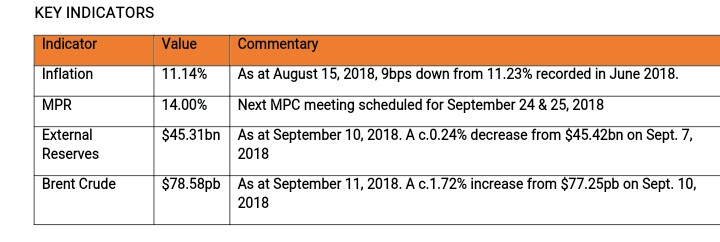

Buhari’s Second Term Poses Risk to Economic Devt – HSBC

Bonds

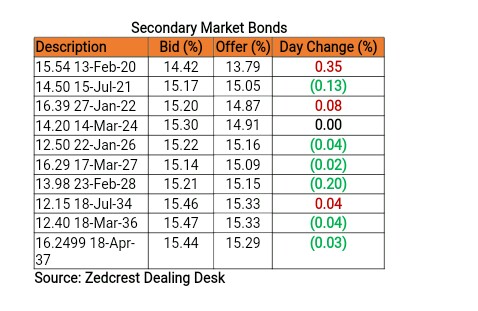

The Bond market remained largely order driven, with continued client interests seen around the mid tenured bonds (26s -28s) and some cherry-picking for higher yields on the 2021s and 2036s. Yields however remained flat d/d, as clients maintained a floor of c.15.10% on their bids.

Clients (Locals) have remained more positively disposed to bonds, in view of the recent uncertainty and risk off stance within the T-bills space. We expect these sentiments to keep bond yields in check in the near term, but we however maintain our bearish outlook ahead of the next FGN Bond Auction (26th September), where we expect renewed supply of bonds to drive yields higher.

Treasury Bills

T-bills market remained significantly bearish in today’s session, as yields trended higher by c.30bps to c.13.01% on average. This came on the back of a further OMO auction by the CBN, where it elongated its offering into a 324-day tenor, the longest since last year August (25th). Market players responded by selling off the short tenured bills as high as 13.50% on some maturities, as they became increasingly risk off, taking the move as a sign of desperation on the part of the CBN.

Subscriptions at the OMO auction remained weak, with market players relatively uninterested in the shorter tenured offerings, whilst bidding as high as 14.50% for the 324-day Tenor. The CBN eventually sold a total of N300m of the 198-day and 81.65bn of the 324-day at 12.50% and 13.20% respectively.

The DMO is expected to offer a total of c.N136bn T-bills to rollover existing maturities. We expect rates to clear at c.30bps above their previous levels.

Money Market

The OBB and OVN rates inched higher in today’s session, closing at 6.33% and 7.25% respectively. This came on the back of outflows from a further OMO auction (c.N82bn) by the CBN. The Net system liquidity is consequently estimated to close the day at c.N350bn from c.N430bn estimated opening levels.

We expect continued interventions by the CBN to pressure rates higher towards weekend.

FX Market

The Naira/USD rate remained stable at the interbank, closing at N306.25/$. At the I&E FX window, a total of $220.61mn was traded in 331 deals, with rates ranging between N360.00/$ – N365.00/$. The NAFEX closing rate appreciated marginally by c.0.01% to N363.07/$ from N363.11/$ previously.

At the parallel market, the cash rates appreciated by 10k to N359.30/$, while transfer rates remained unchanged at N361.50/$.

Eurobonds

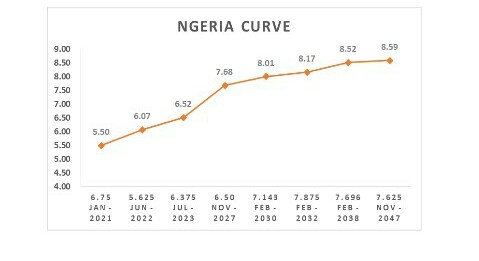

The NGERIA Sovereigns remained relatively flat, with yields ticking slightly higher by c.3bps on average, as investors were slightly bearish on the 23s, 32s and 47s.

The NGERIA Corps were also bearish, with the most selloffs seen on the DIAMBK 19s and Access 21s. We however witnessed slight interests on the FBNNL 21s and FIDBAN 22s.