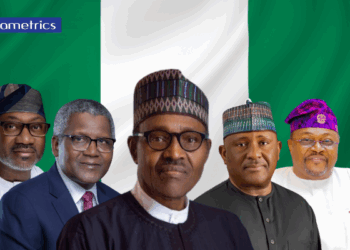

Nairametrics understand some traders are bewildered and clueless as the body language of President Muhammadu Buhari, during his Sunday speech, may be a signal that the 73 year-old has no intentions to devalue the currency.

Despite the looming recession that made the Monetary Policy Committee (MPC) of Africa’s largest economy adopt a more flexible exchange rate policy, Buhari’s comments on Sunday that devaluation has always been harmful to the country may have left investors as confused as ever.

“We resolved to keep the Naira steady, as in the past, devaluation had done dreadful harm to the Nigerian economy,” Mr. President, during his democracy day speech. Emiefele, on May 25, threw the naira into open market and abolished the N197 exchange rate aimed at making the currency more accessible.

Investors bought equities in anticipation that a possible devaluation of naira will bolster share price as the Nigeria Stock Exchange (NSE) Index closed at 27,129.41 on Friday, May 2016, more than 20 percent above a three-year-low in mid-January, according to data compiled by Bloomberg.

Yields on Nigeria’s government bond fell across maturities on May 25 as traders bought debt to cover their positions; a day after the CBN left interest rates unchanged, and pledged a flexible currency policy to lure back foreign investors, according to the Reuters.

These policy uncertainties and lack of economic direction may lead to more capital flight as investors fret that a sudden devaluation will culminate in loss of significant investment.

The restrictions and shortage of liquidity made JPMorgan Chase & Co. exclude Nigeria from its local-currency emerging-market bond indexes tracked by more than $200 billion of funds.

Also, Moody’s, the company that ranks the creditworthiness of borrowers downgraded the country’s long term issuer ratings from Ba3 to B1 on the back of continued fall in the price of oil. The recent attacks on pipelines of multinational oil companies have led to loss of millions of barrel of crude, a further drain on government revenue.

Emefiele said the economy that contracted 0.36 percent in the first quarter of the year, the lowest since 2004, and may be heading for a recession on the back of delayed budget passage.

“Furthermore, I supported the monetary authority’s decision to ensure alignment between monetary policy and fiscal policy. We shall keep a close look on how the recent measures affect the Naira and the economy. But we cannot get away from the fact that a strong currency is predicated on a strong economy,” said Buhari.