In my opinion, there are a few clear signs that show when a country is in trouble. The first is a swing from surplus to deficit or a widening current account deficit, another is also a fall in the price of the country’s exports. Both signs were true of Thailand in the mid 90’s, just before the currency peg was broken in 1997.

Thailand’s GDP growth in the first half of the 90s averaged over 8% to 6% in 96. Foreign investors attracted to the stable baht, high interest rates (vs rates in Eurodollar market) and high growth rate flooded into Thailand. But then the music stopped. Led by a sharp reduction in export growth, economic activity started to slow. The weakness in the financial sector, put pressure on the baht to depreciate.

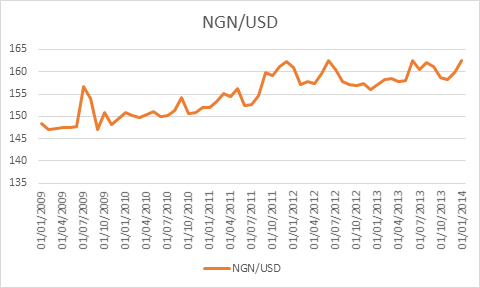

Just like Thailand, Nigeria showed the signs of an economic boom from 2000s. With GDP growth swinging between 6% and 8% from 2006 to 2014. A somewhat stable currency between 2009 and 2013, depreciating by just under 8% through that period.

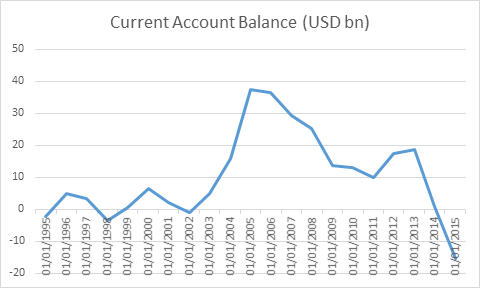

Fast forward to 2015, following the collapse in oil prices, Nigeria’s current account turned negative for the first time since 2002.

Current account balance

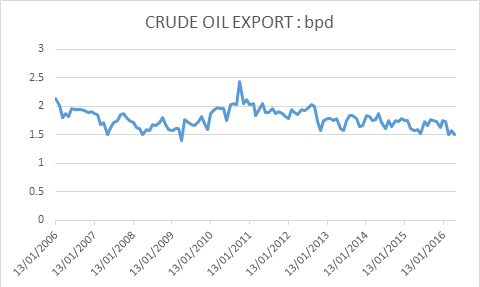

Although oil and gas accounts for 35% of the country’s GDP, petroleum export revenue represents over 90% of total exports revenue. Now not only is the price of oil trading over 50% below 2014 high, but due to oil pipeline vandalism from militants in the Niger-Delta region, Nigeria has also begun to see a reduction in exported barrels of oil per day.

Oil price.

Barrels per day of Nigeria’s oil exports have not been this low since 2009.

Crude oil export.

After over a year of maintaining the Naira’s peg with the US dollar, the Central Bank of Nigeria abandoned this peg. Instead of depleting its FX reserves the bank announced that it will allow the Naira to be market-driven, setting the stage for a devaluation of the currency when the system kicks in on the 20th of June.

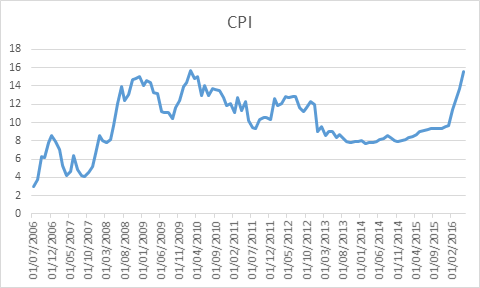

My concern is that Nigeria tends to pass through high import costs as its currency falls. A falling currency will easily force inflation higher, as the country is already suffering from its highest inflation rate in 6 years.

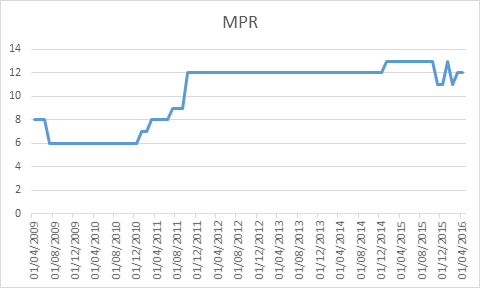

The central bank will be forced to raise rates, which will add to the government’s borrowing costs.

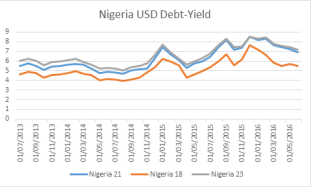

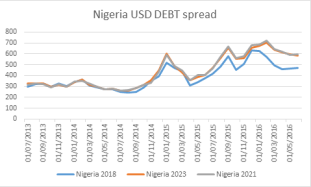

Currently, the Nigeria dollar debt is trading at an average yield of 6.5%. It’s not a historical premium, but the highest in 2016. This gives me the impression that for some reason the market has taken a view that the country’s finances are stable and relatively safe.

The local government bond now trading at negative real yields.

In my opinion, the market is yet to fully adjust to the fact that the numbers in Nigeria have changed; Nigeria is still reliant on a commodity story that has also changed-suffering price and export reductions, it’s currency now floating will naturally devalue and add inflationary pressure on an economy that’s already seeing high numbers due to bad policy. I also see the market adjusting to an increase in government borrowing costs.

At the end for Thailand, policymakers had no easy choices once pressures on the exchange rate emerged, as defending the peg or allowing the currency to depreciate both involved significant costs. Thanks to the power of hindsight, it’s obvious to us that this dilemma could have been avoided by allowing the currency to freely float earlier than they did. It is saddening that the Central bank of Nigeria had not learned this lesson. I think we hold tight and enjoy the ride.

Follow Arnold on twitter @ArnGreen and visit his blog https://thecitytrader.wordpress.com

good for cbn,there is what is called thinking for for a purpose or think strategically,now what is your objective.there id also called the circling and the evolution of the mind for perfection.