The decision by the Central Bank of Nigeria (CBN) to adopt a flexible exchange rate regime in May sparked a mixed bag of responses largely positive and domestic equity markets rallied. As with a lot of things, the apex bank Governor nearly managed to snatch defeat from the jaws of victory by hinting at a two-tier FX market with an interbank window operating side-by-side with a critical window.

However a month later the governor firmly embellished his ‘credibility’ credentials with a volte face – one single window, full floating with OTC futures market just like in developed markets. However, after tumbling 43% on the first day of trading, the naira began trading in a narrow range and system liquidity was very low with the apex bank being the dominant player in the FX market.

Also noticeable was the lack of volatility, despite the occurrence of events which should have triggered a surge in volatility. This development would usher in cries that the FX market was rigged and rumours about secret CBN emails to bank treasuries dictating how banks should bid. What does this mean? Are we floating? Why is the CBN managing things? Shouldn’t the naira be allowed to swing wildly?

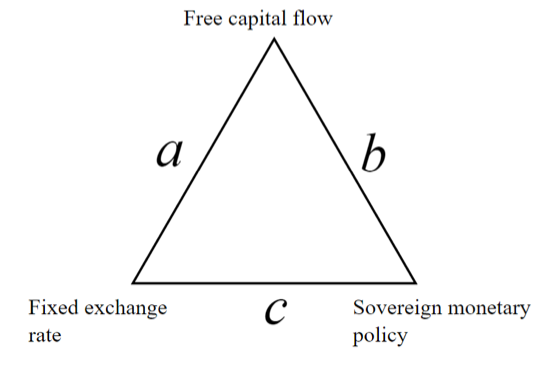

I will attempt to provide answers in this post using the outcome of a certain economic law. In physics, the equation E = mc 2 which captures mass energy equivalence is perceived as almost infallible. In economics, the closest thing to this equation is the impossible trinity/trilemma coined after work by 1999 Nobel laureate Canadian economist Robert Mundell and Briton Marcus Fleming. At the heart of the trilemma is the idea that central banks have three cardinal desires:

- To have a fixed exchange rate

- To have free flow of capital or full capital account liberalization

- To have monetary policy independence

Source: Wikipedia

The impossible in this trilemma is that at every point in time, central banks can only achieve two goals at the expense of a third but not all three at the same time. Thus the trilemma can be used as a sort of framework to understand how economic policy makers are thinking as at every point in time, policy makers are operating along some portion of the triangle above. It is important that policy makers understand where they operate as no choice implies you’re operating on some portion of the triangle by default.

Following recent events in the Euro-zone, having independence over monetary policy is generally viewed as a cardinal objective which shifts focus on the other two objectives. For advanced countries with complex financial markets and institutionalized risk management frameworks like liquid futures and forward markets, capital account liberalization is preferred over fixed exchange rates.

In developing countries with no systems for hedging FX risk, the fixed exchange rate lever is often preferred. Implicit in a desire to float a currency is that you’re no longer interested in where the rate is as there exist facilities to hedge against currency volatility. Implicit in the floating decision is the desire for full capital account liberalization as financial markets are deep enough with diverse participants with different opinions such that exit of one buyer or seller does not lead to declines in liquidity. Clearly in arriving at the decision to float, which to be fair is noble, I doubt the apex bank thought through the implications. Nigeria would not be an outlier since the turn of the 1990s, countries moving to a floating FX regime have generally been forced.

Put simply as FX reserves dwindled, the ability to even determine the rate no longer existed leaving the choice to float as default. Does this mean Nigeria has no foreign reserves, make of it what you will but FX reserves are at multi-year lows and the CBN was active in the swap market up until 2016.

As a friend of mine would say, history does not repeat itself men repeat history. In 2011, CBN commenced a tightening cycle which would see its key policy rate hiked to 12%. The apex bank would leave monetary policy tight over the next four years even though for much of the period inflation declined deep into single digits. In addition, the CBN governor would remove the one-year holding period for foreign investors interested in Nigerian securities, a sort of capital control, and strive to keep the naira stable. Naturally, high interest rates in a zero interest rate world and the appearance of a stable currency combined to attract sizable foreign inflows, estimated at $18billion using CBN data between 2012 and the middle of 2014.

Through the eyes of the trilemma, the CBN sought to attract FPI flows i.e. assuming Nigeria was ripe for full capital account liberalization. It also sought to keep the currency stable which it did implying CBN had to give up monetary policy independence by keeping interest rates high even though domestic conditions warranted an easing. But the thing with FPI flows in a market without depth is that it’s a ticking time bomb and fast forward to Q4 2014, when oil prices began a steep plunge into the abyss and you have a scenario in a club when shots are being fired and everyone races to the door. Two years on the NGN is down over 80% even though the fundamental trigger for the outflows, crude oil prices, have pared back some of the early losses.

