The tight money policy being pushed by the Central Bank of Nigeria (CBN) combined with a slump in oil prices has led to a consumer depression in Nigeria.

This is likely to be protracted with negative implications for FMCG firms operating in the country according to Investment Bank Renaissance Capital (RenCap).

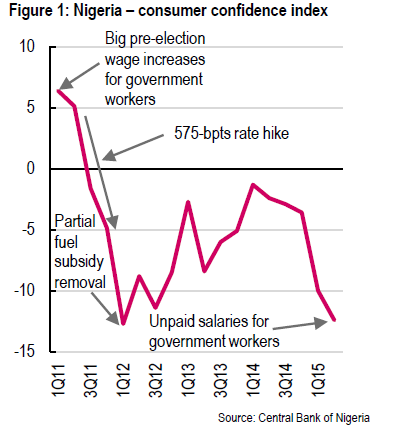

Nigeria’s consumer confidence index tracked by RenCap fell to -12.4 in the second quarter of 2015, from -2.4 a year earlier and -10.0 in the previous quarter.

Since the series began in 2011, the only other time the consumer confidence index fell this low was in the first quarter of 2012, when it dropped to -12.7 following the partial removal of fuel subsidy.

“As we see economic activity weakening in the short term and monetary policy remaining tight (given the central bank’s fixation on a strong naira), we expect the consumer depression to be protracted,” RenCap’s Sub Sahara Africa economist, Yvonne Mhango, said in a July 31 note.

The slump in commodity prices including oil which makes up 70 percent of Nigeria’s budget has put a strain on government finances, employees who are owed salary arrears and businesses suffering the trickle down from a negative wealth effect.

Oil entered its second bear market since mid-2014 in July as a flood of output from North American shale regions, the Persian Gulf and deepwater fields overwhelmed consumption by refiners and chemical producers.

RenCap’s regression model that predicts the outlook for consumer sentiment found that interest rates and government wages have the highest correlations with consumer confidence.

The tight liquidity conditions (MPR and CRR at elevated levels) and high interest rates inhibit access to credit, particularly for those traders and distributors of consumer goods that partly depend on credit to facilitate their businesses.

The weak consumer confidence is reflected in recent company results.

Dangote Sugar Refinery’s first-half pretax profit fell 4.5 percent to 9.80 billion naira ($49 million) versus a year earlier, the firm said on Friday.

Conglomerate UACN also reported a 58 percent decline in its half year pretax profit to 2.14 billion naira ($11 million), compared with the same period of last year as gross earnings fell to N37.37 billion in the period to end-June from N40.25 billion

Nigerian Breweries, MRS oil, 7up, Ashaka Cement, Mobil Nigeria, Seplat and HoneyWell flour Mills are some of the other listed companies that have announced lower profits this quarter.

Consumer confidence may improve moderately in the third quarter of 2015, following the proposed clearance of 2bn in salary arrears.

There have also been moves by some banks to restructure private sector loans.

“By half-year, we have restructured $103 million worth of loans made to construction, public sector and service segments in Nigeria. We are in the process of restructuring $75 million in the upstream oil and gas sector,” Ecobank’s chief risk officer, Dayo Orimoloye said Friday in a conference call to investors.

However the still-low 12-month outlook for the oil price, and its negative impact on government revenue means that payments for salaries and fuel subsidies are likely to continue to fall behind, according to RenCap.

“This would be negative for wage growth and economic activity. We thus expect the consumer confidence index to move sideways in the negative 8-11 range over the next 12 months, implying the consumer depression is likely to be protracted. For sentiment to improve, we would need to see monetary policy ease and a material improvement in the oil price that allows government finances to recover,” Mhango said.