In Nigeria, millions of people brush their teeth with different brands of toothpaste every day. The country’s large population size provides immense potentials for toothpaste manufacturers hoping to take their shares of the market. This explains why there are at least thirty different toothpaste brands available in the Nigerian market, examples of which are Dabur, Oral-B, Pepsodent, Colgate, Close-Up, etc. Out of the lot, we have chosen to compare Close-Up and Oral-B in this week’s battle of the substitutes.

The history of Close-Up in Nigeria

Close-Up has had a long and successful history in Nigeria ever since its introduction in 1975 by Unilever. Being the only brand in the market for many years enabled it to garner millions of loyal consumers. Today, the brand is still one of the biggest in the country, thanks to good marketing strategies and widespread distribution channels.

Also, Close-Up is constantly being enhanced through innovation in quality, even as it is given needful visibility through creative advertisements. All these have helped to sustain its success.

Close-Up Nigeria is part of a global, very successful brand of gel toothpaste available in North America (USA and Canada), as well as India, Sri Lanka, etc. In Nigeria, the toothpaste brand is still manufactured by Unilever Nigeria Plc.

About Oral-B

Oral-B is relatively new in the market, having just been introduced in 2011. This makes it more than thirty years younger than Close-Up. Judging by its relative popularity and success however, it is almost difficult to believe that it has existed for barely a few years. Apparently, Oral-B is leveraging its quality standard and the impeccable track records of Procter & Gamble (its manufacturer) to ensure success.

Much like Close-Up, Oral-B is a global brand. In Nigeria, it is constantly undergoing modification and offering variants to consumers even as strategic advertisement is used to keep it visible.

Similarities between Close-Up and Oral-B

Virtually all toothpaste are composed of the same ingredients. What makes them unique, therefore, is the formulation, the packaging, and the marketing strategy utilised to sell the products’ benefits to the target audience. In this vein, both Close-Up and Oral-B are quality brands. According to Nneka Emmanuel who uses Oral-B and Close-Up, “Both are good in terms of quality. Before the introduction of Oral-B, I used to only brush my teeth with Close-Up toothpaste. When Oral-B came and I tried it, I liked it immediately, just as much as I like Close-Up. So, I’ve been using both alternately ever since.”

Both brands are also manufactured by very reputable companies with good pedigrees. Procter & Gamble and Unilever are two of the biggest consumer goods producers in Nigeria, and indeed the world. For many years, they have been producing essential products that are used every day by Nigerians.

The products are also well-marketed. As a matter of fact, one of the reasons why Close-Up has remained relevant till date is because of the effective marketing strategy adopted by its manufacturer. Similarly, Oral-B was able to achieve astronomical growth, thanks in part to effective marketing.

Both Close-Up and Oral-B engage in relevant corporate social responsibility. Unilever is known to sponsor several youth programmes on university campuses during which it shares its products, specifically the different variants of Close-Up. Likewise, P&G regularly embarks on CSR missions, providing free dental checks to Nigerians.

Finally, both brands offer different tube sizes such as 140g, 140g x2, 140g x3, etc. All of these go for similar prices. In the same vein, the brands offer variants such as herbal, deep action, etc.

Differences between Close-Up and Oral-B

Aside from the fact that Close-Up is over thirty years older than Oral-B, other factors help to differentiate between them. These factors include taste, colour, and packaging. For instance, while Close-Up products are predominantly red (as the herbals), Oral-B is mostly turquoise blue. Same goes for their packaging.

Another difference between them is the fact that Close-Up has a 30g X2, sachet-packed product in the market. This helps Close-Up to reach consumers of different financial capacities. Oral-B currently does not have such an offering in the market.

Market Survey

From our interaction with some toothpaste users in Lagos, it is obvious that not only is Close-Up still popular in the country, it is also widely used. Most of the respondents noted that they have literarily used Close-Up all their lives.

“Close-Up is the only toothpaste brand I’ve used all my life. I like the smell, the taste, the colour and the effect it has in my mouth. I also like the fact that the prices have remained consistently affordable. Also, they now offer variants of herbal and whatnot. I like it.” said Tunde, a teacher resident in Lagos.

Others like Nneka Emmanuel said that they use Close-Up most of the time, but also alternate it with Oral-B, especially when they cannot easily access Close-Up.

Also, some others said that they switched completely from Close-Up to Oral-B because they think that the latter has more to offer.

“For many years, I used Close-Up. But after I came across Oral-B and tried it, I had to ditch Close-Up immediately. Today, my family and I use Oral-B. To be frank, Oral-B offers a greater advantage. That’s the only reason why it has done so well within the short time it’s been around” said Mrs Ajao, a banker.

Meanwhile, Mama Lateef, a neighbourhood convenient store owner in Iyana-Ipaja, Lagos said that although her customers buy both Close-Up and Oral-B, she typically runs out of the former first. Speaking further, she said that the reason for this is “…because Close-Up has been around for a long, long time and attracted a lot of fans. I myself use only Close-Up, especially the herbal type.”

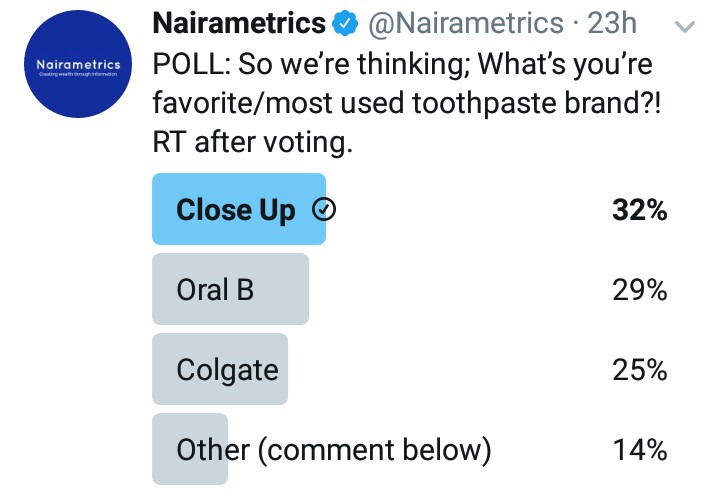

As always, we conducted a Twitter poll as a way of gathering more data for our comparison. In the poll, we asked our followers to choose their best brand among Close-Up, Oral-B, Colgate and any other toothpaste brand(s). Out of the total number of respondents, 32% said that Close-Up is their favourite. This is closely followed by Oral-B, which 29% of respondents said is their favourite. Colgate came in third place with a 25% vote, while 14% of the votes went to the others.

This poll result is indicative of the close competition between Oral-B and Close-Up – one of the reasons we chose to compare the two. It also clearly shows that many Nigerians still like the pioneering toothpaste brand in Nigeria. Therefore, based on these findings, we declare Close-Up the winner of this week’s battle of the substitutes.

I am genuinely grateful to the owner of this website who has shared this great paragraph at here.