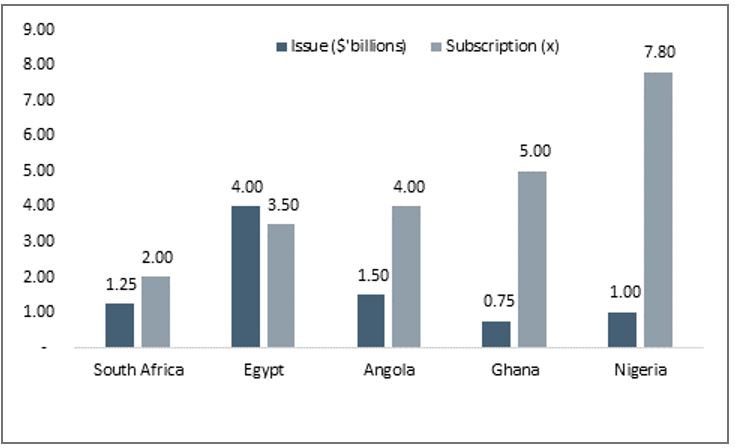

Nairametrics| On Wednesday, Nigeria closed out on its long-awaited Eurobond programme, raising $1 billion via a 15-year bullet bond. The issue, which was over-subscribed with bid-cover of nearly 8x was priced at a yield of 7.875%, extends Nigeria’s dollar yield curve by an extra 5-years. Relative to indicative 8% pricing on the offer prospectus, the actual borrowing cost on the issue looks decent and even better when compared to the most recent SSA issues with Ghana’s 5-year issue in September priced at 9.5%.

Global capital flows not quite averse to FGN dollar debt

To our minds, despite the bad press about an inflexible exchange rate and depressed oil production, the robust subscription and better pricing on the issue implies that markets viewed Nigeria more favourably than feared. This view is not surprising going by trends in Nigeria’s Eurobond yields which declined over 200bps in 2016 in spite of negative ratings action in 2016 and higher US interest rates. The more bullish market view reflects more comfort with Nigerian dollar risk on account of improving oil prices and lower external debt burden (3.8% of GDP) of which only $1.5billion is in the form of non-concessionary Eurobond debt.

Figure 1: Size and subscription trends of recently issued African Eurobonds

Source: Bloomberg, ARM Research

Smaller issue packs lesser punch in resolving fiscal funding woes

However, as we argued in our note last year (Testing the Eurobond waters: From Ghana with Love), given the scale of dollar illiquidity in domestic FX market and pressing fiscal financing needs, the issue should have been much larger and amounts to shooting a pistol relative to a bazooka.

For the sake of context, using the official exchange rate, the $1 billion issue translates to a mere 13% of budgeted 2017 fiscal borrowing needs. Thus, given the quite optimistic non-oil assumptions which underpinned the 2017 budget, fiscal borrowing plans seems rather impractical assuming the FGN takes to implementing the budget in its entirety.

Furthermore, given recent rise in naira bond yields, a more sizable issue would have lessened the need (and cost insensitivity) for local borrowings – which would have gone some distance in keeping a lid on rising debt service costs which hit 52% of federally retained revenues in 2016. In terms of cost savings, the yield on the issue is nearly half the interest paid on domestic borrowings of similar maturity.

Overall while the successful $1 billion Eurobond issuance heralds some much needed progress on the foreign financing leg of fiscal reflationary plans, we feel that the scale of current economic challenges renders any positive assessment of the issue as largely fleeting.

To make significant headway in dealing with the current recessionary climate, we reiterate that economic managers must directly tackle the constraints to growth across oil and non-oil GDP. Specifically, the FGN would need to make progress on conciliatory talks in the in the Niger Delta a pre-requisite for recovery in oil production while the CBN would need to to provide a resolution to the issue of an illiquid foreign exchange rate market.

This article was written by ARM Research.