Bellwether

Market breadth advances to 0.96x

Daily Market Summary: 4 NSE sector indices closing underwater(Opens in a new browser tab)

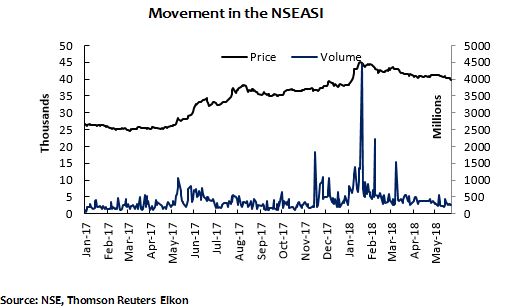

- The NSEASI-1.08% closed in the red, despite a fleeting stay in positive territories today.

- Year to date return on the bourse slided to 0.95%.

- A total of 342.05 million (+53.86%) shares worth NGN4.74 billion (+188.46%), were exchanged in 5,057 (+13.36%) deals.

- HMARKINS+6.25% closed as the best performing counter yet again, while profit-takers saw IKEJAHOTEL -7.04% close as top laggard in the session.

- An analysis of all NSE sector indices reveals an improvement in market sentiment, barring the banking, consumer, and industrial goods space which saw gains stifled by the price shedding on heavyweights.

-

Slow down in Agric GDP Growth rate suggests Buhari’s Agro-policy is failing (Opens in a new browser tab)

Why stocks are down

- Based on our analysis of trades today, we attribute the extended bearish close to the losses recorded on some bellwether counters like DANGCEM-1.02%, NESTLE-3.75%, NB-4.35% andZENITHBANK-1.92%.

-

CSCS Plc will pay a final dividend of ₦3.5 billion(Opens in a new browser tab)

Insurance sector:NSEINS10 index gains 99bps

The bulls regained their charge on a number of counters such as; HMARKINS+6.25%, MANSARD+4.17% and LINKASSURE+3.80%.

Angola’s oil money lures Sahara Group(Opens in a new browser tab)

The sector recorded the greatest buying pressure, with its index advancing by 0.99%.

The Year to date return on the NSEINS10 index therefore advanced to 1.61%.

Contact Morgan Capital for more information.

Email: info@morgancapitalgroup.com

www.morgancapitalgroup.com