In Nigeria’s technology and startup community lies several dead ideas and concepts— from the ones that failed to take off fully to the ones that could not scale and innovate soon enough to stay ahead of new trends.

Studies from the United Nations Industrial Development Organization’s Investment and Technology Promotion Office in Nigeria show that only 20% of SMEs manage to survive in Nigeria.

“Although everybody in Nigeria desires to become an entrepreneur, only 40% of the dreamers get to start, but no more than 20% survive.”

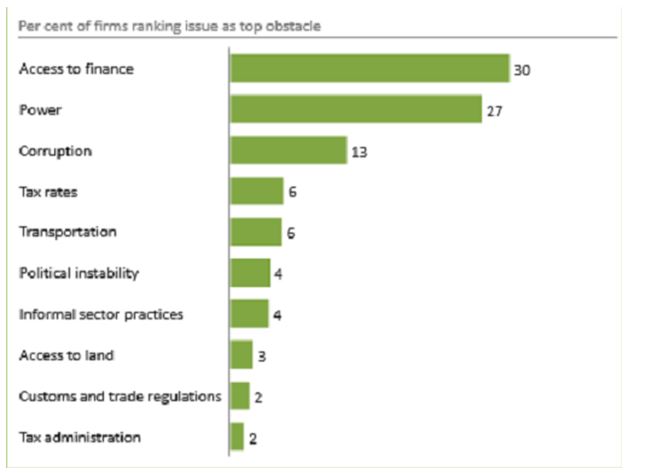

In just one week, several media platforms are already awash with stories of failed startups. No doubt, startups in Nigeria have to fight against so many harsh economic factors that one would be right to conclude that the business climate is conducive for failure. Some of these factors were highlighted in the 2016 World Bank Enterprise survey, which surveyed over 2000 Nigerian small businesses and outlined the biggest obstacles to doing business in Nigeria.

Here are some startups that have bitten the dust in recent times.

GoMyWay

Less than 2 years into its operations, the ridesharing platform announced in September 2017, that it would be shutting down. Citing lack of resources to run the business, the shareholders/Investors came to a conclusion to shut down operations.

Perhaps, the biggest reason GoMyWay could not monetise its platform is the fact that some of the users tried to circumvent it. This is same for most platforms; once the users on the 2 sides have contact, there is an incentive to always take transactions off the platform. Both parties would just reach a private agreement on time and place of pick-up every day. The platform was thus reduced to a place for an introduction.

Efritin.com

The classified ads platform also recently announced that it was shutting down its operations. Nils Hammar, Saltside Technologies founder and CEO, revealed that it was because the platform didn’t generate desired returns on investment (ROI); hence, the decision to scale back on its investments in Nigeria. He also noted the high cost of data and internet use as a major hindrance to the business.

In addition to Hammer’s points, there is the age-long problem of the high cost of doing business in the country. The platform eventually bit the dust in October 2017, barely 16 months into its operations.

Showroom.ng

The platform came on board with the aim of making millionaires of up to 100,000 Nigerian carpenters and try it did. The showroom platform for carpenters to display their works and get connected to customers also shut down business. After 12 years of hustling, CEO, Sheriff Shittu, announced in 2016 that it was closing up shop.

The inability to scale on its operations dealt a big blow to this promising platform.

Easy taxi

Easy taxi was one of the first Rocket Internet hordes to launch in Africa in 2013.The platform which began operations in Brazil connects taxi drivers and passengers; it has over 1.5million app downloads and 45,000 taxi drivers on its platform. Despite an additional funding of over $10million from Rocket International for its expansion into Asia and Africa, the news of its exit from the African market came as a surprise to many.

The co-founder on the Nigerian side, Bankole Cardoso, stepped down in April 2016 and the business packed up. Reports had it that the startup was looking to focus on its Latin America market.

Konga

Konga made entry into the Nigerian market in 2012 and was one of the biggest e-commerce players in the country. 2 months after laying off over 60% of its workforce, the embattled e-commerce platform last week announced that it had been acquired by Zinox, a local tech firm which manufactures and distributes computers and manages data center infrastructure. This sees Zinox take over Konga’s assets including its online mall.

The cash-for-equity deal was reportedly higher than the $10 million price that has been widely reported. Zinox will buy out ownership stakes from Naspers and Kinnevik who are major investors in the e-commerce platform.

Camplus

The startup, whose mission was to connect students and student entrepreneurs across Africa through e-commerce, was founded by David Edet in 2016. It had a promising start and made more than N4 million in sales revenue in just a month after launch.

According to David, the downfall of Camplus was imminent as “the recession prices and the high cost of running the business in Nigeria was such a hard blow.”

Olx

This classified ads platform also announced that it was shutting down its operations in Nigeria and other African countries last week, barely 3 years after entry into the Nigerian market. Naspers, former major shareholders of Konga which it divested to Zinox Technologies recently, said it has made a decision to consolidate its business operations in Nigeria.

According to Naspers CEO, Bob Van Dijk, Naspers plans to accelerate the “path to profitability” of its e-commerce businesses and sees a potential for initial public offerings of companies in its portfolio.

Major reasons why these startups fail

Lack of market need

If there’s no need or demand for the products and services you are providing, then your startup won’t be around for long. In fact, most startups fail due to lack of market demand. It is necessary that the startup is centred on satisfying particular needs that people have in order to ensure that the offering has an existent market.

Mismanagement of Funds

Mismanagement of funds for startups ranges from mixing personal and business funds, to giving too much credit to customers based on sentiments. The more debt a business has, the higher the risk of it folding up.

Poor customer service

Poor customer service is the easiest way to lose customers. Professionalism and customer service etiquette must not be compromised for anything. Treat the customers well and they will be willing to come back and also refer the platform to others.

I noticed that all the companies have one thing in common. Lack of consistent revenue and ofcourse profit. Those of us in marketing always say, profit is king.

Let’s face it, no single business can survive without consistent revenue inflow. It doesnt matter where the company is located and the more businesses learn how to drive more revenue than focus on vanity metrics, the better for startups.

I see alot of businesses focus on ’empty’ metrics instead of focusing on the most important thing-revenue.

A client of ours (before we took them on) spent over 40 million naira on their business setup but were only willing to spend less than 500K on marketing.

When it became clear to them that the business was about going under, they ran to us for help. Revenue is the main thing. Profit is key.

Johnson Emmanuel

I agree, that’s just the same reason artists but views on Youtube, which is crazy because you are supposed to be making money from views. I think it boils down to “outlook” , not many people would have access to a companys’ actual revenue flow but almost everyone can see the numbers. Jumia also falsified numbers trying to het into NYSE. Companys always want to portray a successful image and this desire can push them to unimaginable lengths. Read about Wells Fargo.