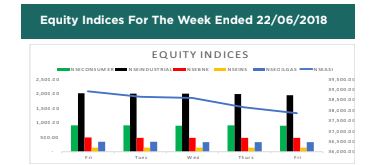

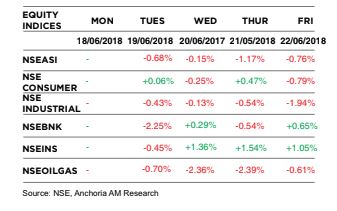

The performance of the Nigerian Equity Market returned bearish last week with the index (NSE ASI) down by 2.74% WTD to close at an index level of 37,862.53 and market capitalization of N13.72 trillion.

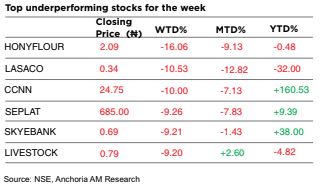

The sectoral performance was negative as bearish sentiments were witnessed in all sectors with the exception of Insurance index that rose by 3.55%. The Oil and Gas sector recorded the highest decline amongst NSE indices with the NSE Oil & Gas index down by 5.94% WTD, owing to significant price depreciation in SEPLAT (-9.26%) and FO (-7.73%).

The market activities were characterised by profit taking during all the trading sessions last week as passage of an expansionary budget of N9.12 trillion by President Muhammadu Buhari during the week failed to positively impact investor sentiment.

In the global space, bearish sentiments were witnessed in all selected markets except the UK FTSE 100 that closed in the green last week as investors focused on trade war between the United States, China and European Union. The Dow Jones fell for eight consecutive times until a rebound on Friday to close the week in the red (-2.03% WTD).

Stock Watch

Over the last five trading sessions:

FBNH (FBN Holdings) fell by 1.84% to close at N10.65.

Recommendation: We maintain a hold rating on this stock.

UBA (United Bank of Africa) fell by 3.63% to close at N10.60.

Recommendation: We maintain a buy rating on this stock.

ACCESS (Access Bank) fell by 1.89% to close at N10.40.

Recommendation: We place a buy rating on this stock.

Contact Anchoria Asset Management Limited for more information

Email: research@anchoriaam.com

www.anchoriaam.com