UAC of Nigeria Plc (9 months ended September 2014)

- UAC of Nigeria Plc (UACN) reported a flat YoY growth in revenues to N60.5 billion for the 9 months ended September 2014 while PBT and PAT fell 22.5% and 20.5% YoY to N6.8 billion and N4.5 billion respectively.

Revenue weakness at UPDC weighs on group top-line

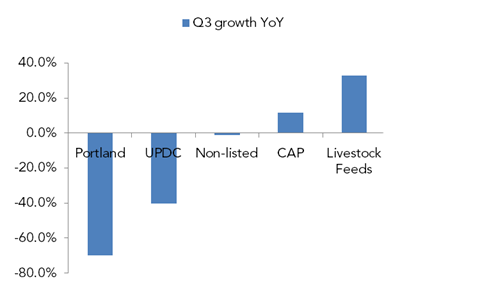

- Q3 14 revenue bucked the positive growth trends over H1 14 (+7.8% YoY) declining 10.6% YoY to N20.3 billion (Q3 14E: N24.2 billion). Disaggregating the sub-components, sales contraction largely stemmed from contraction at listed real estate subsidiary UACN Property Development Company (-40% YoY to N8.2 billion) and Portland Paints (-70% YoY to N610 million). Further weakness emanated from revenues ex-listed subsidiaries (which comprises Grand Cereals Limited, UAC Foods, UAC Restaurants and MDS Logistics) which declined 1.1% YoY to N13.6 billion. On a more positive note, paints subsidiary Chemical and Allied Paints (CAP) and animal feeds producer Livestock Feeds reported 11.5% and 32.5% YoY rise in revenues to N1.7 billion and N2.1 billion respectively.

Figure 1: YoY Revenue growth across UACN subsidiaries

Source: Company financials, ARM Research

Softer cereal prices drive gross margin expansion

- At N15.8 billion, Q3 14 COGS declined faster (-12% YoY) than revenues and our estimates (N18 billion) resulting in 4.3% YoY decline in gross profits to N4.49 billion. We believe the tamer input costs reflects softer cereal prices over the period with mean maize prices tracked by FEWSNET declining 17% YoY in Q3 14. Consequently, gross margins expanded 140bps YoY to 22.1%.

Nonetheless, opex pressures erode gross margin gains

- Q3 14 operating expenses rose 7.4% YoY to N2.6 billion with opex to sales ratio rising 2.2pps to 13%. Although no breakdowns were provided, we believe this is linked to higher admin expenses as UACN continues integration of new acquisitions. Thus, Q3 14 EBIT declined 17.3% YoY to N1.8 billion with related margins shrinking 70bps YoY to 9.1%.

UPDC valuation losses exacerbate earnings pressures

- Finance charges also declined 28% YoY to N1.08 billion largely on account of a 9% YoY cutback in short term borrowings at UPDC to N17.3 billion. Nevertheless, UACN reported negative ‘other income’ of N78 million vs. positive N2.1 billion in Q3 13. This loss mirrors declines of similar magnitude reported at UPDC whose valuation gains underpinned ‘other income’ over 2013. Largely reflecting the moderation, Q3 14 PBT and PAT declined 57% and 59% YoY to N1.2 billion and N690 million respectively with corresponding margins contracting 650bps and 410bps YoY to 6% (PBT) and 3.4% (PAT).

Price declines open upside to FVE

- The deterioration in revenues at UPDC is reminiscent of a similar reversal in 2013 and is likely to drive a moderation in our FY 14 revenue expectations for UACN. Furthermore, whilst tamer input costs as cereal prices recede on the commencement of the main cereal harvest in Q4 and lower leverage levels portend scope for earnings expansion, strong ‘other income’ base effects are likely to result in an extension of Q3 14 earnings weakness. Farther out, we still remain positive on UACN due to its exposure to the growth accretive agro-allied space where robust demographic-macroeconomic outlook aided by supportive FGN policies should bode well for top-line growth. UACN trades at current P/E of 22.4x vs. 18x for Bloomberg regional peers. As with consumer names in our coverage, the stock has declined 24% YTD with last trading price at a 27% discount to our FVE (N64.05), which translates to a BUY rating.

Source: ARM Research