As someone once said, policy makers can say all they want but they have to answer up to the trinity. It’s too late to reverse the tide and go back on floating however it is better for Nigeria’s policy makers to clarify thinking on the impossible trinity. Given the importance of monetary policy sovereignty and the current economic hole we have dug ourselves into, I think monetary policy sovereignty should remain focal.

Perhaps the current predicament illustrates the power of the trilemma more clearly, Nigeria is on the border of economic recession, real wage growth was negative in 2015 and given the shocks to purchasing power (PMS and electricity tariff hikes+ naira depreciation) which have resulted in cost push inflation there’s no basis for a tight monetary policy stance. However if you desire a stable FX rate, which CBN action since the start of floating would suggest, you need to attract FPI flows by hiking base rates. Ditto the loss of monetary policy independence, we are now subject to the desires of FPI flows.

On the latter two pillars, I would opine that in the absence of a weak financial markets, focus should be made on developing a well-thought out domestic savings mobilization framework. This is central as financial markets work well in the west because they largely mirror the underlying economic activities in their natural state. Nigeria’s financial markets are at best still in infancy even though some of its regulators talk up fanciful tales of trillion dollar market cap. Reason being in the absence of strong domestic institutional investors, the easy temptation is for policy makers to try to seduce hot money flows which as Harvard economist Dani Rodrik argued are at the heart of all global financial crises since the end of WW2. No economy can develop via portfolio flows even moreso an economy with illiquid equity market and inactive non-sovereign bond market. Such a country is simply unprepared for full capital account liberalization and should seek develop its institutions to the point where they can counterbalance volatile swings.

Does this mean Nigeria should desire a fixed exchange rate regime? In my sojourn in economics, nothing is exactitude or extreme, it is to paraphrase my grad school econometric teacher all about linear approximations. The answer is neither in declaring a hard peg or preaching a laissez faire free market gospel but more exactly a currency can be floating but fairly stable in a narrow trading range.

The fundamental value of every currency must reflect movements in the underlying current account. So in periods when the exports exceed imports currency stability should reflect and vice versa for periods of trade deficit. But importantly, there should be no foolish comments about a hard peg like the appropriately priced N199/$ statements of the past few months. Importantly, in terms of sequencing focus should be on creating an environment which attracts FDI, the ‘high skilled’ equivalent of capital mobility. This would require fixing legal systems and setting up economic structures which incentivize foreign involvement across several sectors of the economy and not an undue focus on ‘magneting’ FPI into shallow capital markets. FPI flows are the low skilled equivalent of capital so just as advanced countries are rejected low skilled labour mobility developing countries must be wary of volatile FPI flows by implementing capital management curbs as the IMF now calls it.

Central to it all, policy makers must prioritize developing financial market systems which align with the underlying economic activity in the natural form. Best to try to bed in the floating system. There will be bumps but the apex bank must be prepared to make certain difficult to accept decisions such as reconnecting BDCs back to the interbank which should speedily wipe out the premiums. In between, flow with the current as by being flexible, CBN signals to other economic agents on the need to buy insurance and hedge against volatility. Naturally as demand for these products rise supply should respond appropriately and we gradually develop liquid hedging markets. The die is cast and the CBN cannot go back to putting the floating genie in the box. I leave with this famous quote which has all kinds of ‘subs’ about our FX market

There is a tide in the affairs of men, which taken at the flood, leads on to fortune. Omitted, all the voyage of their life is bound in shallows and in miseries. On such a full sea are we now afloat. And we must take the current when it serves, or lose our ventures – William Shakespeare

Follow the author of this article on Twitter @Walesmit and check his Medium Page

Wonderful article. The problem with Nigeria and the emerging economies is basically we are not as disciplined as the developed world. We always think we can eat our cake and have it. For an economy to develop it must be prepared to allow shocks on all fronts. An investor’s primary concern is about his/her risk and return. Lets allow good and sound monetary policy and free flow of capital. Forex rates will find their levels.

A thot just came to me. In most developing nations our climatic conditions is generally warm throughout the year with sun seen on an average of 12-13 hours daily, while in developed nations they are used to extreme weather conditions and sun seen for between 4 -20 hours in different time of the year

Lets abide the rules of the market economy – there will be times of bust and boom , man go always survive as long as the earth still exists