Nigeria’s President Muhammadu Buhari re-iterated over the weekend that he would not be disposed to devaluing the Nigerian Naira (NGN).

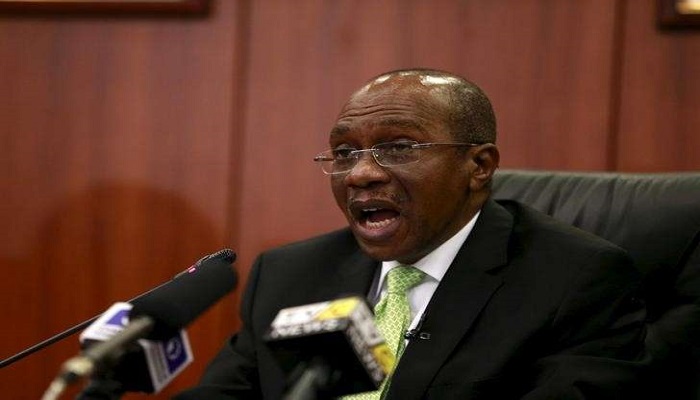

Buhari is no economist for sure; however those who are his economic advisers and those who are part of the economic management team such as the CBN Governor Godwin Emefiele, Finance Minister Kemi Adeosun, and Trade and Investment Minister Okey Enelamah should be conversant with the concept of REER.

What is the REER?

The real effective exchange rate (REER) strips out inflation.

So for Nigeria as an example … if Nigerian inflation runs at 10 percent on average and US inflation runs at 1 percent — the NGN would need to sell off (or adjust lower) by 10 percent annually in nominal spot terms – just to keep the currency stable against the US dollar in real terms.

Recently Renaissance Capital compared the REER rate for all of EM and most of Frontier and a few beyond Frontier countries – against both their long-term average REER implied currency rate – and against the weakest point seen over the last 20 years.

The investment Bank used the Bruegel database which arbitrarily chooses December 2007 as 100 and compares how currencies have moved over 20 years around that level, relative to inflation.

Fig 1 : REER for select Emerging/Frontier Markets (Source: Renaissance Capital)

The results from the data above shows that If the NGN had kept pace with inflation differentials since its 20-year low in 1995 – it would be NGN618/$ today!

Of course we are not advocating for the Naira to fall to those levels, however the research does show that when adjusted for inflation the naira is relatively strong even at N350/$.

The most important thing for the economy is having a flexible exchange rate that clears at (or near) the market rate so that there is incentive to take risk by entrepreneurs as well as an elimination of corrupt practices of round trippers and those that benefit from arbitrage.

So next time someone is arguing about the pros and cons of devaluation for the naira, ask them if they have kept the REER in view.

This REER is not properly explained.

The concept of REER is not really that hard.

Let’s use the annual change in the price of a plot of land as proxy for inflation in an economy…since land/property is usually a store of value and rises by as much as inflation.

Let’s say you bought a piece of land in the year 2000 for N100, 000.

And that year the dollar Naira exchange rate was N100/$1.

Now if in 2015 (15 years later), the plot has risen to N700, 000 due to cumulative inflation over the period, but the dollar Naira exchange rate is now N200/$1 in 2015.

The plot of land has effectively inflated by 600 percent (N100k to N700k); however the dollar exchange rate has changed by only 100 percent (N100/$ to N200/$1).

The REER would have seen the dollar Naira fall by 600 percent to N700/$1 (in 15 years).

In other words the currency has not tracked the level of inflation in the economy over time, so it is still relatively strong in real (not nominal) terms.

PAT MELIK

Thanks for the explanation