- Julius Berger has appointed Mrs Belinda Joke Disu and Mrs Gladys Talabi as directors at Julius Berger Plc.

- Mrs Belinda Joke Disu is his daughter and a Group Executive Director at Globacom. Mrs Talabi is the Executive Director Legal/Security Services at Globacom and has worked there for over 15 years.

Nairametrics investigations suggest billionaire investor and owner of Globacom, Mike Adenuga is now the single largest majority shareholder in Julius Berger Nigeria Plc.

Our sources had hinted to us months ago that the billionaire owned majority shares in the construction giant but the proof was hard to come by until last week.

The proof

Julius Berger Plc, on Friday sent a notice to the NSE, appointing two new directors to its board, namely Mrs Belinda Joke Disu and Mrs Gladys Talabi. Both ladies are senior staff in Globacom, one of the three major GSM providers in the country, and Mike Adenuga’s right hand women.

Mrs Belinda Joke Disu is his daughter and a Group Executive Director at Globacom. Mrs Talabi is the Executive Director Legal/Security Services at Globacom and has worked there for over 15 years. Prior to that, she worked in Devcom Merchant bank which was also owned by Adenuga. Devcom was merged with Equitorial Trust Bank also owned by Adenuga in November 2005, and then merged with Sterling Bank in September 2011. Adenuga retains a minority stake in Sterling, which is listed on the Nigerian Stock Exchange (NSE). The two ladies being appointed to Julius Berger’s board confirms our suspicion.

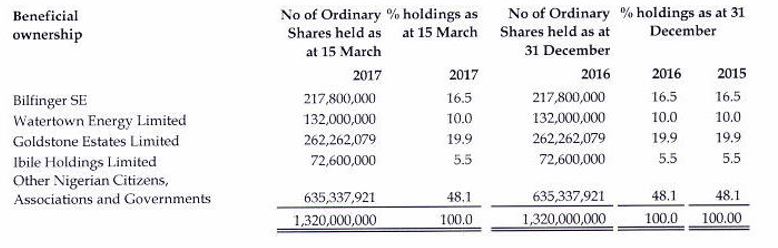

Shareholders of Julius Berger

Source: Julius Berger 2016 Annual Report

A look at the company’s breakdown of majority shareholders (above) suggest, Mike Adenuga’s stake in the company is via an SPV called Goldstone Estates Ltd. As at the end of 2014, Bilfinger had sold 9% of its stake to Goldstone Estates Ltd. Going by the snapshot below, it has sold a further 10%, increasing the stake to 19.9% making it the single largest shareholder in Julius Berger. Of course a Google Search for the company will lead to a dead end.

Nestoil , an indigenous engineering firm owned Dr. Ernest Azudialu-Obiejesi bought a 10% stake in the firm in 2012 in a deal worth N1.4 billion, following Bilfinger Berger’s selling down of their stake in the firm. It acquired the stake via a vehicle called Watertown Energy Ltd. Year to date, the company’s shares are up 2.51% on the NSE.

Why would Adenuga buy a stake in Julius Berger? Though he may be popular due to his ownership of Globacom and to a lesser extent Conoil, Adenuga fondly known as ‘The Bull’ has real estate holdings running into billions of Naira. He could either be looking at expanding into construction or developing large real estate projects which would require services of a good construction firm. Globacom recently was rumoured to be interested in a potential acquisition of Etisalat Nigeria, which is currently battling to repay a $1.2 billion loan taken from a consortium of banks.

Julius Berger was founded in 1965, as a unit of Bilfinger Berger a German construction firm and listed on the Nigerian Stock Exchange (NSE) in 1991. The company has constructed several landmark projects in the country including the Eko bridge and the Abuja National Stadium. Figures from its 2016 financial statements show Julius Berger made a loss of N3.8 billion, due to foreign exchange acquisition losses of N14.3 billion. First quarter 2017 results also show a loss after tax of N426 million, which was also caused by foreign exchange acquisition losses.