The lackluster stock market in Nigeria may have conditioned investors to become used to low average returns. The performance of the market in recent years may also have made investors less expectant of excellent or high returns in any particular year. It may therefore come as a surprise to discover that there are a number of stocks that have and are able to provide investors with not only excellent returns but returns in excess of 100%. Below are two of such high Alpha stocks

Tiger Branded Consumer Goods Plc

Tiger Branded Consumer Goods Plc formerly Dangote Flour Mills Plc, has witnessed a YTD stock price increase of 284% as at July 15th 2016. This is coming on the back of scientifically improved earrings as reported in the March 31st 2016 financial statements. Tiger Branded Consumer Goods PLC had net 6.22bn in 2014 which fell by 101.40% to a net loss of N12.577bn in 2015 leading to earnings per share (EPS) of -N1.24 and -N2.51 in 2014 and 2015 respectively. However, the interim financial report for March 31st 2016 indicates that the company has returned to the profit zone with a net income of N1.912tn or EPS of N0.38. Although the company last paid dividend on July 19th 2012, it has a 52-week high of N6.18 and low of N0.78

Source: Quantitative Financial Analytics/NSE

Tiger Branded Consumer Goods Plc is engaged in the milling of wheat and production of wheat products. The company produces and sales three major products: bread flour, confectionery flour and pasta semolina. Operating through three major segments, the company’s Flour segment manufactures and sales bread and confectionery flour while its Pasta segment manufactures and sales spaghetti and macaroni. The Noodles segment engages in the manufacturing and selling of noodles.

Tiger Branded Consumer Goods Plc shares which began the year at a price of N1.13 traded at N4.35 giving its YTD gain N3.22 or 284%. This implies that if you had invested N10,000 in Tiger Branded shares at the beginning of the year, your investment will be worth N28,400 now

The company’s shares have 0.33 correlation with the Nigeria stock market’s Allshare Index, with a YTD Beta of 2.28 as well as Alpha of 478.81. As can be seen from the price chart above, it does look like the price increase is moderating.

United Capital Plc

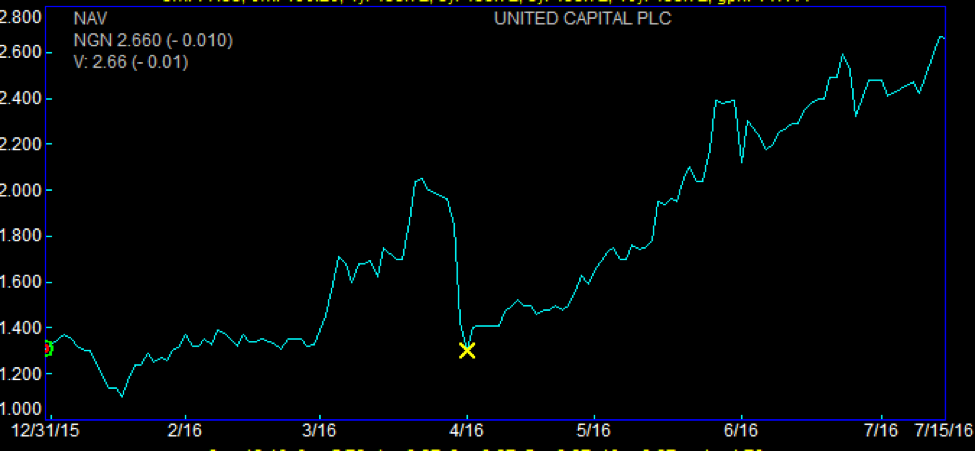

United Capital Plc, formerly UBA Capital Plc, provides investment banking services, portfolio management services, as well as securities trading and trusteeship. The company also provides financial services like project finance, capital markets, mergers and acquisitions and structured finance. The share of the company increased by N1.7 to N2.66 from its beginning of year price of N1.31. This represents an increase of 129.77%. The stock of the company went ex on July 16th for a N.35 per share dividend which gives the stock a total YTD return of 157.72% and dividend yield of 24.45%, the fourth highest dividend yielding stock in Nigeria so far this year (as at July 15th). The stockboasts of an Alpha of 87.22 and Beta of .8 as well as correlation of 0.53

Alpha is the excess return of a stock portfolio over a given benchmark such that If an investment outperforms the benchmark, it generates positive alpha. The greater the alpha, the more the out performance over the benchmark of interest. On the other hand, Beta is a measure of volatility of a stock in relation to movement of a stock market as a whole. High-beta stocks are considered to be riskier and more volatile than the market index but such stocks provide a potential for higher returns while low beta stocks portend less risk and offer lower returns as well.

Source: Quantitative Financial Analytics/NSE

United Capital recorded an improved earnings in 2015 when it made N2.57tn in Net Income, an increase of 38% from the 2014 Net Income of N1.86tn. By that performance, its EPS went from NN.31 in 2014 to N0.43 in 2015. Within the last 52 weeks, the shares of the company went as high as N2.84 and as low as N1.05 The price trend above indicates that the bullish tendency of United Capital shares is likely to continue, at least in the short run.