Most Forex brokers aren’t your traditional financial intermediaries found on Wall Street. When operating in international currency and CFD markets, full understanding of the structure and strategic objectives of Forex brokers may mean a difference between success and utter failure for a trader. There is much more to the subject than just transparency of commission structures and hidden costs. Knowing how to spot a truly professional brokerage solution, which will serve your interests instead of stuffing their own pockets with your money, will go a long way in safeguarding your capital.

Dangerous Business Model of Market Making, or B-Book

What is the business model of most Forex brokers, how do they operate and make money? What are the fundamental differences from traditional structures that equity investors are used to?

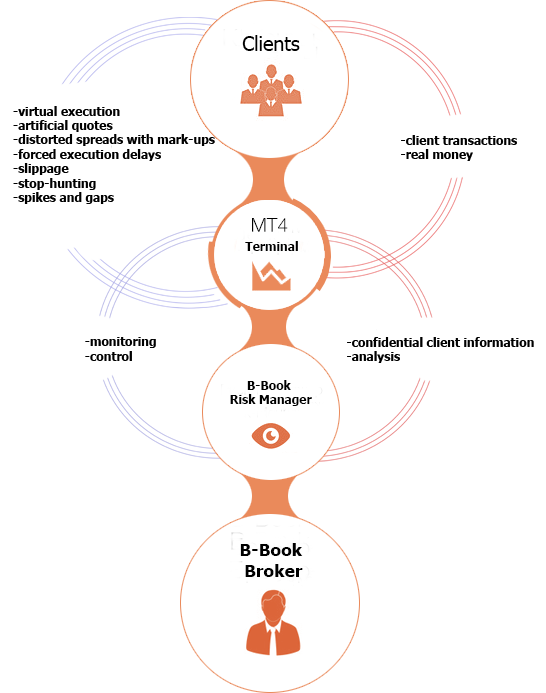

There are only two business models among the thousands of brokers globally. The first and most commonly used model is known as market-making, or B-Book. Whether regulated or not, such brokerages present the greatest risk of financial losses and missed profits to clients. B-Book is a technical term, which implies that the provider will virtually execute trades without sending them to live markets. Such methodology allows the virtual broker to keep all trades on the books, acting as counterparty to every transaction under assumption that the prevailing majority of clients will eventually lose all money. Client loss here becomes broker gain, and vice versa.

You may have read numerous reports with trader complaints covering a variety of manipulative broker techniques they encountered when trading in Forex and CFD markets, including stop-hunting, forced delays in trade executions, unjustified price spikes, artificial gaps, unexpected slippage and drastic surge in spreads, among the many other shady practices that witnesses report. The chances are, few would know the underlying reasons behind such broker behaviors. In reality, it all comes down to the factors of opportunity and financial incentive. Since their profitability and the very financial survival is driven by client losses, such brokers tend to misuse the technical facilities of B-Book systems, interfering with client trades, manipulating execution and even dressing up price quotes to maximize their own profits.

Unfortunately, as practice shows, even regulated brokers are prone to these abuses. The reality of things and practical experience of investors with market makers show that there is no such thing as a reputable B-Book broker, while the business model itself is fundamentally skewed to benefit the broker at the expense of the client.

Let’s have a look at actual numbers. Presented below is a screenshot from a small-sized B-Book broker that went out of business recently, deciding to share this valuable information with investors. Profitability of this broker with only three employees is mind-boggling. Truly so, they make money from thin air:

As you can see above, clients altogether lost astonishing $195,000 in one day of trading. B-Book broker will transform these virtual client trades, where no actual market trading occurred in the first place, in broker’s own profits. The very next day, these funds are being used to pay for even more advertising, selling the concept of easy money to trusting investors. This is precisely why the brokers that have some of the highest online visibility due to heavy advertising, use B-Book models, while professional ECN brokers have relatively small presence online and advertise their offers within reasonable budgets. High competition for advertising spots saw brokers’ marketing costs skyrocket, and it is generally the case that only market-making B-Book brokers, who essentially use client money to pay for advertising, are able to afford the cost.

