BP released the 64th edition of the Statistical Review of World Energy on Wednesday June 10th 2015.

The 2015 edition of the report reviewed by Nairametrics highlights that significant changes in global energy production and consumption have had profound implications for prices, for the global fuel mix, and for global carbon dioxide emissions.

More importantly the report revealed three broad trends that are shaping the global energy markets.

What should be of worry to the country’s economic managers is that all three trends are bearish for Nigeria.

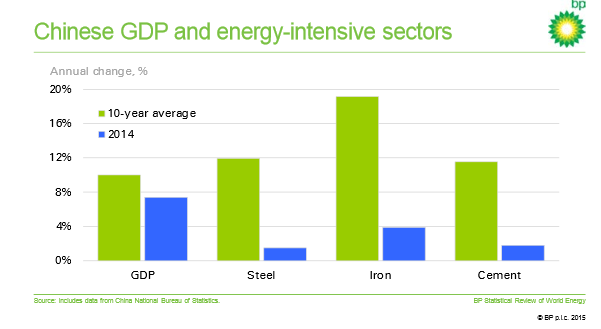

Trend 1: U.S shale revolution powers on

In energy, 2014 was the year of the American eagle, as the US shale industry went from strength to strength. At its height last year, more than 1800 rigs were operating in the major US oil and gas plays, drilling around 40,000 new wells, according to BP.

Capital spending in the shale industry is estimated to have reached around $120 billion in 2014, more than double its value 5 years earlier.

To put that in perspective, Nigeria is thought to have lost more than $28 billion of investments into its oil and gas industry in the past 5 years as a result of the non- passage of the Petroleum Industry Bill (P.I.B).

The increase in U.S productivity is even more striking, with productivity in tight oil plays increasing 7-fold since 2007.

The results were equally startling.

“US oil production rose by 1.6 Mb/d in 2014, by far the largest growth in the world, and the first time any country has increased its production by more than 1 Mb/d for three consecutive years,” BP’s Group chief economist Spencer Dale, said.

As a result, BP says oil production in 2014 exceeded the previous peak level of US output set in 1970.

Most significant of all, the US passed both Saudi Arabia and Russia to become the worlds’ largest oil producer for the first time since 1975.

Fig 1: U.S shale revolution

This trend is Bearish for Nigeria because:

The implications of the U.S shale revolution for Nigeria are profound.

US net imports of oil in 2014 were less than half their 2005 peak levels. In 2007, just prior to the financial crisis, the US was running a current account deficit of 5 percent of GDP

In 2014, US energy imports comprised just 1 percent of GDP, and US production accounted for almost 90 percent of its energy needs –a level not reached since the mid-1980s.

Meanwhile as a result U.S imports of crude oil from Nigeria have virtually dried up.

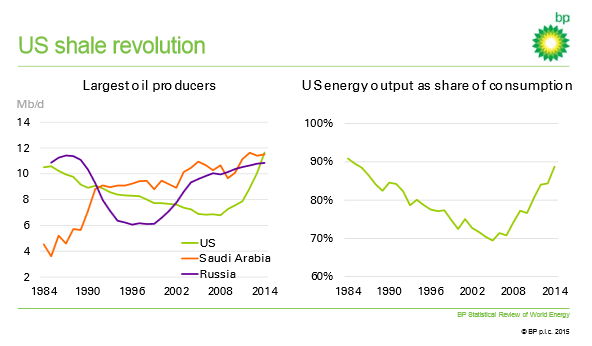

Trend 2: Chinese demand tapers out

Chinese GDP growth slowed to 7.4 percent in 2014, significantly weaker than the double digits growth rates between 2000 and 2010.

This slowing was accompanied by a continuing shift in the pattern of growth, with real estate investment and parts of industrial production decelerating sharply, according to BP.

As a consequence, growth in some of China’s most energy-intensive sectors such as steel, iron and cement –sectors which had thrived during China’s rapid industrialization –virtually collapsed in 2014, as more service-orientated parts of the economy came to the fore.

This changing pattern of economic growth caused the growth of China’s energy consumption to slow sharply to just 2.6 percent in 2014, less than half its average over the past 10 years (6.6%) and the weakest rate of growth since the late 90s, according to BP.

