- A budget wedding hardly comes to mind when you dream of your wedding day

- However, as they say, with love, all things are possible.

- If you are facing financial challenges and still want to get married to your lover then this article is for you.

- Money should not be a barrier to tying the knot with your loved one.

- As such, this article will show you how to organize your wedding with as little as N100,000.

What Nigerians do/Wedding funds drive

These days, people ‘tax’ everyone they know when they want to get married. Your financial contribution to the preparations becomes a MUST. I was minding my business ‘jeje-ly’, when I received a call from an ex neighbor who called to tell me that he was getting married. I was really happy at the news and congratulated him.

Get this; he was calling to get my contribution not to invite me to his wedding. I was miffed! I wasn’t there when you met your girlfriend (a lady like me), neither was I present when you got down on your knee and proposed to your wife-to-be in a highbrow restaurant. So why should I be a financier for your impending nuptials? I’m sure many people have their stories concerning the compulsory donation.

I once attended a wedding reception five years ago in Benin City, Edo State and witnessed a funny, somewhat interesting spectacle during the ceremony. As the couple sat on the beautifully decorated chair facing the guests in the spacious hall, I observed tears running down the groom’s eyes. I thought it was tears of joy, but later found out that the reverse was the case. He was crying when he saw the huge number of people trooping into the hall.

[READ ALSO: What can you do for side hustle as a banker?(Opens in a new browser tab)]

He told me that the number of people he had invited was based on his budget but was surprised when more than 200 people were already inside the hall at the time. Fraught with a lot of unexplained emotions, the groom broke down and cried. Tears flowed freely from his eyes as he wondered how to get additional refreshments for the uninvited guests.

Current situation

The average Nigerian man who is eligible for marriage, usually gives financial constraints as the first reason for delaying his dreams of getting settled. Truly, it cannot be denied that this is the number one barrier to most partners walking down the aisle, because once the barrier is broken, all other minor items usually fall in place.

I had to ask someone who had weathered the storm and gotten married within his means and he (Clement) had this to say:

”When I was planning to get married in 2005, things were so difficult and I had less than N50,000 in my savings account. My wife, out of concern asked me a few months to our wedding whether it won’t be wise for us to postpone the event based on the unavailability of funds. I categorically told her ‘No!’, because I was determined to see it through. Funds came from unusual sources and the wedding was conducted successfully. I celebrated my 12th year anniversary last Sunday and the marriage is blessed with three lovely kids.”

Planning a Nigerian wedding with N100,000

The truth is that one can achieve whatever one sets his/her heart to achieve as long as the determination is there. The question I asked myself yesterday while pondering on this subject was, “Is it really possible to organize a wedding on a tight budget of N100, 000?” The answer is a definite YES and I am going to explain how it can be done soon enough.

The biting economic situation in the country notwithstanding, Nigerians still create enough room for themselves when it comes to the issue of exchanging marital vows. One may ask: “How do they do it?” It is not difficult to achieve as long as one draws a decent budget based on the funds available. There is clearly no need to be extravagant when the resources are not really available.

The major items that consume most marriage budget are foods, drinks, clothing, reception venue, photography/video and music and Invitation cards The good news is that it is possible to cut down costs on these items and achieve the target of using N100, 000 to organize your dream wedding. The only condition is to stick religiously to the budget and avoid last-minute adjustments no matter the pressure.

Steps to planning a N100,000 wedding

The Guests

The first step in ensuring that you stay within the chosen budget is limiting the number of guests you intend to invite for the wedding reception. For the purpose of this budget, we shall stick to inviting 100 guests including families, colleagues and friends. The higher the number of guests invited, the higher the expenses that will be incurred. Entry into the reception venue should be strictly by invitation. This will curb the number of uninvited guests to the program.

Food – Cook by yourself

Talking about food, rice is the favorite item used in entertaining guests in most weddings. Whether fried rice, jollof rice, white rice or coconut rice, people still enjoy eating it in most wedding programs. To start with, ensure that you go for just half a bag of rice for the event and this will cost about N9,000. This should be able to go round the 100 invited guests. All that is needed is for those serving, to measure the quantity of rice served.

Another important ingredient in most wedding programs is the meat. We shall be going for 2 cartons of frozen chicken which can be gotten at the rate of N12,000 each amounting to a total of N24,000. The chicken should be cut into about 120 pieces so it can go round each of the 100 invited guests. The reason for the additional 20 pieces is to allow for shortfalls when frying and serving.

Groundnut oil – is needed for frying and also for preparing the rice. We shall be going for 4 litres of groundnut oil for the purpose of the budget. This will cost about N2,200 in the open market and it should be enough for all the frying and also for the rice. Ensure judicious use of it to avoid wastage.

A big can of tinned tomatoes costs about N1000, while fresh pepper and tomatoes worth N2,000 including ingredients (to spice the rice and meat) worth N2,000 should be enough to settle the food area. One thing to be taken note of is strict monitoring of those doing the cooking, because it is common to see women sneaking food items, especially fried meat home after cooking. That is a sad reality of the times we are in and proper monitoring will close those loopholes and ensure that the items are enough for the food to be prepared.

Drinks – go hand in hand with food in every marriage program. Since we are on a very tight budget, we shall be sticking to soft drinks alone. Of course people will complain, but it’s your occasion and you do what you have to do based on your budget, not what pleases people. The fact remains that if you bring in a truck load of assorted drinks, people will still complain about not getting enough to drink, so stick to soft drinks.

