance since May. Other factors that shaped the week activities included: Fear of Fed rate hike ahead of Dec. 18 – 19 Fed policy meeting.

Stock Watch

Over the last five trading sessions:

DANGSUGAR (Dangote Sugar Refinery) grew by 4.25% to close at N13.50.

Recommendation: We place a buy rating on this stock.

UBA (United Bank of Africa) remained unchanged to close at N7.50. Recommendation: We maintain a buy rating on this stock.

HONYFLOUR (Honey Well Flour Mill) grew by 4.55% to close at N1.15.

Recommendation: We place a buy rating on this stock.

ZENITHBNK (Zenith Bank) grew by 1.51% to close at N23.55.

Recommendation: We maintain a buy rating on this stock.