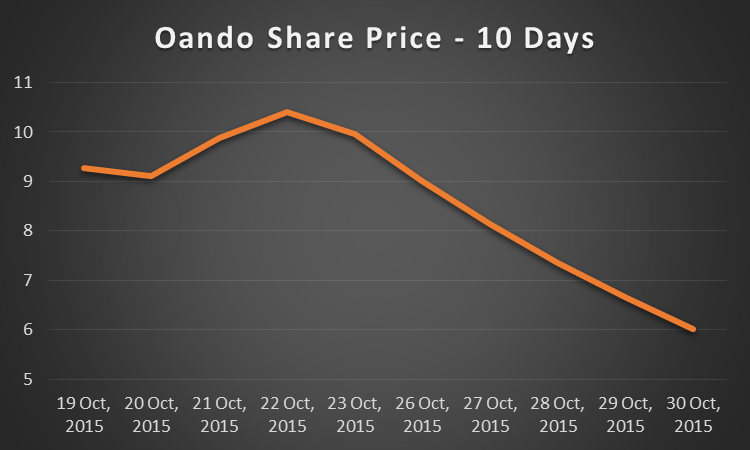

Oando Plc incurred the wrath of investors last week following the release of its 2014 full year and 2015 Q1,Q2 and Q3 results respectively. The share price lost a whopping 39.6% of its value shedding off about N47 billion in market value. The stock has basically lost a minimum of 9% everyday since Monday October 26th 2015.

Oando, you may recall announced record losses amounting to a combined N228 billion (over $1billion) between 2014 and September 2015. The record losses also threw the companies retained earnings into a deep hole as it is now a negative N153.5 billion effectively wiping out any hope for dividends this year or in the nearest future.

Sources inform Nairametrics that a lot of shareholders were racing to dump the stock and recover whatever the can no matter how small. The stock continued to remain in a full offer position most of last week with over 40 million units available for sale with no buyer at one time during trading.

It is unclear how things could pan out this week as some investors inform Nairametrics that things could even get worse. Some believe the current price may not be the right floor for the stock pointing to the fact that the current market value of N72 billion is about 60% higher than the Net Assets of N45 billion.

Some other investors however believe this could be a buying opportunity for bargain hunters who may be relying on the resilience and tenacity of the CEO Wale Tinubu to turn things around.