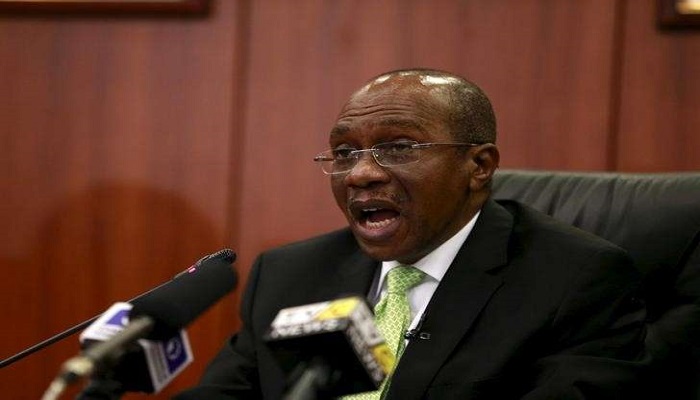

Nigeria’s Central Bank Governor Godwin Emefiele has a credibility problem.

The naira is tanking despite futile attempts to hold it at a nominal level of N199/$ apparently arrived at by pulling that number (N199) out of a hat since it has no macroeconomic relevance, anchor or bearing.

The Real Effective Exchange Rate (REER) or inflation adjusted UDS – NGN is well above N400/$, while a purchasing power parity estimate or big Mac index (using Johnny Rockets as a proxy), would give u a USD/NGN closer to N320/$.

But the above facts are just a little inconvenience to our all knowing Emefiele who currently lives in denial.

In the real world where businesses have to struggle to survive and create wealth entrepreneurs are buying the dollar at N340, which is 70.85 percent higher than the official make believe CBN rate.

The problem with the CBNs current policy (or lack of it) is the inability to use flexibility or volatility to its advantage.

Currency markets are some of the most volatile in the world.

It doesn’t make sense to fix the naira at N199 to $, when nobody can get it at that rate.

Using the markets will enable the CBN free up pressure on the naira like it is done everywhere else in the world, a case in point being Vietnam.

The State Bank of Vietnam reduced the local currency the dong’s reference rate in January 2016 for the first time since August, saying that it is moving to a more market-based methodology in setting a daily reference rate versus the dollar.

“The dong’s daily reference rate will make it easier for market stakeholders,” Do Ngoc Quynh, Hanoi-based head of treasury at Bank for Investment & Development of Vietnam, told Bloomberg.

“It also helps policy makers avoid accumulated pressure on the dong and allows them to be more proactive in coping with changes in global markets.”

The new methodology the Vietnamese Central Bank has adopted will calculate the daily reference rate based on a weighted average of dong prices in the interbank market the previous trading day.

The Vietnamese State Bank will also introduce three-month forward sales of U.S. dollars to commercial banks at the daily rate plus an additional 1 percent.

Instead of emulating the sensible policies of Vietnam, Emefiele has chosen instead to mimic Venezuela where currency controls and dwindling hard currency for businesses have created severe shortages of goods.

It is a country where inflation is forecast at 720 percent (that’s not a typo) this year.

Nicolás Maduro Venezuela’s hapless President has refused to adopt adjustment measures including devaluation and an increase in petrol prices, just like Emefiele and President Muhammadu Buhari.

In the black market, the Venezuelan currency the bolivar has lost 92 per cent of its value in the past 24 months, with the dollar costing 150 times the official rate.

This is the largest exchange rate differential ever registered in Venezuela as is the case currently with Nigeria.

Emefiele must know that doubling down on his current naira policy will cause untold damage to Nigeria’s economy and history will not judge him kindly were that to happen, as he is being seen by most analysts as someone too keen to please his master and keep his job than do the right thing for Nigeria’s economy.

Nigeria might begin to see empty supermarket shelf’s as soon as April according to channel checks with manufacturers.

Anecdotal evidence also shows that imports have fallen off a cliff since the beginning of the year (bad for growth) and manufacturers are closing factories as they cannot get raw material.

This is coming close to 1984/1985 and essential commodities all over again.

In another move two former CBN Governors, Chukwuma Soludo (2004 – 2009) and Sanusi Lamido Sanusi (2009 – 2014) have spoken out against the CBN policies being pushed by Emefiele.

It is unprecedented for 2 former CBN Governors to criticize the policies of their successor.

Vietnam’s steady economic growth at near 7 percent this year will make it one of the fastest growing economies in the world for 2016.

Venezuela’s economy on the other hand is forecast to shrink by almost 5 per cent this year (2016) after an 8 per cent contraction in 2015.

It is time for the CBN to move the Nigerian economy away from the precipice and begin to emulate VIETNAM instead of VENEZUELA.

No matter the case, Nigeria can never be like Venezuela. Reason bcoz we produce and farm many of the food we consume.

My question to the author of this article is this, what benefits would an official devaluation bring either in the long or short term? The root cause of Nigeria’s problem is the drastically reduced dollar revenue that’s borne from the global oil price drop. The so called fall in Naira is driven by an overwhelming demand for the green back. The government is understandably unable to meet the demands simply because it just doesn’t have enough to go round. Whilst there are different opinions on CBN’S approach to the dollar hoarding,some measure of capital control was absolutely necessary. I’ve read all kinds of international critics of CBN policy from IMF to The Economist,Bloomberg,etc etc but their criticism boiled down to its facts is that they think a cheaper Naira would attract investors. And the by definition the CBN not devaluing the Naira is doing the Economy harm.

I disagree,as a matter of fact I think such a postulation is not only counter intuitive it’s also deliberately disingenuous. The truth is that real investors are actually now fleeing the economy. Whilst other would be investors are observing the situation to see where the bottom would rest. If you were invested in Nigeria as an international investor you do not require a PHD to understand that a falling Naira equates to a lower return on your investments. For any lay reader consider you put a £1000 in a Nigerian bank to gather interest. Early last year you would have in the region of N260,000 in the bank using an exchange rate of N260. Today if you decide to withdraw that N260000,excluding interest at the unofficial rate of N450 your £1000 in the space of a year is now worth about £565. Meaning you have lost almost half of your money due to devaluation. This cuts across everything from property portfolios to share options. Whilst we all know that the dollar scarcity is injurious to many businesses being the import dependent nation we are ,I think we should be very careful what we wish for and not dance to the tune of currency speculators and international vultures who are only after their respective bottom lines and offer no real value to the Nigeria.