Fig 2: Chinese GDP vs. energy consumption in key sectors

This trend is Bearish for Nigeria because:

This trend is Bearish for Nigeria because:

If the U.S has stopped buying Nigerian crude and Chinese demand is slowing, it portends danger for our current accounts, Federal and State budgets, currency and macro – economic stability in general.

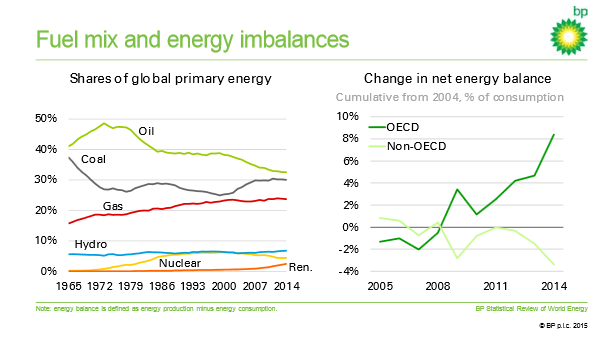

Trend 3: Renewable energy is more than just a fad

The global go green movement is beginning to have an effect.

The share of non-fossil fuels as a percentage of global energy consumption reached an all-time high of almost 14 percent, with the shares of hydro (6.8%), nuclear (4.4%) and renewable power (2.5%) all increasing.

Despite a backdrop of slowing energy demand and weak growth in fossil fuels, non-fossil fuels continued to grow robustly, increasing by 3.7% in 2014, comfortably above their 10-year average (3.2%).

“The relative resilience of non-fossil fuels meant that they provided a bigger contribution (67 Mtoe) to global energy growth than fossil fuels (55 Mtoe) for the first time for over 20 years, other than when the world economy has been in recession,” said BPs Spencer Dale.

Fig 3: Global fuel mix

This trend is Bearish for Nigeria because:

Our economy essentially remains a one – trick pony (Oil), even as our leaders in the executive and National Assembly remain tone deaf and generally without a plan on how to diversify and prepare for the coming storm.

It is safe to say that this trend will accelerate in the next 5 – 10 years.

As the Stone Age did not end due to a lack of stones, the oil age would probably not end from a lack of oil.

![[ANALYSIS] BP report reveals 3 bearish trends for Nigeria](https://nairametrics.com/wp-content/uploads/2015/06/bp-sHALE.jpg)

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/DeOFG2jebG https://t.co/WmkUL3BG3l

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/bPinEgyZsn https://t.co/fq4Z5AC9AU

RT @Nairametrics: [ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/DeOFG2jebG https://t.co/WmkUL3BG3l

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/e6YlfIf0Op

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria: BP released the 64th edition of the Statistical Rev… https://t.co/6BttiorNbd

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/cynxUYktnw

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria – https://t.co/p120BZxfy4

[ANALYSIS] BP Report Reveals 3 Bearish Trends For Nigeria

https://t.co/OaDPnXkrbm

RT @Nairametrics: [ANALYSIS] BP report reveals 3 bearish trends for Nigeria: BP released the 64th edition of the Statistical Rev… https://…

RT @Nairametrics: [ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/DeOFG2jebG https://t.co/WmkUL3BG3l

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/1j2uszqZFC https://t.co/ody6NBQwAa

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/i4bjvb6ETi

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/1j2uszqZFC https://t.co/RP9iItXUIs

RT @ugodre: [ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/1j2uszqZFC https://t.co/RP9iItXUIs

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/1j2uszqZFC https://t.co/yK4Q1Hd90H

[ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/1j2uszqZFC https://t.co/gGjMcYXiiP

RT @ugodre: [ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/1j2uszqZFC https://t.co/gGjMcYXiiP

RT @ugodre: [ANALYSIS] BP report reveals 3 bearish trends for Nigeria https://t.co/1j2uszqZFC https://t.co/gGjMcYXiiP

BP report reveals 3 bearish trends for Nigeria: https://t.co/EqK3sDPMgw

RT @CSLStockbroking: BP report reveals 3 bearish trends for Nigeria: https://t.co/EqK3sDPMgw

Look