Scary consequences of B-Book business models

Most common grey techniques used by B-Book brokers are presented in the screenshot that follows. You can clearly see that brokers have the technical means to force execution delays, damaging client accounts when traders may need to exit the market urgently on huge price swings. They can and often do disregard stop-loss requests, or execute orders at inferior prices, take client money from positive slippage, artificially inflate spreads, and utilize other complex tools to guarantee broker profits. These systems are not designed to provide honest brokerage services, and are not aimed at long-term customer satisfaction. All they are meant to do is maximize client losses for maximum broker rewards.

Worst of All, This Could Actually be Legal, Even for Regulated Brokers

Curiously enough, most of the manipulative techniques discussed above could be perfectly legal, even for regulated brokers, registered and operating in reputable jurisdictions. This is the case because according to client contracts, which are the terms and conditions that customers accept online when opening Forex broker accounts, agreements are drafted with full disclosure of the market-making role of the broker. According to these agreements, brokers act as exclusive dealers for all Forex and CFD trades, and legally have the right to offer the kind of execution they deem acceptable under circumstances. If the circumstances are such that the client is making money, it may just be in the best interests of the broker to put a stop to the winning trades and reverse gains. If it is perfectly legal to do so, there might as well be no stopping the broker from doing it.

Alternative DMA/STP solutions for professional traders

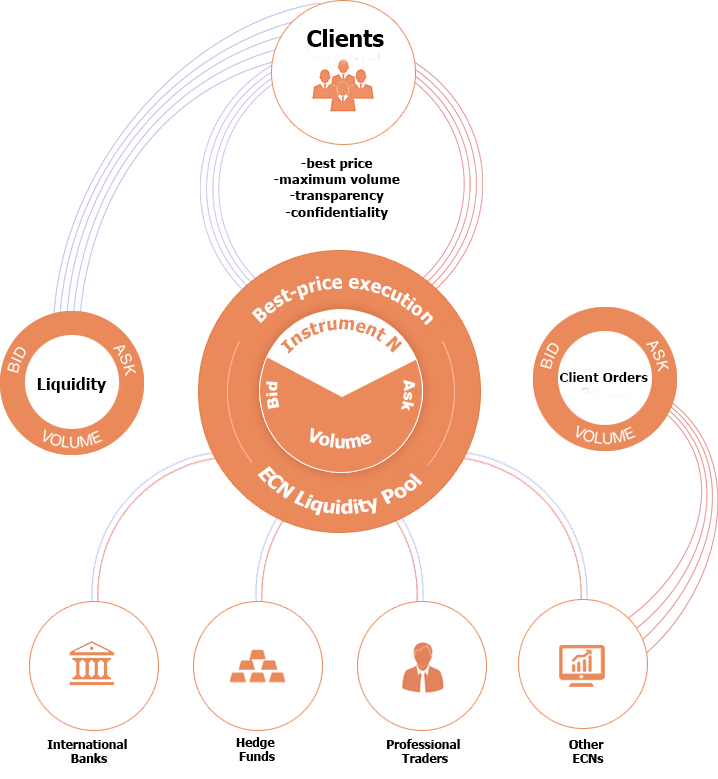

DMA/STP, often referred to as simply ECN brokers, pursue best interests of their clients in contrast to the above practices. Also known as A-Book brokers, DMA/STP firms operate solid brokerage businesses as they are meant to be. Equipped with technical means to deliver absolute best trade execution, DMA/STP brokers are driven by client-centric business models, which motivate them to continuously improve their services, reduce trading costs and provide solutions that help traders achieve better results. DMA/STP brokers will deliver true market prices and route all client trades to international banks and other liquidity providers through ECN environments. Concord Bay is one example of an international brokerage that operates according to a 100% DMA/STP business model, in a fair and transparent business relationship where broker is motivated to help clients succeed in the markets, growing trading volumes and facilitating client profitability a win-win relationship.

The Bottom Line

If you ever thought of making money with a market-making broker, you might as well forget it altogether as the chances of your dreams materializing are next to none. The only viable brokerage solution for professional Forex and CFD traders is one where broker’s financial motivation is tied to client success, with a commission-based compensation instead of the more common B-Book model where broker makes money on client losses. DMA/STP firms, like Concord Bay, also known as A-Book brokers, cater to professional traders and investors, delivering superior execution and first-rate electronic trading services structured to facilitate success of their clients.