Global oil prices have been falling steadily for more than 6 months now, and different scenarios, analysis have been postulated recently as to why oil prices might fall to $30 a barrel or even lower.

These predictions generate mixed reactions from different countries depending on whether they are net importers or exporters of oil. Consumers in many oil importing countries might be more relaxed because these countries will have to pay less to fuel their cars, but it’s the countries that depend on oil as a major revenue earner for their nations that will be scared and could pay dearly for this volatility in oil prices.

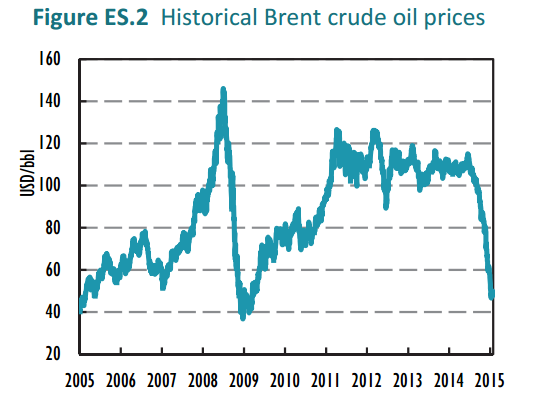

World oil prices have been steadily rising over the past 5 years, Brent crude rose to as high as $111.26 a barrel in 2012, up from $61 in 2009. However from mid-late 2014, prices began to slump and it fell to as low as $50 a barrel in April 2015, for the first time since May 2009. As at today oil sells for around $47 per barrel.

Reasons for the Price Fall:

- Weak demand in many countries (such as china), due to slowing economic growth.

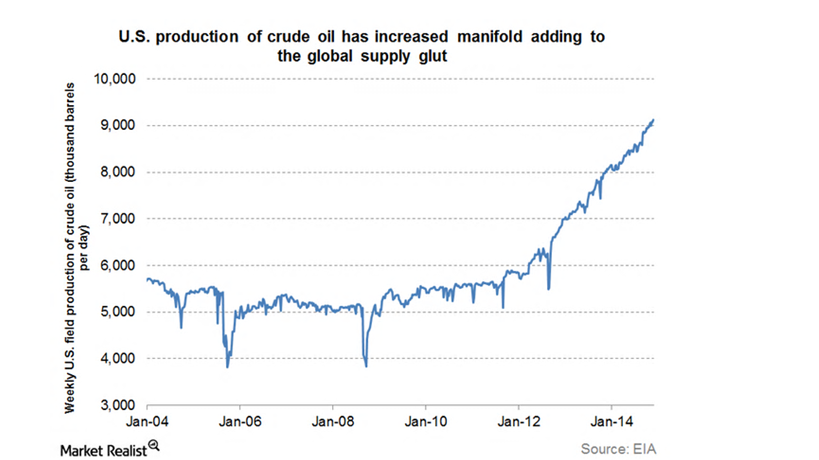

- Surging US shale Oil production.

- Over Supply of oil forcing prices to drop.

- OPEC not cutting production as a way to prop up oil prices.

WHAT ARE THE IMPLICATIONS FOR NIGERIA?

Russia loses about $2bn in revenue for every dollar fall in oil price, the World Bank has already warned that Russia’s economy will shrink by at least 0.7% in 2015 if oil prices do not recover.

Nigeria like Russia is a net oil exporter, and will face severe consequences if the oil price keeps falling. Below are the implications…

- Infrastructure will be hampered:

According to the Nigerian Bureau of Statistics, as at Q2 2015, Nigeria earned N2.8trillion from exports out of which oil accounted for N2.5 trillion or 87.3% of that value. If oil prices keep falling Nigeria will earn less than this which will mean less funds for infrastructural development to cater for projects in all 36 states of the country. Capital projects like roads, bridges, rail, and electricity require massive amounts of money.

- The Naira will take a severe beating:

A continuous fall in oil prices will have the naira value depreciate, this is because falling oil prices will cut export revenues hence driving down the value of the Naira.

- Oil companies will Sack/Lay off workers:

Oil companies are likely to be hampered by cheaper oil. The reduction in profits of these companies like shell, chevron etc. will have severe consequences. Some of which will include job cuts, layoffs, and lower spending.

- Uncertainty for 2016 Budget:

The fall in price will create uncertainty for the benchmark for the 2016 budget. The 2016 budget will be critical for this new administration, as it will be the first budget to be passed by them. The budget will be critical to kickstart the economy along the lines of which this administration led by President Buhari will like to go. Lower oil prices will be a painful sore for the budget.

- More Debt:

If oil prices keep falling, given the weak level of foreign reserves, economic pressures will remain, which might lead to government spending cuts. The government may also be forced to go to the capital market to issue bonds and borrow more money hence increasing domestic debt.