The Nigerian Interbank Market did the unthinkable today!

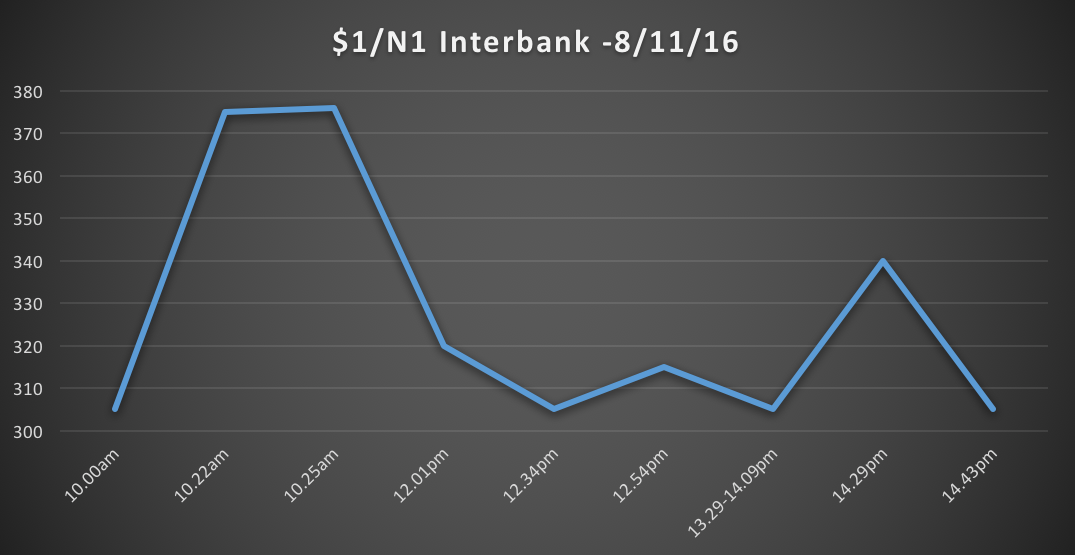

The exchange rate opened at N305, depreciated to as low as N375/$1 before regaining lost value and closing the market at N305. See chart.

Source: Nairametrics research

According to Reuters data, seeing that the rates were higher than their preferred target the central bank intervened by selling around $1.5 million to some banks “helping the naira to close at the previous day’s rate of 305”.

Reuters also reported that the FMDQ had confirmed a single trade worth $10,000 had been made at a rate of 376.63 early on Tuesday “but gave no further details”.

The market volatility witnessed today is the sort of shenanigans taking place at the interbank. Analysts believe that the CBN’s reluctance to allow the exchange rate float is distorting the market negatively. With such a volatility occurring in one day alone, critics opine that they do not see how any serious foreign investors will be comfortable bringing in forex into Nigeria.

As discussed in an earlier article, commercial banks also appear to have abandoned the CBN’s unofficial peg and are now willing to pay at prices much higher than the “unofficial official” N305 especially as there is always a willing buyer on the other end of the trade.