We shall be going for five crates of assorted soft drinks like Coke, Fanta and Sprite at the rate of N1350 per crate. This will give us a total of N6,750. You cannot do without water, so we shall go for 5 bags of sachet water at a total cost of N500. There should be 6 bottles of water at a cost of N600 for those at the high table.

The wedding attires

This can be tricky, considering how much attention women give to wedding gowns. But this is a wedding on a very tight budget so we have to be realistic. There is no need to make a new wedding gown for the bride. Just go for a rented gown which can be gotten for between N10,000 and N20,000 depending who you are renting from.

We will advise using that of a relative or close friend as wedding gowns are often worn once. If you have the looks, then you can even borrow from a fashion designer looking for good photo-ops to sell their wedding gowns.

The bride’s shoe and makeup are other important things to spend money on. A budget of N5,000 to N7,000 should make this work.

Left for us, the groom will have to look at his wardrobe and get his best jacket. If they are not good enough, then you can also borrow from a close friend or relative. Ties, shoes and other accessories are things you already own, so no need to fuss.

Jewelry – Wedding rings are probably the biggest challenge for newly weds. But since this is a tight budget, we will assume this as a symbolic gesture. For this purpose, we can go for cheap rings. Look, no one needs to know except you and your bride. When you have money, you can always change your rings and life goes on.

The Wedding cake

Wedding cake is a common feature in most wedding receptions and a moderate one which can be baked and decorated at the cost of N10,000, will be decent enough for the occasion.

Venue

To cut costs further, it is needful to hold the wedding reception within the church premises to avoid paying huge fees for rented halls. Most churches allow couples to use their church premises as long as they keep it clean after use. All that will be needed is renting canopies and chairs at the cost of about N5,000. If your church doesn’t have premises or hall then you can use that of a friend.

Invitation cards

Thoughts about printing invitation cards should be discarded. You should opt for using bulk SMS. This won’t cost more than N500 at most. You can also design a single invitation card and send via email to invited guests at a moderate cost of say N500. This will no doubt help to ensure you stay within your stipulated budget.

The not so mandatory

Most Nigerian weddings require that you share souvenirs in exchange for gift items. For you, this is not mandatory as you are on a tight budget. Presenting souvenirs to guests is optional, depending on the purse of the couple involved.

Another item you can skip paying for us hiring a Hiring of a DJ and getting a photographer/ video man to cover the occasion. Being a small family sized get together wedding, all you need to do is get a friend to lend you a sound system loud enough to get people to dance as well as operate a mic. Most people will fall over themselves to be the DJ of the day for free.

Getting a photographer to cover the event is not also mandatory. These days, mobile phones do an amazing job at keeping memories. Besides, most people take pictures as a hobby and what you need to do is to find someone who will gladly do this for you for free. This will likely be a family friend, who won’t demand cash from you, as they already know that you are on a tight budget.

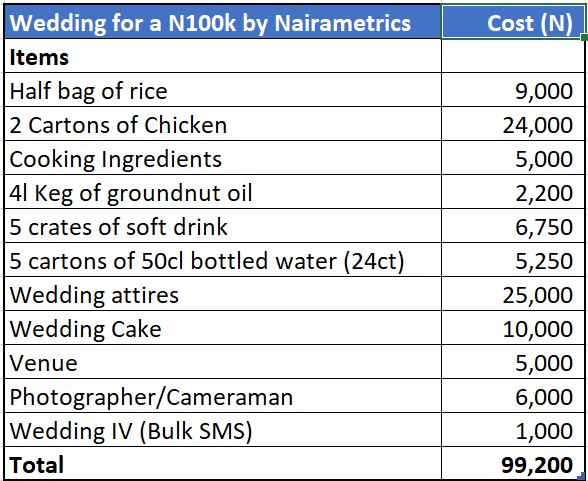

Here is a breakdown of the above mentioned costs:

Yes, We can!

Planning a wedding can be stressful and costly if strict budgeting is not adhered to. It will be nice to see both families of the couple come together to rejoice with their loved ones, but even better if the couple do not go out of their way to incur unnecessary expenses all in the name of pleasing friends and families that would grace their wedding ceremony. The above budget is just a guide that is practically implementable. All that is needed is the boldness to go ahead to do it.

Have a blissful wedding!

This is wonderful. Please if you are in Lagos, i would like you to handle my upcoming event. Thank you.

I’m short of words!

Thanks for this refreshing post…

Wow..with this weddings will be done at ease.

Wao! This is really great. The thought of financing a wedding as weaken me and I don’t want to get married via pregnancy. Thanks a lot I pray my spouse understands

Thanks a lot. Most times the thought of wedding always scares the hell out of me and it’s not because of anything other than finance for the wedding….And it is really making my girlfriend feel I am not ready for commitment…And at times family and friends always complicate things with their unnecessary demands

Wow

This is a life saver

I reali appreciate you

Thank a bunch

Wow so nice well done to who pioneered this post.

Thank so much,dis is really nice

Thanks for sharing your ideas on this… You are very well appreciated

Wow it’s really helpful and nailed it , thank you may God give you more wisdom

This is a great inspiration and motivation…more greese to your elbow

Thanks,so much

Thanks so much sir, this is really helpful, and this what has been given me headache all this while but now I know I can get it done.

Nice one ma’am

Wow this I really really nice

More wisdom

Thanks a bunch

There is no traditional wedding items that should be brought by the groom in the budget

This is good writeup. If it will work out