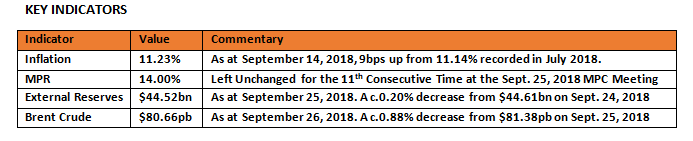

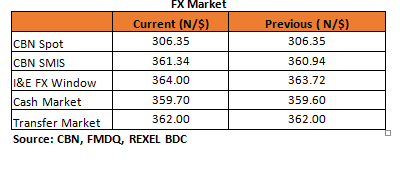

US Fed raises interest rates, gives bullish outlook for economy

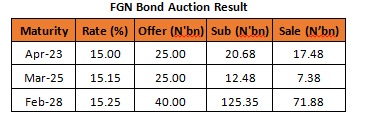

Bonds

The Bond market remained relatively flat, with yields compressing marginally by c.2bps, following slight buys on the 21s, 27s and 34s. In line with our expectations, demand at the FGN Bond auction was moderately robust with average bid to cover at 1.64x. We witnessed significant oversubscription of c.250% on the 2028 bond which recorded the most sale of N71.88bn of the N50bn offered.

The DMO consequently raised a total of N96.74bn at marginal rates of 15.00%, 15.10% and 15.2459% on 2023, 2025 and 2028 respectively. The clearing rates were c.57bps above their previous auction levels in tune with the recent developments in the market.

We expect the market to remain range bound in the near term, to be largely supported by interests from Local clients and the recent easing in EM pressures. Our expectation however remains for a further uptick in yields in the months ahead, to be driven by expected uptick in inflation and increased fiscal injections, combined with risk off sentiments in view of the forthcoming General elections.

Treasury Bills

The T-bills market traded with mixed sentiments in today’s session, with further selloff witnessed on the shorter end of the curve (Oct – Dec), while we witnessed slight interests around the mid tenors (Jan –Mar). Yields consequently stayed relatively flat at c.12.97% on average.

We expect yields to decline slightly tomorrow, due to anticipated inflows from OMO maturities. We however expect the CBN to intervene with an OMO auction, which should expectedly stifle buying interests in the market, especially if a long tenor bill >300 days is offered by the CBN.

Money Market

The OBB and OVN rates remained elevated, closing today slightly lower at 16.67% and 17.92% respectively, as system liquidity is estimated to remain much unchanged from its previous levels (c.N120bn).

We expect rates to trend lower tomorrow, due to anticipated inflows from OMO maturities and Retail FX refunds. Market players would however remain wary of expected funding for CBN’s Retail FX auction on Friday.

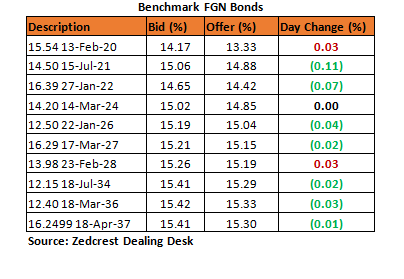

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.35/$ (spot), while the SMIS rate depreciated by c.0.11% to N361.34/$ from N360.94/$ previously. At the I&E FX window a total of $164.47mn was traded in 358 deals, with rates ranging between N330.00/$ – N365.00/$. The NAFEX closing rate depreciated by c.0.08% to N364.00/$ from N363.72/$ previously.

At the parallel market, the cash rates depreciated by 10k to N359.70/$, while the transfer rate remained unchanged at N362.00/$.

Eurobonds

The NGERIA Sovereigns maintained its bullish run in today’s session, with yields compressing by c.5bps on average, amid continued interests from Investors within the SSAs (KENINTS especially). We witnessed the most interest today on the 2038s and 2047s, which gained c.0.70pp on the day.

The NGERIA Corps remained slightly bullish, with strong interests seen on the Access 21s Snr, and slight interests on the FIDBAN 22s.