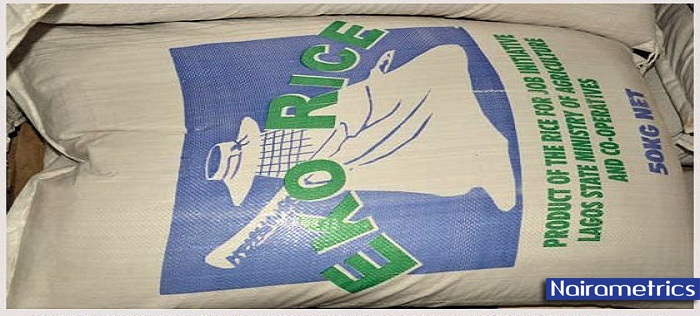

Governor Akinwunmi Ambode has announced that the Eko brand of rice would be ready in six months.

He made this disclosure while inspecting the of Imota rice processing factory in Ikorodu.

While at the factory, Ambode was briefed on the present production capability of the Rice mill, which is presently stood at 2.5 metric tonnes/hour.

The Governor was told that the inadequacies of the rice mill include its low capacity to parboil and dry effectively.

You will recall that Lagos State under the Ambode administration this year, signed an Memorandum of Understanding, MoU, with Kebbi State Government on rice cultivation.

Governor Ambode reiterated government’s commitments in ensuring that Lagosians are fed with locally-cultivated rice of high nutritional quality.

“This is the only platform we can use to allow the inflow of rice paddy from Kebbi State. You will all recall that we just signed a MoU with Kebbi State and the intention is that we want a consistent flow of raw materials to come so that the era of importing rice from abroad would become a thing of the past.

“Asides Kebbi State, Lagos is also looking at possible partnership with other states on the long run, such collaboration will ensure that residents can consume locally processed rice within the next six months,”

The Lagos Sate Chief Executive hinted that efforts are on to make the mill private sector driven would commence immediately.

He said the state would engage the services of the best professionals and experts to run the mill.

WELL DONE GOV. AMBODE. YOU ARE A ACTION GOVERNOR THAT IS WORTHY OF EMULATION BY OTHER GOVERNORS. LET LAGOSIANS BE FED AND ALL OTHER PROGRESSIVE PHENOMENA WOULD NATURALLY FOLLOW.