Daily performance of the Nigerian Stock Exchange for the trading day ended 12th June 2017.

Nigerian stocks closed trading on a negative note as the all share index dropped -0.12%. Market capitalization at the close of trading was N11,489,620,398,061.92.

Highlights of today’s trading session...

- NSE All Share Index was 33,235.28 down -0.12%.

- Market capitalization closed at N11.5 trillion.

- Volume of shares traded was 501,081,775.00 units.

- Number of Deals was 6,635.00.

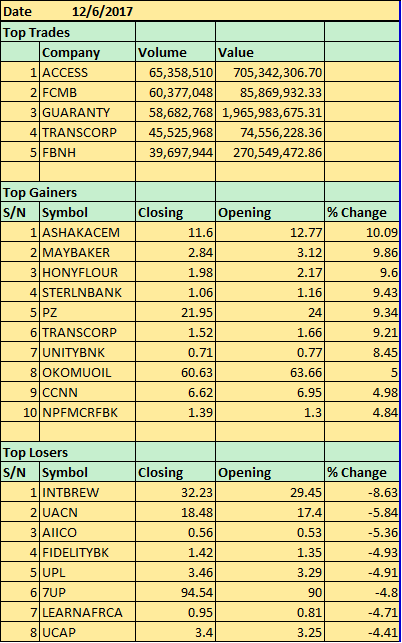

Gainers and losers

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg)